Indexed In

- Open J Gate

- Genamics JournalSeek

- Academic Keys

- ResearchBible

- Cosmos IF

- Access to Global Online Research in Agriculture (AGORA)

- Electronic Journals Library

- RefSeek

- Directory of Research Journal Indexing (DRJI)

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- Scholarsteer

- SWB online catalog

- Virtual Library of Biology (vifabio)

- Publons

- Geneva Foundation for Medical Education and Research

- Euro Pub

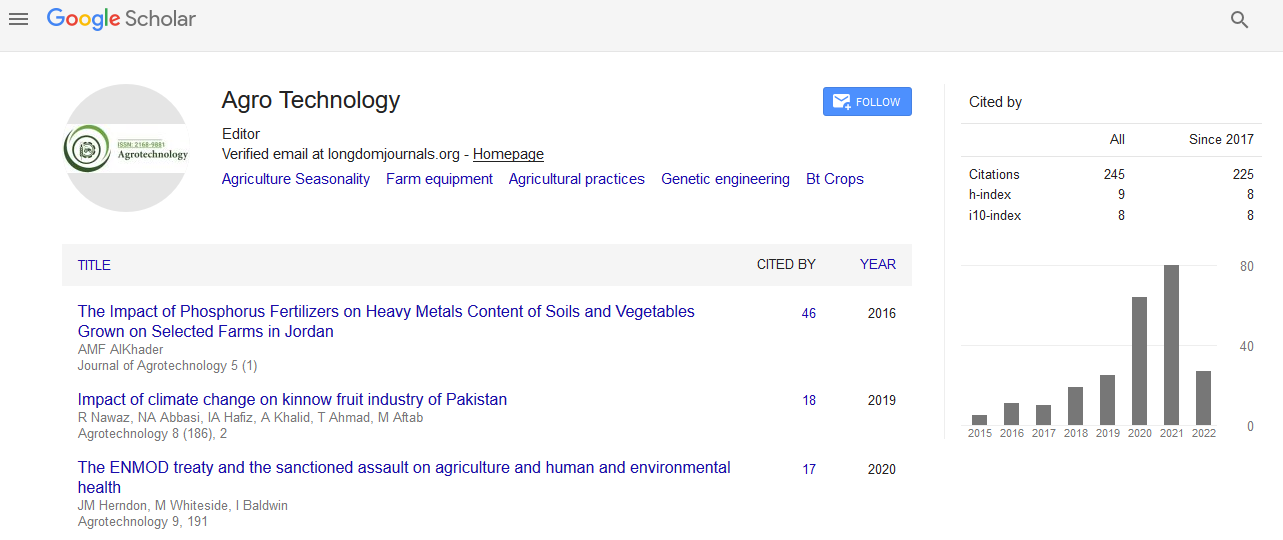

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Demand of biofuel Feedstocks to mitigate worlds bio-energy requirement with major country assumption

International Conference on Agricultural & Horticultural Sciences

September 14-15, 2012 Hyderabad International Convention Centre, India

Sushilkumar B. Shinde

Posters: Agrotechnol

Abstract:

The demand for feedstocks currently used to produce ethanol and biodiesel is projected to continue growing in a number of countries although at a slower pace than in recent years. Expansion continues to depend on policy support, mainly use mandates and tax incentives motivated by environmental concerns and a goal to reduce energy dependence.Six countries and regions (United States, Brazil, European Union (EU), Argentina, Canada, and China) accounted for about 90 percent of world biodiesel production and 97 percent of ethanol production in 2010. In 2012 and 2021, production in these countries is projected to rise about 50 percent for biodiesel and 40 percent for ethanol. Country Assumptions United States: The 45-cents-per-gallon tax credit that had been available to blenders of ethanol and the 54-cents-per-gallon tariff on imported ethanol used as fuel expired at the end of 2011. High levels of domestic corn-based ethanol production continue over the next decade, with about 36 percent of total corn use projected to go to ethanol production. However, gains are smaller than have occurred in recent The biomass-based diesel use mandate under the Renewable Fuel Standard of the Energy Independence and Security Act of 2007 has risen to 1 billion gallons for 2012 and is assumed to remain at that level for subsequent years. European Union: The EU is the worlds third largest consumer and the largest importer of biofuels. Biodiesel production is pro - jected to increase by one-third between 2012 and 2021. To boost biodiesel production, the EU increases oilseed production and imports of oilseeds and vegetable oil feedstocks, mainly from Ukraine and Russia. Brazil: In Brazil, the worlds second largest biofuel producer, sugarcane-based ethanol production is projected to rebound from recently reduced levels that resulted from two years of low sugarcane production and high international sugar prices favoring the conversion of cane to sugar. Then from 2012 to 2021, Brazils ethanol production is projected to rise more than 90 percent to meet both increasing domestic demand and growing export demand from Europe and the United States Argentina: Argentinas biodiesel production is projected to expand 60 percent between 2012 and 2021. Argentinas export tax structure favors exports of biodiesel rather than of soybean oil. Canada: Ethanol production is projected to increase 80 percent, with corn imports accounting for an increasing share of the feedstock. Biodiesel production climbs about 70 percent, most of it using rapeseed (canola) oil as a feedstock. China: About 4 million tons of corn was used to produce fuel ethanol in 2010. China has implemented policies to limit further expansion of grain- and oilseed-based biofuel production for transportation fuel use, and is now emphasizing the use of non grain feedstocks such as cassava.

Biography :

He has work in planning commission as intern for Formulation of 12 th five- year plan and emerging issues in agriculture sector under the guidance of Dr. Abhijit Sen and Dr. V. V. Sadamate.