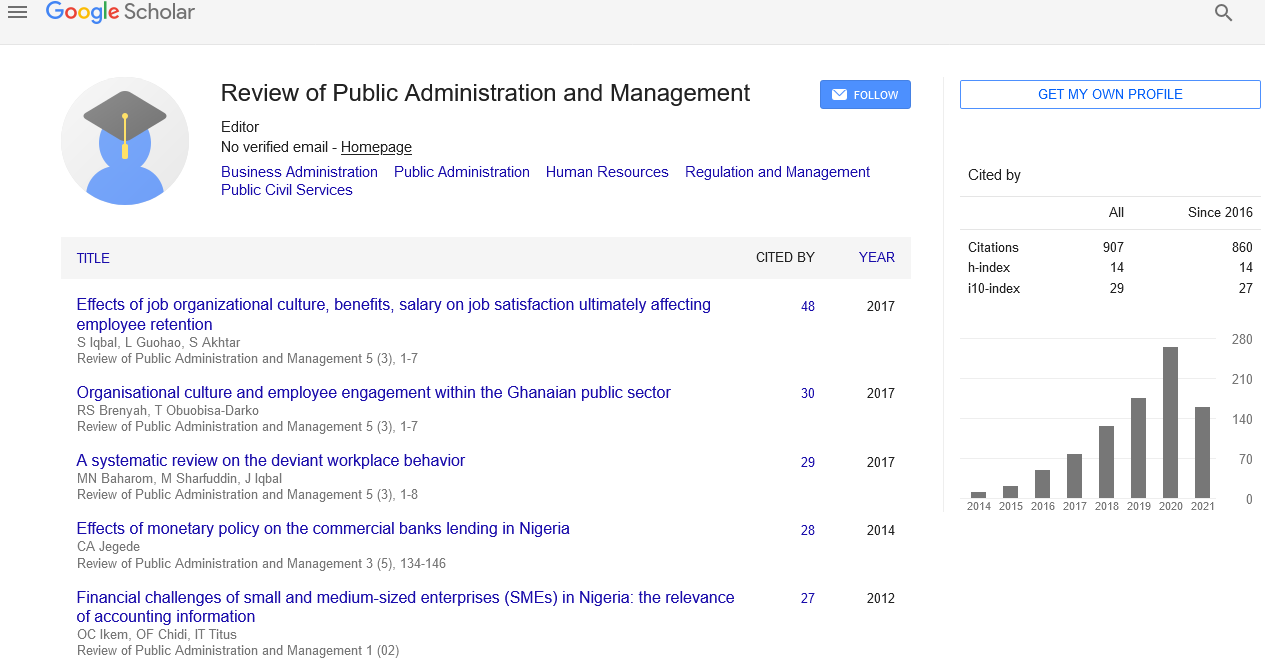

Indexed In

- CiteFactor

- RefSeek

- Directory of Research Journal Indexing (DRJI)

- Hamdard University

- EBSCO A-Z

- Scholarsteer

- Publons

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Review Article - (2022) Volume 10, Issue 11

Might legalized gambling expose Kenyan microenterprises to survival risks during COVID-19 Pandemic

Fredrick Onyango Aila* and Caroline OlooReceived: 29-Mar-2022, Manuscript No. RPAM-22-15906; Editor assigned: 01-Apr-2022, Pre QC No. RPAM-22-15906(PQ); Reviewed: 15-Apr-2022, QC No. RPAM-22-15906; Revised: 30-May-2022, Manuscript No. RPAM-22-15906(R); Published: 06-Jun-2022, DOI: 10.35248/2315-7844.22.10.374

Abstract

Microenterprises are very small in size but growth oriented enterprises largely dependent on founder’s cultural orientation for survival. Kenya enacted a legal framework on micro and small enterprise development in 2012. However, heightened activity of legalized gambling houses in the past decade has exposed microenterprises to survival risks. This has been aggravated by the COVID-19 pandemic, especially lockdowns and other control measures. We find that in the midst of the pandemic, wages are reduced due to lay offs, revenue based taxation of microenterprises is reduced due to gambling, but gambling has increased steadily. We observe temporal benefits of gambling in terms of certain jobs and demand for goods; however, individuals are psychologically distressed. We propose policy reforms focusing on initiatives that sustain short term microenterprise liquidity as well as shifting operations to the digital space.

Keywords

Betting; Lotteries and gaming act; Family business; Gambling houses; Legal formality; Cultural orientations; Involuntary tax; Cash flow; Marketing communication; Entrepreneurial survival; Coronavirus; COVID-19; Pandemic

Introduction

Microenterprises are really small enterprises started recently but with a growth potential. Micro, Small, and Medium Enterprise (MSME) growth is considered as an engine for generating employment, enhancing more inclusive growth and sustainable economic development. Suggests that the survival chances of the small manufacturing enterprises lie much within their own control on the other hand see this in terms of embracing a mix of strategies. Three start-up idea sources have been presented by Longenecker “many start-ups are developed from type and ideas those providing customers with a product or service that does not exist in their market but already exists somewhere else. Some start-ups are based on type B ideas those that involve a technically new process. Type C ideas probably account for the largest of all start-ups. They represent new ventures founded on me too strategies, differentiating themselves through superior service, higher quality of performance or lower costs. From these ideas the micro enterprise crafts a growth and survival strategy.

