Indexed In

- Open J Gate

- RefSeek

- Hamdard University

- EBSCO A-Z

- Scholarsteer

- Publons

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Research Article - (2023) Volume 11, Issue 2

Ways to Mitigate the Adverse Effect of Balance of Payment Disequilibrium Due to COVID-19 Pandemic on a Country's Economic Health

Ray Vincent Manzano*, Anthony Randolph Pablo, Florinda Vigonte and Marmelo AbanteReceived: 15-May-2023 Editor assigned: 17-May-2023, Pre QC No. IJAR-23-21367 (PQ); Reviewed: 31-May-2023, QC No. IJAR-23-21367; Revised: 07-Jun-2023, Manuscript No. IJAR-23-21367 (R); Published: 15-Jun-2023, DOI: 10.35248/2472-114X.23.11.321

Abstract

The balance of payment is an essential indicator of a country's economic health because it measures capital inflows and outflows. The COVID-19 pandemic has caused significant economic disruptions, including balance-of-payment deficits in some nations. Mitigating the negative impacts of balance-of-payment instability is an important study area in international economics. This literature review looks at measures to reduce the harmful effects of balance of payment disequilibrium on a country's economic health, notably during the COVID-19 pandemic. To mitigate these adverse effects, governments must implement measures such as reducing import dependency, diversifying export markets, and promoting domestic industries, providing financial support to affected sectors, and adopting fiscal and monetary policies encouraging economic growth. In addition, countries must collaborate and cooperate to ensure a stable global economic environment. By implementing these measures, countries can minimize the negative impact of a worldwide financial crisis and promote sustainable economic growth. It is recommended that policymakers lessen the adverse impact of balance of payment disequilibrium on a country's financial health. They should also focus on the importance of a comprehensive approach involving short-term and long-term policies.

Keywords

Balance of payment; BOP (Balance of Payment) Disequilibrium; COVID-19 pandemic; Economic crisis; Mitigation measure; Working capital cycle

Introduction

International Economics analyzes and identifies the ways or measures to mitigate the adverse effects of balance of payment disequilibrium on a country’s economic health [1]. The COVID-19 pandemic's disruptions have pushed every economy in the globe into the deepest recession. As a result of the COVID-19 pandemic's disruptive impact, the Philippine economy declined by 9.5 percent in 2020. As the recovery remains fragile and is at its early stage, the government should maintain sufficient policy support to ensure a robust economic recovery while safeguarding against potential macroeconomic and financial risks. Economists expect the economy to grow by 7.4 percent in 2021, accelerating to 7.8 percent in 2022.

The balance of payment is an essential indicator of a country's economic interactions with the rest of the world. A deterioration in the balance of payment can pressure a country's foreign exchange reserves, affecting its ability to meet its external obligations and harming the nation's overall economic health. The pandemic has significantly impacted the balance of payment and the overall financial health of nations [2].

The researchers conducted this study to address the following issues: lack of familiarity with the balance of payment; lack of knowledge regarding the impact of Balance of Payment Disequilibrium on a country’s economic health; being overwhelmed by the various economic indicators that help determine a country’s economic health; and lack of knowledge on the measures or ways to mitigate the adverse effect of the balance of payment disequilibrium due to the COVID-19 pandemic on a country’s economic health.

The researchers’ general objective is to analyze and identify the effects of a global economic crisis, such as the COVID-19 pandemic, on a country’s balance of payment and overall financial health. The researchers also aim to identify ways to mitigate determined adverse effects. To achieve this learning outcome, this study:

Define the Balance of Payment (BOP), identify its importance, and comprehend the general rules in dealing with the balance of the cost.

• Analyze and identify the differences and similarities by comparing the balance of payment and the balance of trade.

• Identify the components of BOP and perform a sample calculation.

• Analyze and identify the effects of BOP equilibrium and BOP disequilibrium on the economic growth of a country.

• Analyze and identify the measures to mitigate the adverse effect of BOP disequilibrium on a country’s economic health.

Lastly, this paper may provide policymakers and analysts with insights into the various strategies and policies that can help countries mitigate the adverse effects of a global economic crisis on their balance of payment and overall financial health (Bank of Uganda).

