Indexed In

- Open J Gate

- RefSeek

- Hamdard University

- EBSCO A-Z

- Scholarsteer

- Publons

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Review Article - (2024) Volume 12, Issue 1

Factors Affecting Credit Purchase Practice in Ethiopia

Yesuf Ahmedin Salih and Dhiraj Sharma*Received: 19-Dec-2022, Manuscript No. IJAR-22-19385; Editor assigned: 22-Dec-2022, Pre QC No. IJAR-22-19385 (PQ); Reviewed: 05-Jan-2023, QC No. IJAR-22-19385; Revised: 27-Dec-2023, Manuscript No. IJAR-22-19385 (R); Published: 03-Jan-2024, DOI: 10.35248/2472-114X.24.12.373

Abstract

This study was conducted to examine factors affecting the trade credit practice of private traders a case of Burie town, Ethiopia. Close ended and open ended questionnaires were used to collect primary data from 304 randomly chosen private traders. A total of ten explanatory variables namely gender, education status, marital status, size of business, age of business, access of bank loan, length of trade relationship with suppliers, frequency of purchase and number of suppliers were included in the selected model. The binary logistic model indicates trade credit practice affected by six predictor variables namely gender of private trader, access to bank loan, age of business, length of trade relationship with suppliers, frequency of purchase per month and number of suppliers. The chamber of commerce should prepare trade credit policies and standards that motivate trade credit practice.

Keywords

Trade credit; Trade relationship; Private traders; Frequency of purchase and finance

Introduction

Background of the study

Small and medium sized businesses are crucial to the development of the private sectors in all nations; however, research shows that small enterprises usually struggle to get outside finance [1]. They are largely barred from conventional institutions of finance, like commercial banks when it comes to financing. It is widely recognized that the development of the financial sector, where banks play a crucial role in supplying major enterprises with essential outside finance, is crucial. Getting a bank loan remains a challenge for small businesses because of their creditworthiness. Both developing and developed countries are increasingly using trade credit financing to fund such enterprises. The seller sees this as an investment in accounts receivable, whereas the buyer treats it as a current liability on their balance sheet [2].

From both a micro and a macro economic advantage point, trade credit is economically significant. One of the most significant resources of operating capital for Iranian businesses is trade credit. By the end of 2018, liabilities for half of the manufacturing firms typically accounted for more than 70% of accounts payable. Since 92 percent of companies use trade credit, it is crucial for both large and small enterprises. It is clear how important trade credit is and what a significant influence it may play in a company's success.

In a recent study, trade financing is typically a low cost, high volume source of capital. With a global average of 0.2 percent and little variation across countries, the risk of default is low. Small enterprises are rigorously hit, with surveyed banks rejecting 45 percent of their trade finance bids. Because they were unable to acquire alternative finance, half of the rejected small and medium size business abandoned trade agreements [3]. A multitude of causes contribute to rejections, including a lack of collateral, insufficient information accessible during the application procedure, and bank profitability. The fall in correspondent banking has added to the trade financing gaps.

In Ethiopia, trade credit from credit suppliers is identified as the common significant source of short-term finance for private business, representing for 17 percent of their working capital finance [4-8]. Borrowing from other informal and official sources was also ranked higher. Furthermore, Gebrehiwot, et al. found that more than half of the studied medium size enterprises used trade credit to finance their operations. However, many potential businesses (i.e., credit hungry clients) were unable to obtain trade credit due to a variety of variables, including familiarity between supplier and customer based on family, religion, and friendship. Regardless of the potential value of trade credit, particularly in underdeveloped nations like Ethiopia, less attention has been devoted to its function and use. In this context, it is critical to examine the factors that affecting the trade credit practice of private traders, particularly micro variables connected to owner and business characteristics. In fact, there has been a lack of literature on the trade credit practice and its factors affecting Ethiopia.