Some however die prematurely. For instance, Kaza investigated reason for not sanctioning loans to women entrepreneurs by banks in Baroda. Found that women gave more importance to family occasions like marriage, child birth or family disputes, more than running the enterprise. This led to premature closure or shutting down the unit. Most microenterprises are embedded in the owner’s culture and are shaped thereof. Eapen posits that social background of the entrepreneur in terms of the father’s occupation plays a significant role in selection and diversification of activities in the microenterprise. Experience gained through working in similar units helps in selecting most suitable enterprises reveal that micro-enterprises risk of dropout ranges from the first two to four business operation years in Ethiopia. The risk of dropout reaches its maximum at 4 years after establishment for micro-enterprises while after 2 years for small enterprises. Kimunga recognizes that small scale businesses face unique challenges which affect their growth and profitability and therefore, diminish their ability to contribute effectively to sustainable development in Kenya. This included lack of management skills, inadequate education, technical skills, access to financial services and legal and regulatory issues argues that the distinct nature of Chinese business networks endows them with significant competitive advantages over their Kenyan counterparts. Structural integrity maintained by Chinese networks enables them to outwit Kenyan micro-enterprises relying heavily on ethnic cleavages precluding effective coordination. Moreover, Kenyan entrepreneurs are struggling to sustain both their enterprises and livelihoods. Generally, majority of microenterprises start on a growth trajectory following a market follower strategy but soon face survival realities and challenges. Their survival can be based on factors within the owners control resulting in deployment of an array of strategies. The central question notwithstanding is that “Is legalized gambling one of these survival strategies?”[1-5].

Literature Review

The nature of microenterprises

Microenterprises are generally small in size but have no universally accepted definition. Most definitions though center on the number of employees as the critical measure of size. The European union defines a microenterprise as an enterprise which employs fewer than 10 persons and whose annual turnover and/or annual balance sheet total does not exceed EUR 2 million. A microenterprise is a sole proprietorship, partnership or family business that has fewer than five employees. Majority of the informal sector of a country's economy consists of microenterprises which are microbusinesses with one to 10 workers, including the owner. USAID defines microenterprise as a very small enterprise owned and operated by poor people, usually in the informal sector. Microenterprise development now includes crop production activities as long as they otherwise qualify on the basis of size and the economic status of the owner operator and employees. The very smallest businesses microenterprisestend to be affected most deeply by business cycles, given their size and limited access to the capital markets and other funding options. A microenterprise is commonly defined as a business with five or fewer employees that require no more than $35,000 in start up capital. This estimated start up cost is much lower in developing countries. Peace Corps assert that microenterprises provide most of the goods and services that meet people’s basic needs in developing and redeveloping countries. They are the only economic organizations that function in a time of crisis. They require small amounts of capital to enter the market and produce results quickly. The small size of microenterprises makes them simple to operate. They use local products and skills. They are labor intensive and create jobs. Microenterprises improve the income of the entrepreneurial poor and are a catalyst for comprehensive community economic development. In Kenya, microenterprises are regulated under the micro and small enterprises act no. 55 of 2012. The broad aim of the act is to provide for the promotion, development, and regulation of micro and small enterprises; to provide for the establishment of the micro and small enterprises authority. The act provides for development and promotion of micro and small enterprises through zoning, of land, development of infrastructure, capacity building programmers for micro and small enterprises, development of markets and provision of marketing services, technology transfer, acquisition, setting and managing the micro and small enterprises development fund. The act offers a working definition for microenterprises in the country: "Micro enterprise" means a firm, trade, service, industry or a business activity (a) Whose annual turnover does not exceed five hundred thousand shillings; (b) Which employs less than ten people; and (c) Whose total assets and financial investment shall be as determined by the cabinet secretary from time to time, and includes. (i) The manufacturing sector, where the investment in plant and machinery or the registered capital of the enterprise does-not exceed ten million shillings; (ii) The service sector and farming enterprises where the investment in equipment or registered capital of the enterprise does not exceed five million shillings”. For our purposes, we adopt a definition indicating owner-managed, constrained resource base, limited scope of business employing no more than 10 employees including the owner. The employees are largely sourced from family members or lowly paid wagers. They are seldom registered as they require no legal formality. Microenterprises adopt the cultural orientations of the founder manager. Find a general consensus among scholars that entrepreneurial competencies are context specific. Therefore, cultural orientations play a vital role in the development of entrepreneurial competencies by demonstrating this in the context of Malaysian SMEs use a sample of 448 individuals analysed in six territories within the country to confirm the existence of cultural differences in individualism between regions of the republic of Cape Verde, as well as their capacity to explain entrepreneurial behavior in these regions. Dess, Brian, Pinkham and Yang synthesize four qualities unique to family enterprises namely: a tendency to be more conservative with longer-term orientations thereby de-emphasizing risk taking actions, emphasizing defensive positions suggesting lack of reactiveness they exhibit a strong preference for survival constraining autonomy and innovativeness; and they vary in terms of innovativeness under normal conditions. The general rationale for microenterprises is source of employment for the founder and his family, profit and survival. Profit might be a far fetched objective because microenterprises returns seldom cover the owner’s household financial demand. Therefore, the enterprises are created by and for the owner’s needs. Given the personal nature of microenterprises, the cultural orientations the owners adopt become the lifeline for the enterprises. Moreover, enterprises have no separate legal entity. Therefore, the owners assume the responsibility for asset acquisitions, business debts, decision making and profits and losses enjoyment [6-10].