Methodology

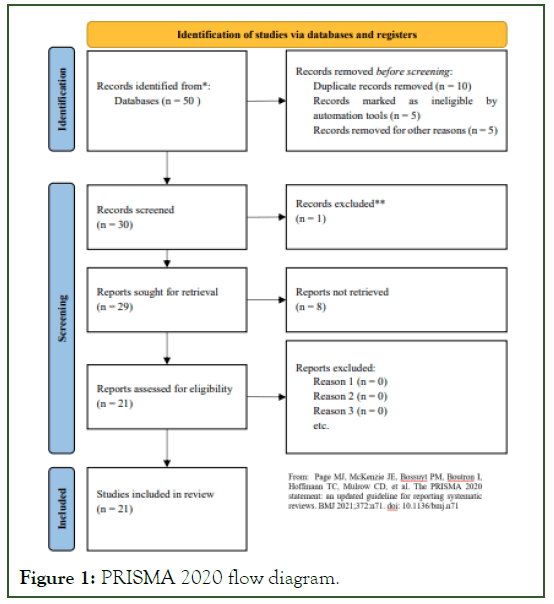

The PRISMA methodology is a systematic literature review approach. The PRISMA methodology is a series of principles or stages for conducting systematic reviews, critical literature analyses, and met analyses. It employs several techniques to search journals and other written sources for review-based research [3].

First, the researchers developed objectives based on the assigned economic topic, the balance of payment. Researchers then outlined how to find relevant publications using keyword research and database searches. The search is then conducted using the chosen keywords and the established objectives from the online database Google Scholar. Researchers then decided and assessed them after compiling several publications, taking into account the following:

Date of publication-sorted from the year 2014 up to the present; Locale of the publication-considered the local and foreign publications, highlighting the studies published during the COVID-19 pandemic; and Contribution/relation of the publication-scanned these publications to discern whether they could contribute to the study (Figure 1).

Figure 1: PRISMA 2020 flow diagram.

Results and Discussion

Imports and exports of commodities and services and capital and transfer payments such as remittances and foreign aid comprise the Balance of Payment (BOP) transactions. International accounts are a country's balance of payment and net global investment position [4].

The balance of payment categorizes transactions into the current account and capital account. The existing account includes transactions related to trade in goods and services, income flows (such as wages, interest, and dividends) between residents and non-residents, and unilateral transfers (such as foreign aid and remittances). A current account surplus shows that a country sells more goods and services than imports, whereas a deficit suggests the opposite.

Importance of balance of payment

A nation's economic and international standing can be identified quite significantly from its balance of payment. Here are several of the most significant reasons why the balance of payment is so essential [5].

Trade: The balance of payment provides valuable information regarding a nation's international trade in goods and services. A current account surplus indicates that a nation exports products and services more than it imports, generally regarded as a positive indicator of its trade competitiveness. In contrast, a current account deficit indicates that a country imports more than it exports, which may point to trade policy and competitiveness weaknesses [5].

Investment: The balance of payment also tracks capital flows between countries, which are essential for financing investment and economic growth. A capital account surplus suggests that a country is attracting more foreign investment than it is investing abroad, which can promote economic growth and development. A deficit in capital accounts indicates that a government is investing more abroad than it is attracting from abroad, which may suggest areas for improvement in its investment climate and competitiveness.

Foreign exchange: The balance of payment is closely linked to a country's foreign exchange reserves, essential for maintaining stability in the currency markets. A sustained deficit in the balance of payment can pressure a country's foreign exchange reserves, which may lead to currency devaluation and inflation. Conversely, a sustained surplus can strengthen a country's foreign exchange reserves and support the stability of its currency.

Policymaking: The balance of payment provides policymakers and analysts with valuable information for assessing a country’s economic health and outlook. By monitoring the balance of payment, policymakers can identify areas of economic weakness and devise policies to address them, including trade policies, investment incentives, and macroeconomic policies such as monetary and fiscal policies.

BOP VS. BOT

Two related economic indicators show a country's financial connections with the rest of the world: the Balance of Payment (BOP) and the Balance of Trade (BOT). They have shared several traits yet also have distinguishable differences, which are listed below [6].

Similarities: Data on a nation's economic trade with the rest of the world is provided by the BOP and BOT. Both are significant indicators of a country's economic health and are included in national accounts.Depending on the volume of exports and imports, the BOP and BOT might be in surplus (positive) or deficit (negative) situations.

Differences:

• The BOT only records transactions related to trade in goods, while the BOP records a much more comprehensive range of transactions, including services, income, and capital flows.

• The BOT focuses on the physical movement of goods across borders, while the BOP includes financial transactions that do not involve material goods, such as foreign investment and remittances.

• The BOT can only be in surplus or deficit regarding trade in goods. At the same time, the BOP can have excesses or deficiencies in its three accounts: current, capital, and financial.

• The BOT is typically calculated on a monthly or quarterly basis, while the BOP is usually calculated on an annual basis.

The BOP and BOT offer insightful data on a nation's economic connections with the rest of the world, but the BOP is a more specific measure that considers a broader range of transactions than the BOT. While the BOP includes trade in services, income, and capital flows, the BOT only focuses on trade in goods. Both indicators are crucial when evaluating the state and prospects of a nation's economy [6].

