Indexed In

- JournalTOCs

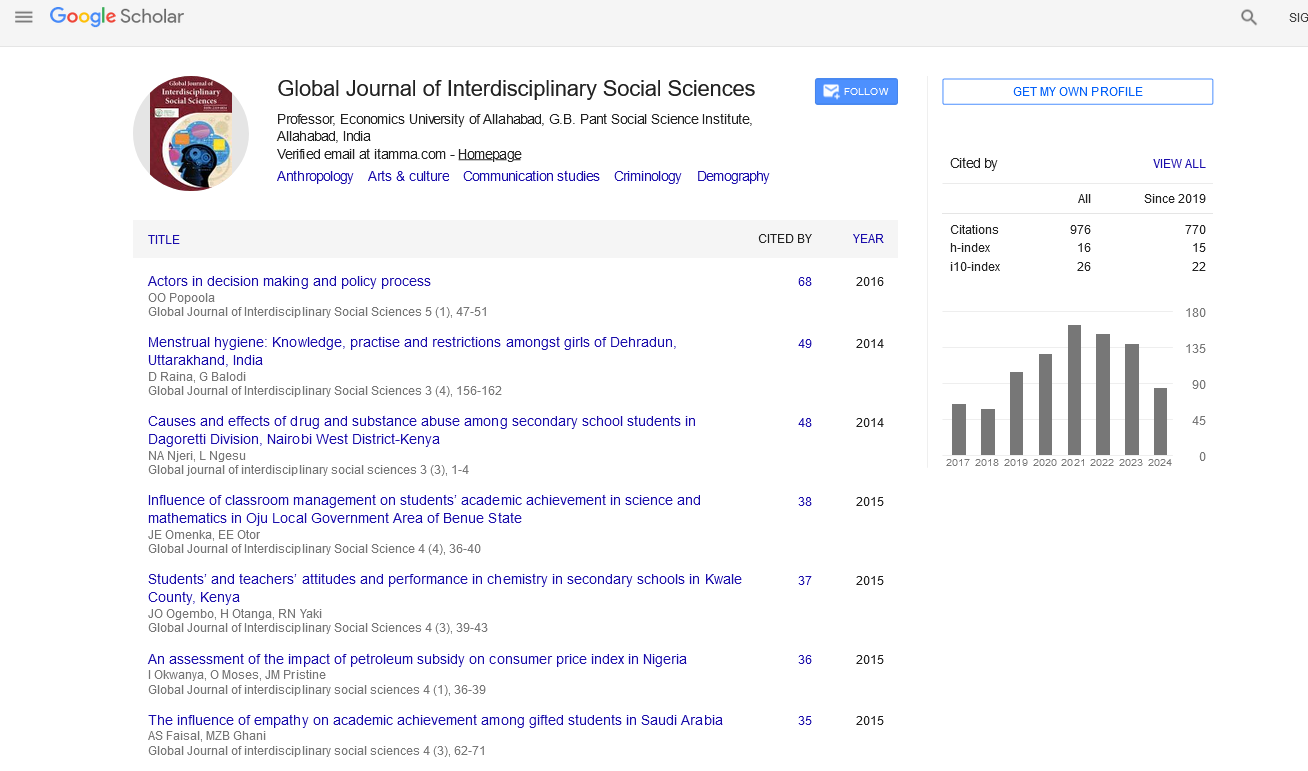

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Opinion Article - (2023) Volume 12, Issue 3

The Evolution of Social Welfare and Poverty in the United States

Amelia Jessie*Received: 28-Aug-2023, Manuscript No. GJISS-23-23628; Editor assigned: 30-Aug-2023, Pre QC No. GJISS-23-23628 (PQ); Reviewed: 13-Sep-2023, QC No. GJISS-23-23628; Revised: 20-Sep-2023, Manuscript No. GJISS-23-23628 (R); Published: 27-Sep-2023, DOI: 10.35248/2319-8834.23.12.063

Description

The United States struggles with the challenge of poverty. The country's vast size and diversity, both in terms of its population and its economic landscape, have made addressing poverty a complex and multifunction issue. One approach that has been pursued over the years is fiscal decentralization, where social welfare programs are managed at the state level. Proponents argue that this approach allows for unique solutions to local needs and encourages innovation. Critics, on the other hand, contend that it can increase poverty by creating disparities in access to benefits. In this article, we will explore the impact of fiscal decentralization on poverty reduction across U.S. states.