Legalized gambling: What it really is! Gambling per se is immoral and should be eschewed. Yet, owing to a greater need to access its proceeds, governments have legalized it, therefore, legalized gambling! Legalizing gambling does not cure the ethical question; it merely answers the legitimacy question. As gambling has been termed involuntary tax by the foolish, legalizing it legitimatizes government taxation of its proceeds. This permits governments to take from the poor involuntarily. Legalized gambling is controlled under Kenya's betting, lotteries and gaming act CAP 131 of 2012. As one plays by the rules, the government guarantees the operations of such gambling houses. The upsurge of gambling business in Kenya in the recent past is alarming. Its impacts on microenterprises, which operate at the lowest end of business chains, are not known given the unrivalled nature of these enterprises. From a business economic perspective; gambling activities have been legalized to constitute a valid strategy for economic development. Dollars has been invested in various legalized gambling projects and the jobs initially created are evident. On the other hand gambling industry has been criticized for inflating the positive economic impacts and ignoring the negative impacts. Gambling has resulted to socio economic costs that have dwarfed the localized economic positives (California Governor's Office, 1992) which has drained on society and has translated into a net loss of jobs, especially micro-enterprises. The most common types of legalized gambling in Kenya are: casinos, lotteries, charity and sports and Internet gambling. Legalized gambling is controlled under the betting, lotteries and gaming act CAP 131 of 2012 Laws of Kenya. Progressively, the proceeds are taxed to raise government revenue. Kenya has recently witnessed an upsurge of legalized gambling activities. This increase is occasioned by a rediscovered appetite for cash by the Kenyan population. Moreover, the government of Kenya attempted to tax all gambling activities at 50% of proceeds in 2017 but changed its mind upon protests from the business community.

“Slapping a 50 per cent tax is meant to check the resultant “negative social effects”. Now that is the moral panic coming from a total absence of debate.”

“Rotich proposed the taxes be raised from 7.5 percent (betting), 12 per cent (lottery), 15 percent (gaming) and 15 percent (competition), to the 50 percent.”

The current Kenyan legalized gambling tax rates in 2020 are 15% for winnings from gaming, lottery turnover and betting revenue. A With Holding Tax (WHT) at the rate of 20% is charged on all winnings. “Winnings from gaming are taxed at a rate of 15%. The lottery tax is charged at a rate of 15% of the lottery turnover. Betting tax is charged at the rate of 15% of the revenue generated from betting. The tax laws (amendment) act reintroduced WHT on winnings at the rate of 20%. Winnings include money won, spoils, profits, or proceeds of any kind that refer to the amount or payment of winnings. The effect of this new definition is that With Holding Tax (WHT) will now be imposed on the gross winnings payable by all sectors governed by the betting, lotteries and gaming act, that is: betting, lotteries, gaming and prize competition. Stapleford shows that gambling, whether legal or not, offers false hope to the participant. Whereas, legalized gambling is said to create jobs, raise taxes and offer entertainment, there is a flip side to it. Regarding jobs, when people spend money on gambling, the money is crowded out from other businesses leading to the cannibalization of jobs within that locality. Engaging in the gambling industry leads to missed opportunity costs of alternative industries by enriching a few rich owners at the expense of the rest of the population. Clotfelter and Cook (1991:117) put it satirically: Most players end up losing money, of course, but that could be said of other forms of entertainment. Of greater significance is the fact that some people are tempted to gamble more than they can afford, with unfortunate results. At the end of the spectrum are big winners, the lucky few who actually realize the dream of riches. Through them lottery redistributes and concentrates wealth.” In terms of taxes, progressivity, compulsive gambling and government corruption are the major issues stapleford. As poorer households tend to proportionately gamble more than their rich counterparts, gambling taxes tend to be more regressive (a larger portion of income is used to pay taxes). Moreover, gambling is addictive leading to compulsive gambling. As big money tempts with big corruption, the relationship between legalized gambling and governments breeds even bigger corruption vices. Therefore, legalized gambling helps governments lose their moral capital. Altogether, the literature documents impacts of gambling on individuals, families and governments with but scarcely assess impacts on microenterprises. Given the nascent nature of legalized gambling in Kenya, its relation to microenterprises is not documented. Reports that Marketing Communication (MC) mediates the relationship between entrepreneurial orientation and firm performance. Interestingly though, whereas Chepkwony concentrate on MC generated by the microenterprise, the reality is that big betting houses tactfully use MC to lure business owners to easily engage in gambling.