Statement of the problem

Privately held medium and small businesses relied heavily on trade credit since they lacked access to bank loans. The claim that trade credit lowers the chance of financial distress for medium sized and small companies in both developing and developed countries is supported by empirical data. Suppliers have benefit over financial intermediaries due to their expertise in dealing with collateral and the fact that they have private information about their customers, as well as the fact that trade credit reduces information asymmetries between seller and buyer. In particular, small businesses rely on trade credit because suppliers usually give more credit than financial institutions [9]. Not with standing the fact that supplier credit requires no identifiable collateral and decreases information asymmetry, the factors that influence the utilization of trade credit have yet to be thoroughly studied. Trade credit is either a supplement to or a replacement for bank credit, according to the trade credit literature. Trade credit holds the potential of making bank credit more accessible or completely replacing bank credit as a means of external financing. Along with research was done by Altunok, et al. businesses with longer bank loan maturities and fixed interest rates are less adamant about obtaining trade credit. Additionally, companies in industrialized nations are given greater trade credit, which suggests that in more competitive markets, trade credit can replace institutional finance [10].

On the other hand, the replacement hypothesis contends that borrowers' dependence on trade credit is more probable in nations with developing financial systems. Similarly, Ethiopia's financial system remains underdeveloped due to the lack of a stock exchange and foreign financial institutions, as well as the sector's isolation from globalization's consequences. In that circumstance, potential borrowers will most likely be denied access to money (credit rationing), forcing them to seek alternative sources of funding. Furthermore, the trade credit practice is governed by a variety of restrictions and factors that range from country to country as well as market to market.

In Europe, small and medium sized businesses that are privately held have found trade credit to be an important source of finance, where it accounts for around 30 percent of GDP. The most significant alternative to bank loans is it Canto-Cuevas, et al. The accounts receivable account for 67% of total sales among Tanzanian rice sellers Kihanga, et al. and to 55% and 60% of African firms receive and supply trade credit, respectively Dary, et al. There have been several studies lately on the variables influencing the trade credit use, including whether it can replace bank loans or other kinds of financing. The findings of Carbo-Valverde, et al.; Yazdanfar, et al.; Bussoli, et al.; Andrieu, et al.; McGuinness, et al. trade credit serves as a supplement to bank financing However, previous studies have not revealed a unifying consensus regarding the variables influencing trade credit practice. These contradicting results have been noted as a result of cultural, market, and financial system differences between nations. Determining the variables influencing private traders' trade credit use in Ethiopia, and more specifically in Burie town, is crucial because these elements are dynamic and depend on local environment variations [11].

Given the liquidity challenges that small private businesses confront, it is clear that boosting access to trade credit necessitates expanding the availability of financial services to everyone. Access to formal financial services is constrained in the Ethiopian financial sector. This could encourage businesses to adopt unregulated financing options like trade credit. In other words, despite its potential importance, trade credit has received little attention in Ethiopia in general, and there has been no research study undertaken in Burie specifically, as far as the researcher is aware. Previous research has mostly been done in nations with strong economies Fisman, et al.; Hasan, et al. The only papers conducted by Getachew, et al. determinant of trade credit in Mekelle town and Regasa, et al. which examine the trade credit evidence and financial constraints from Ethiopian firms. According to the research, firms with financial constraints use trade credit less frequently than firms with no financial constraints, suggesting that firms with bank credit restrictions also use trade credit less frequently. In this regard, it is very important to analyze factors that affect the trade credit practice of private traders specifically considering micro variables related to owner and business characteristics. This research study fills a literature gap on the factors affecting trade credit practice in Ethiopia as a developing country.

Literature Review

When a company sells items to a customer and does not receive immediate payment in cash, it is giving credit to the customer (accounts receivable or supplier credit). When a company buys items from a supplier and pays later, it receives credit from the provider, which is referred to as accounts payable. Trade credit is a type of credit given to customers when payment for goods purchased is postponed and are one of the most significant short-term funding sources for businesses [12]. Trade credits are created as a common credit relationship in the course of an enterprise's everyday business operations and commodity transactions. In terms of financing, trade credits are a kind of short-term credit with a relaxing effect on financing limitations that upstream companies provide to downstream businesses.