General rule in calculating balance of payment: The sum of all current capital and financial account transactions should be zero when determining the balance of payment. This is known as the "balance of payment identity," which stipulates that every transaction involving citizens and non-citizens of a country must be recorded in the balance of payment and that the sum of all debits (payment made to non-citizens) must equal the sum of all credits (payment received from non-citizens). Due to the variety and complexity of economic interactions between residents and non-residents, measuring the balance of payment in practice can be challenging. The balance of payment identity provides a valuable foundation for verifying that all transactions are appropriately documented and accounted for and that the total balance is zero.

Components of BOP and sample calculation: The Balance of Payment (BOP) consists of three main components: the current account, the capital account, and the financial account. Each of these components represents a different type of economic transaction between residents and non-residents of a country [4].

Current account: These keep track of transactions involving the import and export of products and services, income flows (such as wages, profits, and dividends), and transfers (such as remittances and foreign aid) [5].

Capital account: These records transactions related to the acquisition and disposal of non-financial assets, such as land and patents, and capital transfers, such as debt forgiveness.

Financial account: These records transactions related to financial assets and liabilities, including foreign direct investment, portfolio investment, and changes in official reserves.

A sample calculation of the BOP might look like this:

Overall BOP balance=Current account balance+Capital account balance+Financial account balance=(-₱5 billion)+₱3 billion+(-₱5 billion)=-₱7 billion

In this example, the BOP is in deficit (negative balance) due to the negative balances in the current and financial accounts. This means that the country imports more goods and services than it exports and invests more abroad than it receives from foreign investors. The positive balance in the capital account partially offsets this deficit, but overall, the country is experiencing a net outflow of funds to the rest of the world.

Bop equilibrium and bop disequilibrium: The Balance of Payment (BOP) has essential effects on the economic growth of a country. When a country's BOP is in equilibrium, the total inflows and outflows of funds are equal, which can positively affect the economy. On the other hand, when a country experiences BOP disequilibrium, it can negatively affect the economy [7].

BOP equilibrium can favorably impact the economy by maintaining stable exchange rates, boosting foreign investor confidence, relieving strain on foreign exchange reserves, and promoting economic growth. On the other hand, BOP disequilibrium may cause currency rate volatility, stress on foreign exchange reserves, higher borrowing costs, and a decline in foreign investment [7].

Ways to mitigate the adverse effect of bop disequilibrium due to the covid-19 pandemic

The need to finance economic stimulus packages in response to the COVID-19 crisis has resulted in considerable increases in external debt in both developed and developing countries.

Furthermore, while the rate of economic growth in some countries has significantly slowed, the economy of other countries are facing adverse conditions [2]. In line with this, the COVID-19 pandemic has significantly impacted the world economy, leading to BOP disequilibrium in some nations.

A combination of short-term and long-term actions must reduce the negative impacts of BOP disequilibrium. The following steps can be taken to minimize the detrimental effects of BOP disequilibrium brought by the COVID-19 pandemic on a nation's economic health:

Boost exports: Trade policy measures to improve the balance of payment refer to efforts to promote exports and reduce imports. Exports may be encouraged by abolishing or reducing export duties and decreasing the interest rate on credit used for financing exports. Exports are also urged by granting subsidies to manufacturers and exporters. Besides, lower in-come tax can be levied on export earnings to incentivize the exporters to produce and export more goods and services. By imposing lower excise duties, the prices of exports can be reduced to make them competitive in the world markets. Promoting their products and services on international markets can help countries raise their exports. This can be accomplished by lowering trade obstacles, providing export incentives, and negotiating advantageous trade agreements.

Strengthen the financial sector: With government intervention, the markets will be efficient and sustainable. Almost all countries intervene in the market; minor interference occurs, at least through setting interest rates using a monetary policy [8]. It is not enough to consider the balance of payment as an economic phenomenon and use only monetary and currency policies’ support to regulate it. In this regard, holding the balance of payment should not be limited to applying financial and foreign exchange mechanisms. It requires the reasonable use of such policy levers to expand high-value-added production and implement comprehensive measures to improve the country's business and investment climate to attract foreign investments [2]. Countries can strengthen their financial sector by improving regulations and oversight, promoting transparency and accountability, and investing in financial education programs.

Control inflation: The impact of currency devaluation on the economy will be positive regarding a sharp price reduction for the country’s essential export goods [9]. By reducing the purchasing power of a country's currency, inflation can exacerbate the effects of BOP disequilibrium. Governments can control inflation through monetary policies such as increasing interest rates, decreasing government expenditure, and managing the money supply.