Gambling in the Kenyan setting

Online betting, casinos, lotteries and among others are some of the popular gambling activities we have in Kenya. In the gambling act 2005 gambling is defined as betting, gaming or participating in a lottery. Gambling was legalized with the 1966 betting, lotteries and gaming act, but it has really taken off in recent years. In Kenya, majority of the individuals engaging in sports betting are male of the ages below 40 years and above 21 years. In addition, the biggest source of income for sports betters is salaries indicating that employed individuals are at a higher probability of engaging in sports betting compared to entrepreneurs and unemployed individuals who stake in the hope of getting luck. Most of sports bets are placed using the website on a more than once per week interval. Sportiest is the dominant brand in sports betting. For a number of Africans who eat from hand to mouth and cannot afford to stock food even for two days, lockdown translates to starvation. In Africa, the impact of COVID-19 has affected both big and small organizations. Even so, the impact on micro enterprises is more acute due to their higher levels of vulnerability. Unlike governments in developed countries, most governments in Africa could not afford to feed so many poor families sustainably and the risk of dependence after COVID-19 is real. COVID-19 is merely worsening a bad situation: before lockdown was implemented, some Kenyan families were already begging for food. With the familiar horror of starvation, gambling with COVID-19 with its relatively small mortality rate can make more sense. In the context of COVID-19, lockdowns, “stay at home” directives, and other “international best practices” would not work in resource-poor crowded settings where families live on daily wages. They would translate to hunger and social unrest as has happened in many parts across Africa, leading to more harm than good and some have opted for betting with revenue generated from their micro enterprises while African governments have taken some action to cushion citizens from the effects of lock down, these efforts are grossly inadequate and unsustainable since the governments rely on international donor economies for economic assistance. With the COVID-19 pandemic crippling these donor economies, assistance would not be forthcoming to African governments. Betting, lotteries and gaming sites are regulated by betting, control and licensing board. Act no: CAP131 is an act of parliament that provides for the control and licensing of betting and gaming premises for the imposition and recovery of a tax on betting and gaming; for the authoring of public lotteries; and for the connected purposes. The act permits a person to offer the Relevant Products as long as they have the relevant license to conduct the various forms of gambling activities in Kenya. The act prohibits betting and gaming with a young person. A young person is defined under section 28 (2) of the act as a person under the age of 18 years. There is a wide range of sports to bet on ranging from football, tennis, cricket, basketball, snooker, cycling and various e-sports.

Legalized gambling and microenterprise behaviour/ impact?

Reith reports America’s National Research Council (NRC) conclusion that: “While gambling appears to have net economic benefits for economically depressed communities, the available data are insufficient to determine with accuracy the overall costs and benefits of legal gambling. Pervasive methodological problems in almost all existing studies prevent firm conclusions about the social and economic effects of gambling on individuals, families, businesses and communities generally”. National Gambling Impact Study Commission (NGISC). It is evident that the NRC hedges its conclusion on effects of gambling on business for the reasons raised earlier. Reardon on the other hand asserts that most people can safely delve into legalized gambling and enjoy it as “a fun, recreational activity.” She however offers a quick and overt caution: “But it’s not that way for everyone.” True, it is certainly not for microenterprises. In Kenya, the outcry is loud. For instance in May 2019, the government issued new advertising regulations for the multibillion (Ksh 200 billion or 1.98 billion USD 1.98 billion) legalized gambling industry. Said Dr. Fred Matting’s, Kenya’s Interior Minister: “Rogue behavior in the betting and lotteries industry is endangering the lives of our young people. This clean-up has just started and we will carry it through no matter what it takes, because young Kenyan lives are worth saving.76 percent of youth in Kenya are bettors this is the highest figure in Africa while half a million have been blacklisted by lenders because they borrowed to bet and failed to pay back.” Some of the people referred to by the government are microenterprise operators. For them, betting is business, with the tough times betting is a form of investment that these operators are willing to engage in, and however, they are unprepared for what they get!Sanda (not his actual name) is a microenterprise owner located at Central Ward, in Kisumu County, Kenya. He operates Sanda Enterprises from a rented residential home. He has organized the home bakery business on a growth trajectory and has successfully added a poultry unit to supplement his income. His family provides labour in addition to engaged hirelings. Each evening, as he reclines, he is bombarded with images of successful people who merely betted their way into fame. The cash pay outs are really tempting. He gives in starts with small bets on one betting house and moves to the others. Soon he is an addict! He sees gambling as an alternative business model, and literally invests in it! His fortunes come tumbling down with a thud! He cannot meet his orders procrastinates business decisions as he gets preoccupied with placing bets. He cannot pay business and personal debts. He sells his business assets to get cash flow for gambling. He closes shop and relocates (or rather is evicted). One more microenterprise dies before its fifth birthday!

