Indexed In

- Open J Gate

- Genamics JournalSeek

- Academic Keys

- ResearchBible

- Cosmos IF

- Access to Global Online Research in Agriculture (AGORA)

- Electronic Journals Library

- RefSeek

- Directory of Research Journal Indexing (DRJI)

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- Scholarsteer

- SWB online catalog

- Virtual Library of Biology (vifabio)

- Publons

- Geneva Foundation for Medical Education and Research

- Euro Pub

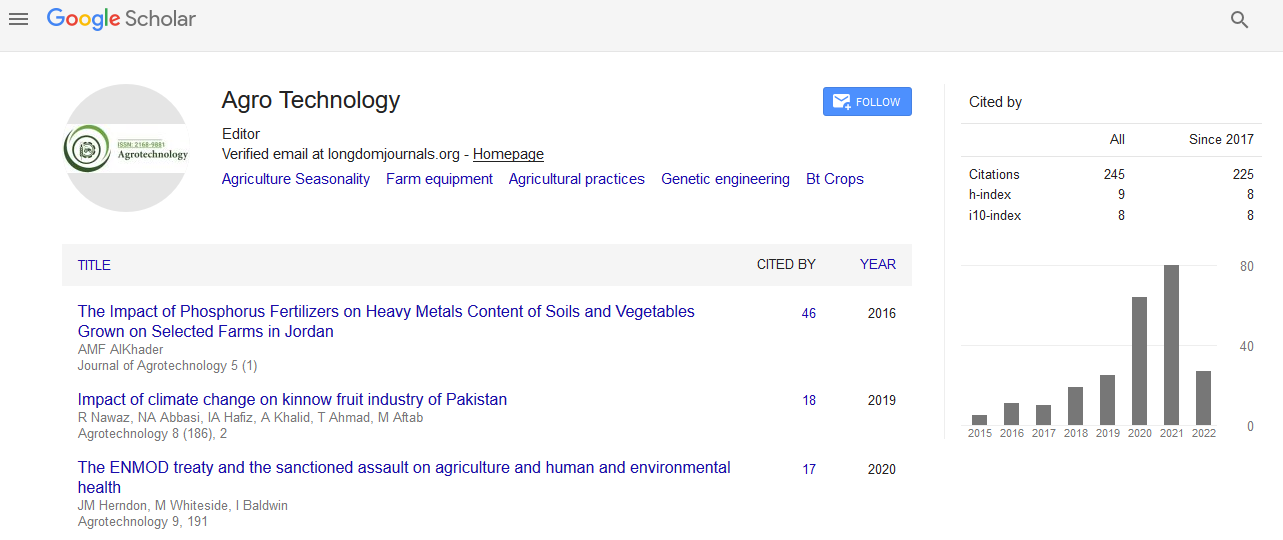

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Impact of institutional credit to agriculture on the farm economy in Karnataka, India

3rd International Conference on Agriculture & Horticulture

October 27-29, 2014 Hyderabad International Convention Centre, India

Y Nagaraju, K Jagadeeshwara, K Raj Mohan Rao and Srikanth K N

Posters: Agrotechnol

Abstract:

The present study was conducted to examine the effects of institutional credit on cost, returns and profitability in the Tumkur district of Karnataka state during 2008-09. A sample of 120 respondents were selected in which sixty were the borrowers of institutional sources and the remaining sixty were the non-borrowers selected from the same area. Independent sample t-test was used to compare the production and income of beneficiaries with non-beneficiaries. The borrowing pattern showed that the per farm amount of loan increased with increase in size of holding. The analysis revealed that the income on beneficiary farm category was higher than non-beneficiaries. Per acre production of beneficiaries with credit for paddy, ragi, groundnut, pegionpea, arecanut and coconut were more compared to the non-beneficiaries and which showed a significant difference except coconut yield. The cost and return structure of major crops viz, paddy and ragi revealed that the total cost of cultivation derived to Rs.12045.11 and 11715.84per acre on borrower farms compared to Rs. 9991.4 and 10056.44 per acre on non-borrowers farms respectively. The net returns derived for paddy and groundnut were Rs. 16,124.33 and 14,809.88 (borrower farms) and Rs.11, 132.22 and 8,771.34 (non-borrowers farms), respectively. The results have clearly demonstrated that there has been positive impact of agricultural credit on the per acre yield of crops under study and also on their income. Thus the flow of farm credit has resulted in improving the economy of the borrower farmers. Keywords: Borrowers, non-borrowers, credit, cost, returns.