Theories of trade credit

Financing theory: Since trade credit might be a major source of interim funding, the financing theory predicts that businesses without access to bank loans would need it more Petersen, et al.; Huyghebaert, et al.; Nielsen, et al.; Bussoli, et al. Conversely, a client has access to a bank loan; as a result, trade credit demand will decline. The basic idea is that one may supplement traditional finance with things like bank loans and trade credit. In other words, when businesses have access to bank financing, they will utilize trade credit less [13]. This is based on the pecking order idea, which contends that trade credit is more expensive than bank credit. Financially unrestrained enterprises should refrain from using trade credit due to the notion that it is much more expensive than bank loans. Since a result, trade credit is increasingly relied upon as bank credit is restricted.

Marketing theory: If there are no incentives for a provider to maintain its client base in a multi-supplier environment, clients may easily transfer suppliers. Giving customers’ trade credit can be one method to maintain them. Pike, et al. citing marketing theory, argue that the role of market competitive pressure as a cause for extending trade credit is important. The marketing theory that "customers are the king of any organization" remains a critical component of every company's success. To outperform competition, a company must acquire a pool of customers by providing consistent customer satisfaction. Granting trade credit is one strategy for building long-term relationships and offering incentives.

Liquidity theory: According to this idea put out by Emery, credit rationed organizations utilize trade credit more often than companies with usual access to financial institutions. The essential premise of this concept is that when a company is financially strapped, trade credit can compensate for a decline in credit from banking institutions. This perspective contends that enterprises with superior liquidity or better access to capital markets may fund credit rationed businesses. To support this claim, empirical data have been gathered in a variety of methods.

Transaction cost advantage theory: Due to the potential financial hardships that clients may experience with larger quantities of purchases, trade credit demand is encouraged Elliehausen, et al. Other scholars emphasize that businesses that make frequent purchases could have a high stock turnover. Their timing of purchases becomes more irregular as a consequence, which might raise their requirement for trade credit due to liquidity problems. Another similar argument contends that if a consumer purchases from multiple suppliers, the delivery date's level of uncertainty rises, increasing the need for trade credit [14]. The possibility of a mismatch between the moment the customer receives trade credit that he or she has extended to his or her own customers and the moment he or she must pay for purchases from suppliers is the subject of a final argument regarding transaction costs of customers and the effects on trade credit demand. If there is such a discrepancy, clients might request trade credit more frequently. In certain cases, delaying payment for purchases might help a firm better synchronize its cash inflows from sales with its outflows for the cost of the things given.

Empirical studies

According to empirical study, trade credit has an impact on firm profitability. Based on the fact that trade credit benefits outweigh the costs of vendor financing for Spanish small businesses, Martinez-Sol, et al. identified a positive correlation between trade credit investment and firm success [15].

Using a sample of Indian manufacturing firms, Vaidya, et al. explored the factors influencing trade credit practice and discovered that issuing trade credit was motivated by inventory management. Businesses use trade credit, both gross and net, to enhance sales and reduce completed product inventories. Companies tend to defer payments to their suppliers as their inventories of semi-finished goods, finished goods, and raw materials grow, resulting in greater accounts payable on their books. This is supposed to help companies recover from negative sales shocks. Trade credit may thus be seen as an economic reaction to changing consumer demand for their final products as a whole. It was found that highly lucrative businesses gave and received less trade credit than less successful businesses (on a net and gross basis). This discovery could be due to a number of factors [16]. For starters, organizations that are more prosperous may not have as big of a problem with demand unpredictability. Customers receive less trade credit from companies with larger bank credit. Larger bank cash is not passed on to customers as accounts receivable by companies. Companies with larger bank obligations, on the other hand, are given more trade credit. The supplementary theory of loans from banks and trade credit is supported by empirical data on the factors affecting trade credit in India.