Kenya’s first COVID-19 case was detected in March, 2020. The effect of the COVID-19 pandemic on the Micro, Small, and Medium Enterprises (MSME) sector in Kenya has been profound. With limited net worth and savings to fall back upon coupled with a squeeze on access to finance, enterprises have faced severe disruptions in demand and payment cycles. This has led to challenges around business continuity and survival. The sector needed appropriate responses at all levels to support its recovery in the aftermath of the crisis. Gambling is a business of uncertainty, and the outcome is unpredictable, this means that the micro-entrepreneurs, who are involved, end up losing capital which would have been injected back to the business for growth. The overall effect of this act is collapse of microenterprise due to diversion of funds to betting [11-13].

Negative impact of gambling for micro enterprises post COVID-19 era

There have already been adverse effects of the COVID-19 pandemic on the several sectors of the Kenyan economy in particular; tourism, agriculture, manufacturing and trade putting people’s jobs and livelihoods at risk. The socio-economic impact of the COVID-19 epidemic operates through two distinct channels. First are the direct and Indirect effects of the sickness, which results from when an income earner in the household falls ill, the ratio of active members to dependents falls. The effects may be compounded by lost earnings and taking care of the ill family member, or funeral costs upon death. Secondly, aversion behavior effects resulting from the fear of catching the virus, which in turn leads to a fear of association with others and reduces labor force participation, closes places of employment, disrupts transportation, motivates some governments to close borders and restrict entry of citizens from afflicted countries, and motivates private decision makers to disrupt trade, travel, and commerce by cancelling scheduled commercial flights and reducing shipping and cargo services. Considering the adverse socio-economic impacts of the COVID-19 pandemic on the health and livelihoods of families and communities, in particular the most vulnerable groups which will regress progress across national government, local governments and communities through community based organizations should adopt and society approach to lessen the adverse impacts. A study by the Kenya Private Sector Alliance (KEPSA) entitled business perspectives on the impact of Coronavirus on Kenya’s economy identified cancellation of business related travels as one of the channels businesses will be affected by the coronavirus. This includes local travel agents receiving cancellations from tourists/clients abroad who are cancelling their trips to Kenya due to the outbreak of the virus. For instance in July–September 2020 when Kenya was experiencing its first wave, tourists who had booked to travel for the migration (wild animals) did not travel. Equally, many clients are now changing their plans to book travels during summer due to uncertainty, Impact of this continues to bite the tourism sector. Measures taken by Kenya and other countries to restrict travel would have huge impact on the travel and tourism sector. The World Travel and Tourism Council (WTTC) figures show that in 2018, travel in tourism in Kenya grew 5.6% and contributed Ksh 790 billion to the economy. It also created 1.1 million jobs. The tourism industry is taking the biggest hit given the measures already taken by the government in shutting down its borders in an attempt to lock out the coronavirus and contain it. The spread of the coronavirus has disrupted the global supply chains. Kenya’s imports from China account for approximately 21% of total imports and with the lockdown put in place last year; activities within the manufacturing sector were seriously disrupted. The low supply of imports from China as well as South Korea especially in terms of electronics could result in an increase in prices. Local traders have already indicated that the prices of electronics, clothes, and furniture many of which are imported from China are likely to increase. The disruption of global supply chains has adversely affected export earnings due to weak demand in these markets. The COVID-19 pandemic has already affected the country’s exports of horticulture and agricultural goods to Europe, which has some of the hardest hit cities in France and Italy mainly because of reduced consumer spending as well as shutdowns in major markets. The Agriculture and Food Authority (AFA), a horticulture regulator in the country, has indicated that Kenya’s earnings from horticulture exports including flowers, fruits and vegetable, fell by 7% in 2019 to Ksh 142.72 from Ksh 154.7 billion, mainly due to lower prices of flowers at the auction in the Netherlands. The situation is set to worsen due to the coronavirus pandemic. A survey by the Kenya Private Sector Alliance (KEPSA) on the Coronavirus pandemic impact on Kenya’s economy indicates that 61% of businesses had been affected by the measures being taken around the world to contain the virus. The survey featured ninety five (95) locally owned businesses spanning seventeen (17) sectors of the economy. In addition, there were thirty two (32) manufacturers surveyed by the Kenya Association of Manufacturers (KAM) with the findings integrated into the KEPSA report. According to the report, most businesses expect to be disrupted by stock-outs and delayed deliveries due to the lockdown, reduced demand for export products, increased cost of goods which will consequently increase the overall cost of production, reduced capital flows, restrictions on travel, and reduced staff time. Kenya like most COVID-19 affected countries temporarily closed schools and learning institutions to mitigate the spread of the outbreak. School closures impede learning and compound inequities, disproportionately affecting disadvantaged children. School closures during COVID-19 pandemic could increase dropouts, child labour, violence against children, teen pregnancies, and persisting socioeconomic and gender disparities. Temporary school closures can have acutely negative effects for displaced or refugee children for whom school can provide a safe space for interaction with peers, psychosocial support, and even a reliable source of food. When schools are closed, children’s mental health issues might be exacerbated by the lack of peer support and alternatives for mitigation of risks. In their recommendations to containing the adverse impact on the Coronavirus in Kenya, KEPSA has recommended supportive measures to aid Kenyan businesses. These include: Granting tax breaks to companies seeking to increase their capacity to produce import substitute goods, which could even mean zero-rating VAT for the next 3-months; releasing VAT refunds to assist businesses with managing their cash flow; encouraging banks to give concessionary loans at low rates to facilitate businesses, and as well provide moratoriums on loans that are due; providing for a Business Stabilization Fund (BSF) to cushion the impact of the coronavirus, especially for micro-enterprises reducing corporate tax for industries that have been highly affected by the coronavirus such as the aviation industry, or waiving corporate tax for a 3 months period as well as a reduction in payroll tax for the next 3 months for the low income bracket workers and strengthening the local supply chain for traders to be able to access import substitute goods. Concerns have been raised about increased gambling problems during the COVID-19 crisis, particularly in settings with high online gambling and risks of migration. Researches have been done to find out the impact of gambling on micro enterprises during COVID-19 pandemic period. Gambling has affected entrepreneurs on online gambling and offshore gambling. This has affected the quality time spent to structure and plan business operations. In turn, this has affected the quality of time input into the business, as entrepreneurs look for “easy money.” Additionally, there is a possibility of the entrepreneur losing on a bet which could have caused substantial amount of money leading to distress and finally attempt to commit suicide. Excessive gambling and use of business resources to gamble has resulted to family feuds like: violence, divorce, and overall collapse of the moral family fabric and has affected the progress of the business. Small businesses closed due to cessation of movements and reduced number of operations due to curfew and lock downs. Businesses dealing with imports and exports also closed down as the pandemic are global. This led people to online gambling like betting or online marketing with uncertainty of getting results. Most micro-enterprises have lost their goods through online businesses, some delivering goods to unknown clients before payment therefore losing their goods. Additionally, companies experience a reduction in the supply of labour, as workers are unwell or need to look after children or other dependents while schools are closed and movements of people are restricted. Measures to contain the disease by lockdowns and quarantines lead to further and more severe drops in capacity utilization. Furthermore, supply chains are interrupted leading to shortages of parts and intermediate goods. Micro enterprises often have a more limited number of suppliers. In some cases, this may shelter them from the shock. At the beginning of the pandemic outbreak in China, this appeared to be the case with German micro enterprises operating more in regional supply chains and therefore less affected by developments in Asia. In other cases, micro enterprises may rely on suppliers from countries and regions with more COVID-19 cases, increasing their vulnerability.

