Indexed In

- Genamics JournalSeek

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

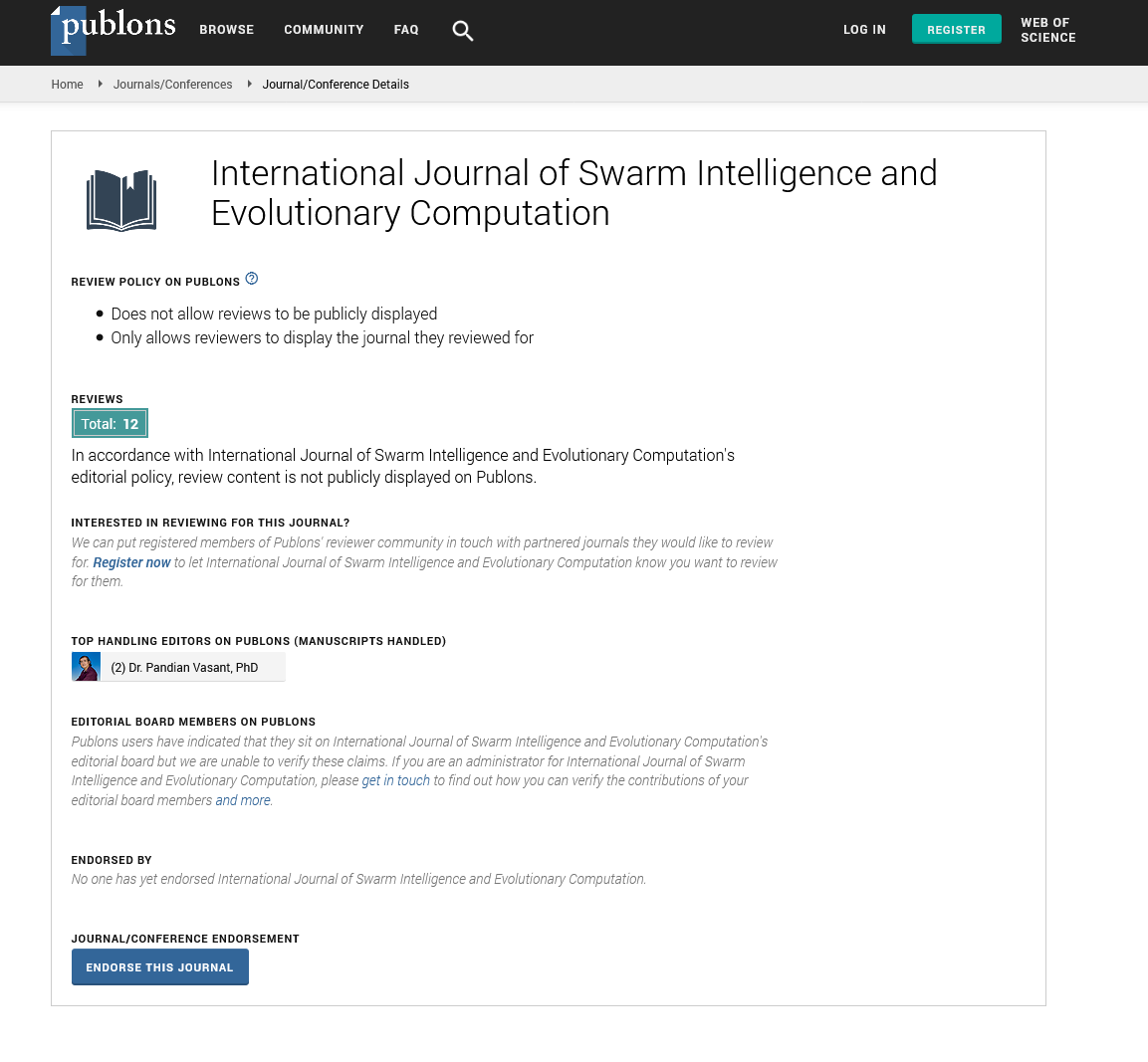

- Publons

- Euro Pub

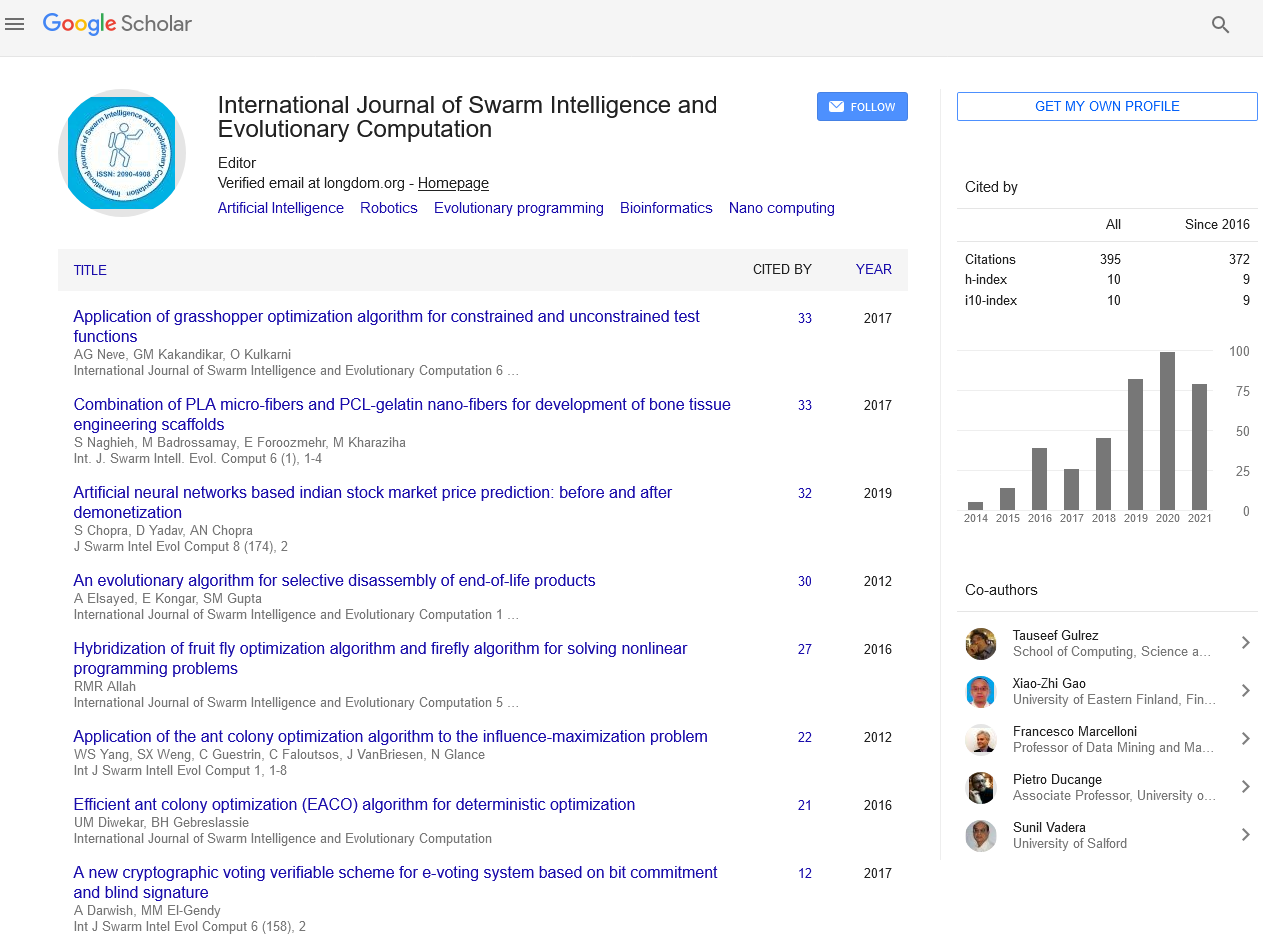

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Carlos Pedro Gonçalves

Department of Management on Civil Aviation and Airports, Lusophone University of Humanities and Technologies, Lisbon, Portugal

Publications

-

Review Article

Coupled Stochastic Chaos and Multifractal Turbulence in an Artificial Financial Market

Author(s): Carlos Pedro Gonçalves*

A stochastic chaos model of adaptive financial speculative dynamics is introduced and shown to capture several key features of actual financial turbulence, including power law scaling in the squared logarithmic returns’ distribution, 1/f spectral signatures and multifractal scaling, the model is expanded to a multiple asset artificial financial market, leading to a coupled stochastic chaos model of financial speculative dynamics, showing evidence of macroscopic financial turbulence, with excess kurtosis, power law signatures, multifractal scaling at the mean field level as well as a relation between dynamical synchronization and financial volatility dynamics. The implications for financial theory and applications of coupled stochastic chaos models to model complex financial coevolutionary dynamics are addressed .. View more»