Cole, et al. investigated what factors affect businesses' reliance on trade credit. The findings revealed that enterprises that used trade credit were larger, more liquid, had poor credit quality, and were older, on the other hand, companies that did not utilize trade credit were smaller, and more profitable, had better credit quality, and had considerable tangible assets. Business owners that utilized trade credit were found to be older; less likely to be female, less educated, and of the same ethnicity, whereas business owners that used bank credit was found to be younger, better educated, and ethnically diverse [17]. The study's results showed that the quantity of trade credit utilized rises with business age, suggesting that older organizations may depend more heavily on trade credit since they are more reliable and have an edge when it comes to information. Additionally, it was found that when a firm's credit quality is weak, more trade credit is utilized since there are fewer physical assets the company may use as collateral for bank loans. Last but not least, it jived with the capital structure pecking order theory and lent credence to the financing advantage hypothesis of trade credit.

In a research on the availability of trade credit to privately owned enterprises and gender, Cole, et al. have examined evidence from small company finance surveys in the United States to find substantial evidence of univariate differences using multivariate analysis. Because women are more probable to be discouraged from acquiring credit and more probable to be denied credit when they apply, businesses owned by women are more likely to be credit constrained than those owned by men. Whereas, when other firm and owner characteristics are taken into consideration, these differences become insignificant. This study suggests that additional disparities between female and male owned enterprises account for the documented gender inequalities in trade credit availability, such as the size and industry of the businesses, as well as the age, experience, and educational level of the owners. In conclusion, empirical evidence on trade credit demand in industrialized nations produced different results in the testing of the trade credit theories outlined above. Because of this, the inconsistent nature of these empirical results shows that the variables impacting the usage of trade credit are dynamic and need ongoing empirical study. The section below introduces empirical information on the utilization of trade credit in Africa [18].

Empirical studies in Africa: According to Ojenike and Olowoniyi's research on the factors affecting of trade credit practice by randomly chosen enterprises in Nigeria provides the other empirical evidence on trade credit. For the investigation, fixed effect panel data from 2000 to 2009 was used. The findings found that the key factors affecting of trade credit in Nigeria were sales value, depreciation value, institutional loan, profit, tangibility, and the enterprises' current assets. The conclusion implied that the sampled firms' retained earnings were comparatively larger, resulting in a non-significant impact on the trade credit usage. The operating costs of the enterprises in the sample were also high. The firms in the sample have tangible assets as well. Because the findings show that the tested enterprises in Nigeria had sufficient working capital, there was no demand for trade credit.

Furthermore, Guy, et al. found that enterprises with a stronger bank reputation use trade credit more than those with a worse bank reputation in a study on the drivers of trade credit demand using a sample of Cameroonian firms using a fixed effect binary logit model. The cost of a bank loan, as measured by the quantity of short term bank credit, has a remarkable effect on the need for trade credit. The transaction cost advantage theory has limited explanatory value, according to this research. However the financing theory has a significant correlation with the behavior of the sample companies. Furthermore, the natures of the transaction, the frequency, and the volume of transactions have a bigger effect on trade credit. The managers' share capital had a favorable impact on how long the trade credit term lasted [19].

Fatoki, et al. used logistic regression to investigate the drivers of new small and medium enterprises’ access to trade financing in South Africa. Only 71 of the 417 respondents were able to obtain trade credit, according to their findings. Managerial capability, the accessibility of a business plan, membership in trade associations, existing relationships, location, firm size, insurance, and combination were all found to be major predictors of new small and medium enterprises’ access to trade financing in South Africa.

Using the structural modeling approach, Hermes, et al. investigated the factors affecting the supply and demand of trade credit supply and demand in Tanzanian rice market. This study discovered that belonging to the similar cultural group increases demand for trade credit but has no effect on supply, implying that cultural ties may serve as a signal for repaying trade credit; the social pressure to pay back is increased when a wholesaler from the same ethnic community is asked for trade credit.