Similarly, obstacles in transportation by sea, road or air affect these SMEs. Some micro-enterprises are particularly vulnerable to the disruption of business networks and supply chains, with connections with larger operators (e.g. MNEs) and the outsourcing of many business services critical to their performance. Over the longer term, it may be difficult for many enterprises to re-build connections with former networks, once supply chains are disrupted and former partners have set up new alliances and business contracts. Dramatic and sudden loss of demand and revenue for micro-enterprises severely affects their ability to function, and/or causes severe liquidity shortages. Furthermore, consumers experience loss of income, fear of contagion and heightened uncertainty, which in turn reduces spending and consumption. These effects are compounded because workers are laid off and firms are not able to pay salaries. Some sectors, such as tourism and transportation, are particularly affected, also contributing to reduced business and consumer confidence. More generally, micro enterprises are likely to be more vulnerable to ‘social distancing’ than other companies. The impact of the virus could have potential spill over into financial markets, with further reduced confidence and a reduction of credit. These various impacts are affecting both larger and smaller firms. However, the effect on micro enterprises is especially severe, particularly because of higher levels of vulnerability and lower resilience related to their size. Micro enterprises may have less resilience and flexibility in dealing with the costs these shocks entail. Costs for prevention as well as requested changes in work processes, such as the shift to teleworking, may be relatively higher for micro-enterprises given their smaller size, but also, in many instances, the low level of digitization and difficulties in accessing and adopting technologies. If production is reduced in response to the developments, the costs of underutilized labour and capital weigh greater on micro enterprises than larger firms. Furthermore, micro enterprises may find it harder to obtain information not only on measures to halt the spread of the virus, but also on possible business strategies to lighten the shock, and government initiatives available to provide support. Overall revenue based taxations from micro enterprises decreased due to gambling. However, betting increased steeply during the pandemic. The state owned operator in betting/online casino decreased markedly throughout the pandemic. Throughout the pandemic, the smaller restaurant, casinos decreased markedly, while major state-owned casinos also closed entirely [14-16].