Fiscal decentralization in the United States can be traced back to the 1930s when the social security Act of 1935 was passed. This landmark legislation created a federal framework for social welfare programs, providing a safety net for those in need. However, it also allowed states significant discretion in implementing these programs. Over the decades, this decentralization trend continued, with the federal government providing block grants and other forms of funding to states for programs such as Temporary Assistance for Needy Families (TANF) and Medicaid.

Proponents of fiscal decentralization argue that it empowers states to tailor their programs to their unique needs. States, they say, are better equipped to understand the specific challenges faced by their residents and can design more effective solutions. This flexibility, they contend, fosters competition among states, driving innovation in social welfare policy.

One of the fundamental arguments in favor of fiscal decentralization is that it allows states to experiment with different policies and adapt them to local conditions. This variability in approaches has indeed led to diverse outcomes. Some states have successfully reduced poverty rates through innovative programs, while others have struggled to make meaningful progress. For example, states like California and New York have implemented more generous social welfare policies, including higher minimum wages and expanded Medicaid, resulting in notable poverty reductions.

However, not all states have been equally successful. States with more conservative approaches, such as stricter eligibility criteria and limited social safety nets, have often seen less progress in poverty reduction. This variability highlights both the potential benefits and drawbacks of fiscal decentralization. While it allows for experimentation and adaptation, it can also lead to significant disparities in outcomes between states.

Another important factor in the effectiveness of fiscal decentralization is the level of federal funding provided to states. States with higher levels of federal support for social welfare programs tend to have more resources available to combat poverty. Conversely, states that receive lower levels of federal funding often struggle to adequately address poverty. Reducing poverty is not only about providing immediate relief but also about addressing the underlying factors that maintain it. This includes access to quality education, job opportunities, and affordable healthcare. Fiscal decentralization has not always effectively addressed these root causes of poverty.

Many argue that a more centralized approach would allow for a more coherent and comprehensive strategy to address the structural issues contributing to poverty. By focusing on longterm solutions, rather than short-term relief, it may be possible to break the cycle of poverty for more individuals and families. While fiscal decentralization has its merits, it is not without its challenges and criticisms. To assess its impact on poverty reduction accurately, we must also consider the drawbacks and limitations of this approach.

One of the most significant criticisms of fiscal decentralization is that it can increase inequality and disparities between states. States with greater resources, either through a stronger tax base or more federal funding, can provide more comprehensive social welfare programs, while poorer states struggle to meet the basic needs of their residents.

States with decentralized social welfare systems may be more vulnerable to economic downturns. When economic crises hit, state budgets often face significant shortfalls, leading to cuts in social welfare programs precisely when they are needed the most. The lack of a federal safety net that automatically responds to economic shocks can leave many vulnerable individuals and families without support during difficult times. While fiscal decentralization has both advantages and disadvantages, it is essential to consider potential solutions and reforms that can enhance its effectiveness in reducing poverty across U.S. states.

To mitigate disparities and address issues of inequality, greater federal oversight and regulation may be necessary. This could involve setting minimum standards for social welfare programs or implementing more equitable distribution formulas for federal funding. Ensuring that all states have a baseline level of support for their residents could help reduce disparities and reduce poverty.

In conclusion, fiscal decentralization has effectively reduced poverty across U.S. states is complex and multifunctional. While it has allowed for innovation and adaptation to local needs, it has also led to disparities, administrative complexity, and challenges in addressing the root causes of poverty. To create a more equitable and effective system, it is essential to strike a balance between state flexibility and federal oversight. By addressing disparities in funding, enhancing coordination among states, and focusing on long-term solutions, fiscal decentralization can be improved to better serve the needs of all Americans.

Citation: Jessie A (2023) The Evolution of Social Welfare and Poverty in the United States. Global J Interdiscipl Soc Sci. 12:063.

Copyright: © 2023 Jessie A. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited