Indexed In

- Genamics JournalSeek

- RefSeek

- Hamdard University

- EBSCO A-Z

- Publons

- Geneva Foundation for Medical Education and Research

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Market Analysis - (2020) Volume 17, Issue 5

Market Analysis on Perinatology & Child Care

Dr. Shinichi Hirose*Received: 11-Aug-2020 Published: 25-Aug-2020

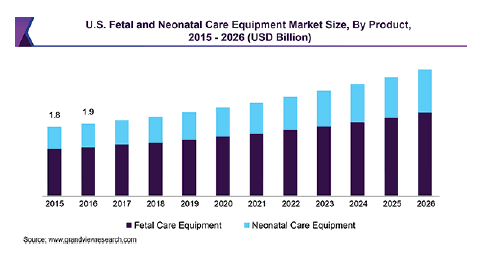

The global fetal (Labor & Delivery) and neonatal care equipment market size was valued at USD 6.3 billion in 2018 and is estimated to grow at a CAGR of around 6.9% over the forecast period. Some of the factors responsible for market growth are the high birth rate in developing countries, rising prevalence of preterm births, and efforts by the government to increase survival rates in such cases.

Increasing prevalence of neonatal hospital-acquired infections and rising awareness about neonatal health & care equipment is expected to contribute to the market growth. According to the UN Foundation, maternal & infant care is a global priority, since around 800 women die every day from preventable causes associated with pregnancy or childbirth. This has led to increased demand for neonatal and fetal care equipment. Furthermore, HAIs are primarily a concern for premature and infants with medical disorders requiring prolonged hospitalization.

The UNICEF (United Nations International Children's Emergency Fund) data stated that 2.5 million children died in the first month of life in 2017 across the world. Furthermore, preterm and low weight birth babies are susceptible to many heath risks and require specialized care. Hence, demand for neonatal equipment is expected to grow exponentially.

Neonatal equipment has been observed to have increasing demand in middle-income countries, as birth rates in these countries are higher, and the priority for improved fetal & neonatal care is high in these countries. As a result, sales of the equipment are expected to flourish at a rapid rate.

Based on product type, the market has been segmented into fetal care and neonatal care equipment. In 2018, ultrasound devices held the largest share in fetal care equipment owing to its increasing application to view the fetus during pregnancy. In addition, rising awareness, technological advancements, and ease in utility have further triggered the usage of portable and do-it-yourself ultrasound devices for home-use.

Fetal monitor segment is anticipated to witness fastest growth rate during the forecast period, owing to its utility in determining the baby's heart rate during pregnancy and labor. Fetal monitoring devices are essential as it allows continuous monitoring of the baby's heart rate and contractions and assists in labor too.

In January 2019, Owlet received award for its band which can provide expecting mother real-time updates about baby's well-being. The band can track baby’s heart rate and kick count and can send alert about contractions. The company is planning to launch product later in 2019.

In neonatal care equipment, monitoring devices segment held the largest share in the year 2018, due to factors such as constant technological advancements in neonatal monitors including improvements in connectivity and ease-of-use in home settings.

On the other hand, respiratory devices are expected to exhibit fastest growth rate owing to increasing demand for respiratory care in neonatal in order to reduce the length of hospital stay and risk of long-term disability. Nearly all newborns are prone to respiratory difficulties at birth, and neonate respiratory devices ease the process ensuring better health of the baby.

This report forecasts revenue growth and provides an analysis on the industry trends in each of the sub-segments from 2015 to 2026. For the purpose of this study, Grand View Research has segmented the fetal and neonatal care equipment market based on product, end use, and region:

Product Outlook (Revenue, USD Million; 2015 - 2026)

Fetal Care Equipment

• Ultrasound Devices

• Fetal Dopplers

• Fetal MRI Systems

• Fetal Monitors

• Fetal Pulse Oximeters

Neonatal Care Equipment

• Infant Warmers

• Incubators

• Convertible Warmers & Incubators

• Phototherapy Equipment

Respiratory Devices

• Neonatal Ventilators

• Continuous Positive Airway Pressure (CPAP) Devices

• Oxygen Analyzers and Monitors

• Resuscitators

• Others

Neonatal Monitoring Devices

• Blood Pressure Monitors

• Cardiac Monitors

• Pulse Oximeters

• Integrated Monitoring Devices

End Use Outlook (Revenue, USD Million; 2015 - 2026)

• Hospitals

• Diagnostic Centers

• Clinics & Others

Regional Outlook (Revenue, USD Million; 2015 - 2026)

• North America

• U.S.

• Canada

• Europe

• UK

• Germany

• Asia Pacific

• China

• Japan

• India

• Latin America

• Brazil

• Mexico

• MEA

• South Africa

• Saudi Arabia

-

Annual Congress on Perinatology & Child Care

Webinar