Positive impact of gambling for micro enterprises post COVID-19 era

On the other hand, gambling has also led to positive economic effect in Kenya. For instance, it is a source of employment. Casinos in the country are intensive labour and have hired security guards, technical support staff, gaming staff, among others. However, employment resulting from gambling is difficult to estimate since gambling involves employees in many different stages. Entertainment in Kenya has been interlinked with gambling as well, for instance, hotel services and chauffeurs are also in higher demand because of gambling. Points out that gambling increases aggregate demand for goods and services in the economy. This money goes directly toward stimulating the economy. This expenditure on gambling can also be magnified when considering the gross domestic product. Besides economic development and job creation, possibly the most important political motivation for the introduction of gambling either lotteries or casinos has been an effort to increase government tax revenue. Tax rates on gambling activities increases per capita income.

Discussion

Additionally, gambling as a source of entertainment does not only lead to more problems as Griffins, argue, but is a way of accessing and building relationships as well. The COVID-19 lockdowns had adverse psychological effects for instance loneliness, depression and suicidal thoughts and relationship breakdowns. These negative impacts are recognized to go beyond individual gamblers and have dire consequences on their micro enterprises and families, hence socializing and building networks during these periods are a good way of relaxation. Policy responses/mitigations for micro enterprises in the wake of COVID-19 pandemic gambling as an activity is not only legal in Kenya, but this country was one of the first in Africa to legalize all forms of betting and casino games almost 60 years ago. Kenya is home to 45 million residents and it has one of the most advanced economies on the continent. Still, this is a very poor country in which nearly 20 percent of the population lives on less than $1.25 per day. Gaming operators in Kenya are subject to taxes which have been reviewed in 2017 in order to address revenue issues and provide a solution for social issues which come with gambling. While it remains part of the law there are no reports of operators collecting the tax, nor any Kenyan gamblers reporting they have paid it. Given the specific circumstances micro enterprises are currently facing, countries have put measures in place to support them. While the first concern is public health, wide arrays of measures are being introduced to mitigate the economic impact of the corona virus outbreak on businesses. Specifically, many countries are urgently deploying measures to support micro enterprises and the self employed during this severely challenging time, with a strong focus on initiatives to sustain short term liquidity. Kenya, as a country should have introduced measures related to working time shortening, temporary lay off and sick leave, some targeted directly at micro enterprises. Similarly, governments should provide wage and income support for employees temporarily lay off, or for companies to safeguard employment. In many cases, countries have introduced measures specifically focused on the self employed. In order to ease liquidity constraints, Kenya should introduce measures towards the deferral of tax, social security payments, debt payments and rent and utility payments. In some cases, tax relief or a moratorium on debt repayments have been implemented. There is urgent need to introduce, extend or simplify the provision of loan guarantees, to enable commercial banks to expand lending to micro enterprises. Alternatively, Kenya should step up direct lending to micro enterprises through public institutions. Progressively, Kenya should put in place structural policies to help micro enterprises adopt new working methods and (digital) technologies and to find new markets and sales channels to continue operations under the prevailing containment measures. These policies should aim to address urgent short term challenges, such as the introduction of teleworking, but also contribute to strengthening the resilience of micro enterprises in a more structural way and support their further growth. Finally, Kenya should have a plan of introducing specific schemes to monitor the impact of the crisis on micro enterprises and enhance the governance of micro enterprises related policy responses [17-20].

Conclusion

The COVID-19 outbreak in the African continues to evolve rapidly, with several new countries reporting confirmed cases and an associated upsurge in incidence cases reported across the region. In response, the government through the ministry of health, has put in place a robust approach to address the COVID-19 threat. As part of the response, the Ministry has constituted a National Coronavirus Taskforce (NCT) to evaluate the evolving risk and advise the government on appropriate measures for preparedness, prevention and response in order to mitigate the public health impact. The government has also established a COVID-19 emergency response fund to mobilize resources to finance pandemic response activities. Enterprises that gamble and the families who owned these enterprise are also affected since the gamblers have lost majorities of their jobs and no longer have stable income may prefer to direct their gambling money on family issues such as food, medication and savings due to job uncertainties and corona virus waves that becomes more unpredictable and the enterprise owners also need to be protected by government policies. Coronavirus is having a ripple effect on the gambling industry. Professional sports have been postponed, land casinos are closed, and social distancing has shut home games down. COVID-19 has already had a profound effect on the betting companies. Although casino websites are currently thriving, there is no telling how long that will last. Land casinos all over the world have experienced a significant drop in revenue due to social distancing and travel bans staying indoors and keeping a distance from people has already become the norm in the hope of stemming the speed of the spread of the virus. Online gambling provides a much safer environment than a crowded casino or football stadium. As the impact of COVID-19 continues to cause delays and interruptions, the effects of the pandemic on the sports betting and online casinos are continuing to evolve rapidly as well. The impact on sports betting may seem inconsequential during such a severe public health pandemic; nevertheless, there will continue to be tangible effects on the industry. Increasingly, it has come to the realization of micro enterprises paying gambling taxes and micro entrepreneurs engaging in gambling business to raise capital that gambling makes no genuine contribution to economic development. Disadvantaged social groups who experience poverty, unemployment, dependence on welfare, homelessness, low levels of education and household income are most likely to suffer the adverse consequences of increased gambling. Financial worries, relationship difficulties and other serious effects have all sprung up from gambling business. In recent times, and with the COVID-19 era, the gambling addiction has immensely impacted on micro entrepreneurs finances, relationships and well-being. This problem has been far reaching and has caused both individuals and micro-enterprises to panic and act in ways they would not normally act.