In conclusion, empirical data from Africa reveals that trade credit is principal source of finance, even in nations where financial markets are failing, contract enforcement is shaky, and information is asymmetric, unreliable, and poor. Firm size and length of commercial relationship were extensively researched in numerous prior studies in Africa, and were proven to be significant determinants influencing trade credit demand.

Empirical studies in Ethiopia

According to a study on medium sized firms' finance in Ethiopia by Gebrehiwot, et al; Wolday, et al. trade credit is a common practice in the medium sized enterprise sector. The vast majority of the small and medium enterprises surveyed (about 80%) used trade credit, either receiving or giving it, or both.

Research gap

Trade credit practice and finance philosophy have a positive and negative relationship with access to bank loans; volume of transaction is positively related with trade credit practice and Transaction cost; size business is both positively and negatively related with trade credit practice and financing theory. A company's age has both good and negative effects on trade credit use and financing theory; familiarity with supplier is both positively and negatively related with trade credit practice and financing theory and finally length of relationship with suppliers is positively related with trade credit practice and financing theory. Hence, this study has dealt with the theoretical justification for trade credit use and pinpointed abundant empirical evidence about the tests of these theories in different context and time. The results of these empirical works in turn were inconsistent from time to time and place to place, which necessitates further empirical work about the topic. Hence, considering existing theoretical and empirical literature is very crucial [20].

Aim of the study

This study is conducted to identify factors affecting credit purchase practice from demand perspective.

Research materials

Research design: This design is defined by the research hypotheses that explain the kind and pattern of interactions between the variables under investigation. Therefore, the study was used both descriptive and explanatory method in order to explain factors affecting trade credit practice of private traders in Burie town, Ethiopia.

Target population and sample size: There are about 1621 small and medium enterprises are registered and licensed under Burie town. The study's sample size (n) was 321, and it was calculated using the Yamane scientific formula (1967);

n:N

1+N (e)2

Where,

N=Population size,

e=Sampling error

Therefore, n=1621

=320.83 approximately 321

1+1621(.05)2

Sampling technique: Simple random selection gives every person in the target population an equal chance of being selected. Since private merchants make up the target demographic, they have a common set of commercial and operational traits. As a result, simple random sampling is appropriate whenever the target population has homogeneous characteristics.

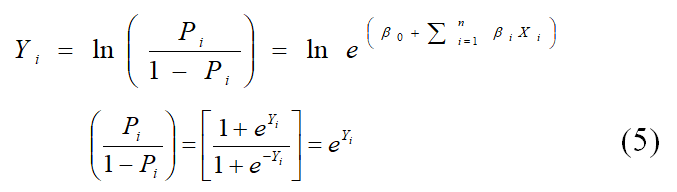

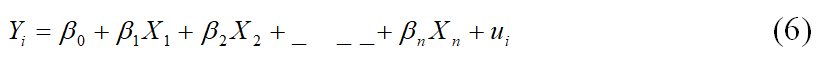

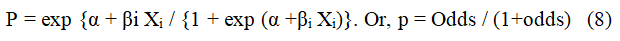

Model specification: To analyze the effect of stimulus variables on the outcome variable, binary logit model was used. The dependent variable's characteristics led to the model's selection. The logit model deals with cumulative probability distribution function whereas the probit model is associated with the cumulative normal distribution. Usually logit is preferred over probit for its comparative mathematical simplicity.

Odds ratio=The probability of using trade credit/probability of not using

The probability that trader is not using can be defined as:

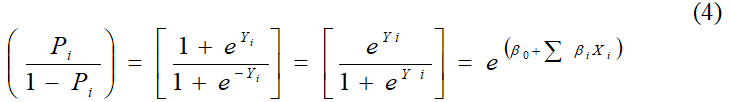

Using equation (1) and (2) the odds ratio becomes:

This can be written as:

Thus, the ratio is the odds ratio of the probability that private trader use trade credit to the probability that private trader has not using. Taking the natural logarithms of the odds ratio of equation (4), one can obtain;

Where,

Yi is the log of the odds ratio, which is not only linear in Xi, but linear in the parameters. Yi is called the logit model.

