Indexed In

- Open J Gate

- Genamics JournalSeek

- Academic Keys

- JournalTOCs

- The Global Impact Factor (GIF)

- China National Knowledge Infrastructure (CNKI)

- Ulrich's Periodicals Directory

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- Publons

- Geneva Foundation for Medical Education and Research

- Euro Pub

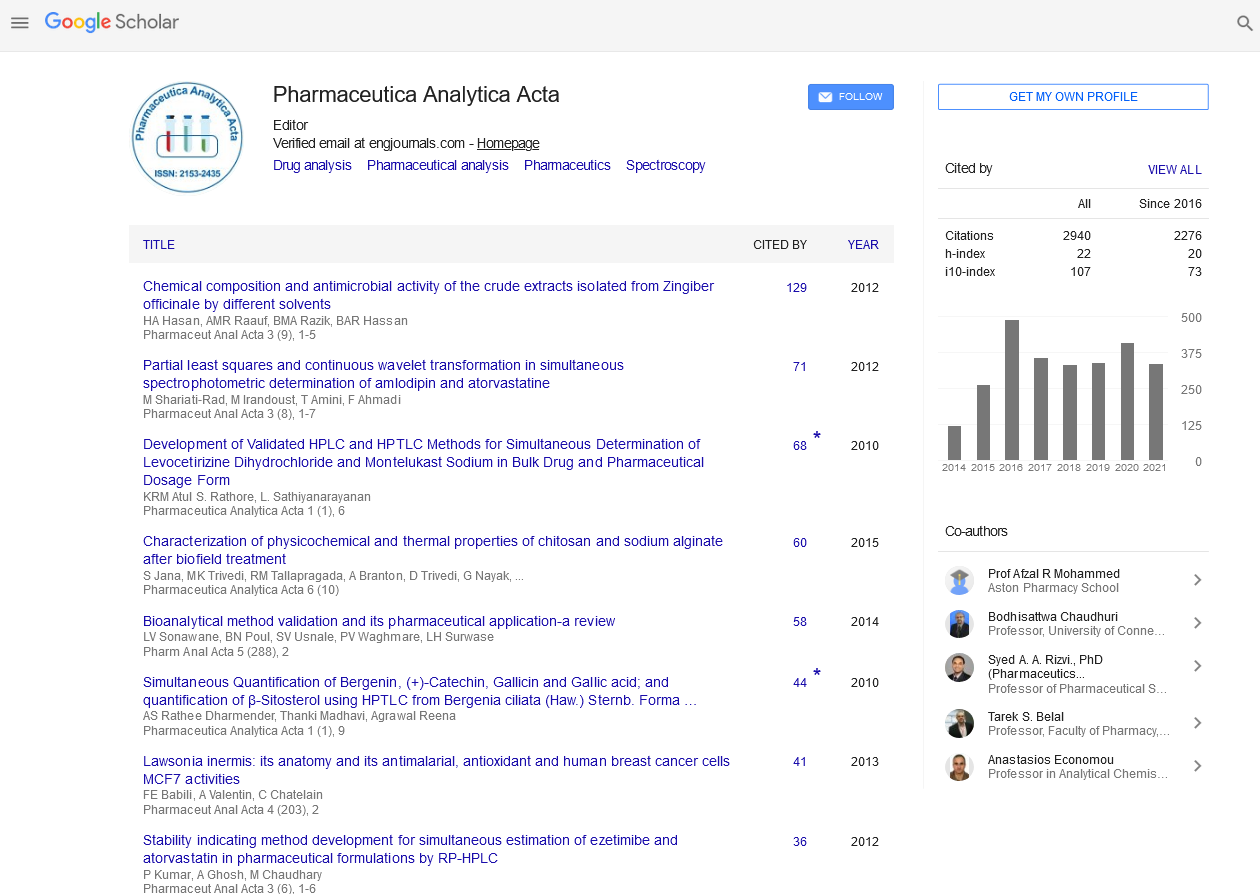

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

A Fund Manager’s Investment Outlook on the Biotechnology and Pharmaceutical Sectors

19th Annual Medicinal & Pharmaceutical Sciences Congress

March 25-26, 2019 Hong kong

Tariq Dennison

GFM Asset Management, Hong Kong

Scientific Tracks Abstracts: Pharm Anal Acta

Abstract:

Statement of the Problem: Biotechnology and pharmaceutical stocks have significantly outperformed broader equity benchmarks over the past 10 years, but these companies remain uniquely difficult to value and risk manage, even for professional investors. Fund Manager Tariq Dennison presents a financial outlook of stocks in the biotechnology and pharmaceutical sectors, starting with a top-down look at how broad and industry focused funds and ETFs choose to invest in these sectors, using examples from actual funds. Next, a few examples of financial models of select companies are highlighted to show some of the challenges and opportunities in valuing shares of companies focused on different stages of drug development. Research and early development stage companies are more often valued and risk managed using a “real options” model, while later stage companies with mature cash flows may be valued with classic “discounted cash flow” models. These top-down and bottom up views are then combined to pave an outlook for investing in funds and shares in the bio & pharma space, and what factors might change fund managers’ views. Valuation is a key emphasis of this presentation and main difference between a practitioner and investor in technologies, since it is easy to lose money investing in even the best technologies if the price paid is too high.

Recent Publications:

1. Dennison T (2018) Invest Outside the Box: Understanding Different Asset Classes and Strategies, Pallgrave McMillan.

2. Dennison T (2018) 10 First Stocks to Buy a 10-year Old to Start Investing Early. Seeking Alpha.

3. Dennison T (2017) The World’s Most Valuable Brands Trading at Below-Market Valuations. Seeking Alpha.

4. Dennison T (2018) The 7 Cs of How Tesla Might Crash (But Not Burn) Seeking Alpha.

5. Dennison T (2017) Understanding How Leveraging and Rebalancing Work. Asia Asset Management.

Biography :

Tariq Dennison CFPCM manages retirement plan investment portfolios at his own firm GFM Asset Management, a Hong Kong licensed asset manager and US registered investment advisor. Mr. Dennison is the author of the book “Invest Outside the Box: Understanding Different Asset Classes and Strategies”, and puts this into practice by investing client accounts in portfolios of stocks, bonds, and ETFs the same way he invests his own money. Tariq has worked at Commerzbank, Bear Stearns, JP Morgan, CIBC, and Societe Generale in New York, Toronto, London and Hong Kong, and also teaches fixed income and alternative assets at ESSEC Business School in Singapore and for CFA Singapore. Mr. Dennison holds a Masters in Financial Engineering degree from the University of California at Berkeley’s Haas School of Business. Tariq is one of the few Hong Kong based specialists in US pension funds, including IRA, 401(k), and defined benefit plans.

E-mail: TDennison@gfmgrp.com