Future Directions

Online gambling operators, governments, and researchers must work collaboratively to conduct valid and reliable research. Researchers should receive access to the large amounts of data collected by online gambling operators, after commercially sensitive information is removed, to enable analysis of gambling behavior. This will have positive impacts on the industry by enabling greater customer understanding. Safe and responsible gambling represents a win-win solution for its clients and the industry. By satisfactorily ensuring that underage players are prohibited from playing, that responsible gambling solutions are in place, by ensuring honest, fair play and integrity, the regulatory processes. If properly regulated and responsible oversight is employed, the harms and risks to vulnerable populations may be minimized. The inclusion of responsible codes of conduct will help assure the public and will ultimately provide safety to individuals and businesses.

REFERENCES

- Ajack M. South Sudan becomes the 51st country in Africa with COVID-19 as it confirms its first case. Time, April 5. 2020.

- Brenner GA. Gambling and speculation: A theory, a history, and a future of some human decisions. Cambridge. Cambridge University Press. United Kingdom. 1990.

- Bowen M, Morara M, Mureithi S. Management of Business Challenges Among Small and Micro Enterprises in Nairobi-Kenya. KCA J Bus Manag. 2009;2(1):16-31.

- Chepkwony CP, Aila FO, Ondoro CO. Mediating effect of marketing communication in the relationship between entrepreneurial orientation and micro-enterprise performance. Int J Economics Commerce Manag. 2017;5(5):612-626.

- Glatfelter CT, Cook PJ. Selling hope: State lotteries in America. Massachusetts, 2nd ed, Harvard Business Press, United States. 1991.

- Czegledy P. Canadian land-based gambling in the time of COVID-19. Gaming Law Rev. 2020;24:555–558.

- Dess GG, Brian C, Pinkham BC, Yang H. Entrepreneurial orientation: Assessing the construct's validity and addressing some of its implications for research in the areas of family business and organizational learning. Entrep Theory Pract. 35(5):1077–1090.

- de Waal A, Richards P. Coronavirus: Why lockdowns may not be the answer in Africa. BBC News. WHO. 2020.

- Eapen. Rural industrialization in Kerala: Re-examining the issue of rural growth linkages. International seminar held in January 2003, Department of Applied Economics, CUSAT. 33-34.

- Edgcomb EL, Klein JA.Opening opportunities, building ownership: fulfilling the promise of microenterprises in the United States. FIELD. USA. 2005.

- OJEU (2003) Commission Recommendation. OJEU. 2003:1-6.

- Ferdousi F, Mahmud P. Investment in Microenterprises for Scaling up Business Growth: Evidence from Social Business Project. INTEC. 2018; 1-472.

- FIELD. Microenterprise development in the United States: An overview. Microenterprise. 2000; 1(1):1-8.

- Frese M. Success and Failure of Microbusiness Owners in Africa: A Psychological Approach. Santa Barbara, CA: Greenwood Publishing Group. Californila, USA. 2002:1-202

- Gadzala A. Survival of the fittest? Kenya's jua kali and Chinese businesses. J East Afr Stud. 2009;3(2):202-220.

- Garcia-Cabrera AM, Garcia-Soto MG. Cultural differences and entrepreneurial behaviour: an intra-country cross-cultural analysis in Cape Verde. Entrepreneurship Reg Dev. 2008;20(5):451-483.

- Guimaraes BE. Determinants of Small Business Survival: The Case of Very Small Enterprises of the Traditional Manufacturing Sectors in Brazil. SSNR. 2016;1-28.

- Griffiths M. Gambling Technologies : Prospects for Problem Gambling. J Gambl Stud. 2013;15(3):265-283.

- Kaza PG. Women entrepreneurs: Innovative lending and credit programmers. National Bank News Reviews. 1996; 13(1):8-9.

- Kimunga JK. Challenges facing small scale business growth and survival: The case of Chloride Exide battery/solar dealers around Mt. Kenya east region. University of Nairobi, Nairobi, Kenya. 2009; 1-88

Citation: Aila FO, Oloo C (2022) Might Legalized Gambling Expose Kenyan Microenterprises to Survival Risks during COVID-19 Pandemic. Review Pub Administration Manag. 10:374.

Copyright: © 2022 Aila FO, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.