Seek assistance from international organizations: The government, together with the Central Bank, has implemented a series of unprecedented relief measures and large-scale policy stimuli to help businesses and households adversely affected by the pandemic [10]. International organizations, including the International Monetary Fund (IMF) and World Bank, can provide financial support, technical assistance, and policy advice to countries [11-15].

Combining short-term and long-term actions is necessary to mitigate the adverse effects of BOP disequilibrium brought on by the COVID-19 pandemic. These steps entail raising exports, lowering imports, luring foreign investment, promoting local investment, bolstering the financial system, containing inflation, and enlisting the aid of international agencies [16-18].

Diversifying economies is another option. Governments can better withstand economic shocks by diversifying their economies. A global pandemic that restricts travel may hurt a tourism-dependent nation. However, if the country also has a strong manufacturing sector, it may better weather the storm. Finally, nations can collaborate to solve the economic crisis [19-21]. Governments may lessen the crisis's effects on their balance of payment and economy by cooperating and coordinating. Reduce trade barriers, share expertise, and resources, and help hard-hit countries.

Conclusion

In conclusion, a worldwide economic catastrophe like the COVID-19 pandemic has harmed a country's balance of payment and financial health. The pandemic has reduced international trade, disrupted global supply chains, and lowered demand for products and services, which hurts impacted nations' balance of payment. To counteract these effects, governments must reduce import reliance, diversify export markets, encourage domestic companies, provide financial support to afflicted sectors, and use fiscal and monetary policies that promote economic growth. For global economic stability, nations must cooperate. These strategies can help countries recover from a worldwide financial crisis and boost economic growth.

References

- Nagwa. Lesson explainer: international economic relations and balance of payment accounts. 2023.

- Jumaeva S. Impact of covid-19 pandemic on balance of payment: evidence from developed and developing countries. Europ J Bus Manag Res. 2020;5(5).

[Crossref] [Google Scholar].

- PRISMA. Prisma-Statement. 2015.

- Kenton W. Balance of Payment (BOP). Investopedia. 2022.

[Crossref] [Google Scholar].

- Karan R. Balance of payment and its importance in global transactions. Shiksha. 2020.

- Surbhi S. Difference between balance of trade and balance of payment (with comparison chart). Key Differences. 2015.

- Guru S. The equilibrium and disequilibrium in the balance of payment. Your Article Library. 2014

- Guzman M, Ocampo JA, Stiglitz JE. Real exchange rate policies for economic development. World Development. 2018;110:51–62.

- Nakatani R. Adjustment to negative price shocks by a commodity-exporting economy: Does exchange rate flexibility resolve a balance of payment crisis?. J Asian Economic. 2018;57:13–35.

[Crossref] [Google Scholar].

- Colombage SS. Policy challenges in mitigating the economic fallout from the COVID-19 pandemic in Sri Lanka. Sri Lan J Soc Sci. 2020;43(2):57.

[Crossref] [Google Scholar].

- 12 methods to correct disequilibrium in balance of payment. Googlesir. 2018.

- Balance of payment (bop): definition, types, and importance. (n.d.). BYJUS.

- Balance of payment formula. Wall Street Mojo. 2019.

[Crossref] [Google Scholar].

- Bista RB. Assessing the covid-19 and its shocks on macro-economic variables in nepal. Econom J Develop Iss. 2020;(29):59-80.

[Crossref] [Google Scholar].

- Corrective measures of BOP disequilibrium. Slide Share. 2023.

- Difference between balance of trade and balance of payment (with Comparison Chart). Key Differences. 2015.

- Philippines-battling the covid-19 andemic and reviving the economy. AMRO ASIA. 2021.

- Hayes A. Disequilibrium definition. Investopedia. 2019.

- Masdjojo GN, Suwarti T, Pancawati H, Sudiyatno B. Indonesia’s balance of payment until the covid-19 pandemic period. Europ J Sci Innov Technol. 2022;2(4):46–59.

- Tanzi V, Bléjer MI. Fiscal deficits and balance of payment disequilibrium in imf adjustment programs*. IMF eLibrary.

- Wang C, Wang D, Abbas J, Duan K, Mubeen R. (2021). Global financial crisis, smart lockdown strategies, and the covid-19 spillover impact: a global perspective implications from Southeast Asia. Front Psychiatry.

[Crossref] [Google Scholar] [Pub Med].

Citation: Manzano RV (2023) Ways to Mitigate the Adverse Effect of Balance of Payment Disequilibrium Due to COVID-19 Pandemic on a Country's Economic Health. Int J Account Res. 11:321.

Copyright: © 2023 Manzano RV. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution and reproduction in any medium, provided the original author and source are credited.