When the stochastic disturbance term (ui) is introduced to the model, the logit model becomes:

Where,

X1-n are explanatory variables;

β1-n, are the slope coefficient;

ui is the error term (absorbs all unobserved factors).

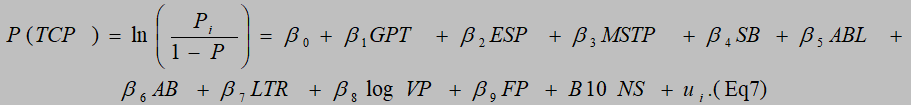

Then, model applied have the following form:

Where,

P (TCP)=The probability that ith private trader uses trade

credit given explanatory variables

β0=Constant (intercept)

β1-β9=slope Coefficients

ln=Natural logarithm of the odds ratio (logit model)

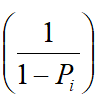

The model can be written as a multiplicative function by taking the exponential form of both sides: Odds (using trade credit) =P/ (1-P)=exp {α+βiXi}=eαeβixi. This is a model for Odds. Odds change multiplicatively with Xi. A one unit increase in Xi leads to a change (increase or decrease) of eβi in the odds that a private trader will use trade credit. The logarithm of the odds changes linearly with Xi; however, the logarithm of odds is not an intuitively easy or natural scale to interpret. Thus, coefficient assigned to an independent variable is interpreted as the change in the logit (log odds that y=1), for a 1-unit increase in the independent variable, with the other independent variables held constant.

Alternatively, it can be expressed in terms of probability as:

Results

Assessment of trade credit practice

For the purpose of assessing private traders' trade credit practices, dummy response questions were used to ask if they practiced trade credit or not in similar studies. The earlier researchers specifically Bussoli, et al; Guy, et al; Getachew, et al. used the same method to assess trade credit practises (Table 1).

| Trade credit practice | Frequency | Percent |

|---|---|---|

| Yes | 187 | 61.5 |

| No | 117 | 38.5 |

| Total | 304 | 100 |

Source: Own survey data (2022)

Table 1: Trade credit practice of private traders.

The above table shows that 61% of private traders used trade credit to finance their working capital, while 39% did not. There were 57% of the total sample of private traders who used trade credit from their suppliers, similar to the results of the prior study undertaken done by Getachew, et al.; Wolday, et al. reported that trade credit was used by 55% of small firms and 58% of microenterprises and that supplier credit, was the second most significant source of financing, therefore these results are consistent with theirs.

Diagnosis test of binary logistic regression assumptions

In this study, a binary logistic regression was performed to study the factors that affect private traders' use of trade credit (Tables2-4). The model included ten predictor variables (gender of respondents, education status of private traders, marital status of private traders, size of business, volume of purchase, age of business, frequency of purchase, number of suppliers and access of bank loan). The full model containing six predictors was statistically significant (10, N=304)=200.369, p<.001 (Table 5).

| Spearman correlations | ||||||||||

| Variable | VP | ABL | FP | SB | MSPT | GPT | ESPT | NS | LRS | AB |

|---|---|---|---|---|---|---|---|---|---|---|

| VP | 1 | .544** | .265** | -.518** | .302** | .348** | -.170* | .420** | 0.088 | .169** |

| ABL | .544** | 1 | .149* | -.242** | 0.113 | .380** | 0.097 | 0.092 | .427** | 0.049 |

| FP | .265** | .149* | 1 | .157* | .517** | .608** | -0.066 | .290** | -.510** | -.149** |

| SB | -.518** | -.242** | .157* | 1 | -.214** | .212** | .311** | -.327** | -.212* | -0.069 |

| MSPT | .302** | 0.113 | .517** | -.214** | 1 | .252** | -0.142 | .532** | -.450** | -0.103 |

| GPT | .348** | .380** | .608** | .212** | .252** | 1 | -0.037 | 0.125 | -0.121 | 0.041 |

| ESPT | -.170* | 0.097 | -0.066 | .311** | -0.142 | -0.037 | 1 | .225* | .472** | -.325** |

| NS | .420** | 0.092 | .290** | -.327** | .532** | 0.125 | .225* | 1 | -.380** | 0.081 |

| LRS | 0.088 | .427** | -.510** | -.212* | -.450** | -0.121 | .472** | -.380** | 1 | .323** |

| AB | .169** | 0.049 | -.149** | -0.069 | -0.103 | 0.041 | -.325** | 0.081 | .323** | 1 |

**Correlation is significant at the 0.01 level (2 tailed).

*Correlation is significant at the 0.05 level (2 tailed).

Source: Own survey information (2022).

Table 2: Correlation among independent variables.

| Step | Chi-square | df | Sig. |

|---|---|---|---|

| 1 | 14.06 | 8 | 0.08 |

Source: Own survey data (2022)

Table 3: Hosmer and Lemeshow test.

| Chi-square | df | Sig. | ||

|---|---|---|---|---|

| Step 1 | Step | 200.369 | 10 | 0 |

| Block | 200.369 | 10 | 0 | |

| Model | 200.369 | 10 | 0 | |

Source: Own survey data (2022).

Table 4: Omnibus tests of model coefficients.

| Step | -2 Log likelihood | Cox and snell R2 | Nagelkerke R2 |

|---|---|---|---|

| 1 | 195.321a | 0.501 | 0.671 |

a. Estimation terminated at iteration number 6 because parameter estimates changed by less than .001.

Source: Own survey data (2022)

Table 5: Model summary.

The above test indicated extent of variation in the dependent variable explained by the model (starting from 0 to 1). These are described as pseudo R2 statistics, rather than the true R2 values that you will see provided in the multiple regression output. In this study, the two values are .501 and .6771, suggesting thatbetween 50.1% and 67.1% the variability is explained by this set of the included variables (Table 6).

| Variable | B | S.E. | Wald | df | Sig. | Odds ratio | 95% confidence interval for odds ratio | ||

|---|---|---|---|---|---|---|---|---|---|

| Lower | Upper | ||||||||

| Step 1a | GPT(1) | 1.175 | 0.515 | 5.208 | 1 | 0.022 | 3.239 | 1.18 | 8.889 |

| ESPT | -0.098 | 0.119 | 0.681 | 1 | 0.409 | 0.906 | 0.718 | 1.145 | |

| MSPT | -0.594 | 0.399 | 2.211 | 1 | 0.137 | 0.552 | 0.252 | 1.208 | |

| AB | -0.224 | 0.099 | 5.125 | 1 | 0.024 | 0.799 | 0.658 | 0.97 | |

| SB | 0 | 0 | 3.098 | 1 | 0.078 | 1 | 1 | 1 | |

| ABL(1) | -1.613 | 0.568 | 8.072 | 1 | 0.004 | 0.199 | 0.066 | 0.606 | |

| LTR | 0.295 | 0.111 | 7.028 | 1 | 0.008 | 1.343 | 1.08 | 1.669 | |

| VP | 0 | 0 | 4.942 | 1 | 0.026 | 1 | 1 | 1 | |

| FP | 0.229 | 0.108 | 4.549 | 1 | 0.033 | 1.258 | 1.019 | 1.553 | |

| NS | 0.32 | 0.083 | 14.97 | 1 | 0 | 1.378 | 1.171 | 1.62 | |

| Constant | -1.513 | 0.674 | 5.038 | 1 | 0.025 | 0.22 | |||

a. Variable(s) entered on step 1: GPT, ESPT, MSPT, AB, SB, ABL, LTR, VP, FP, NS

Source: Own survey data (2022)

Table 6: Logistic regression estimation result.

Discussion

Interpretation of the output of binary regression model

Gender of private trader and trade credit practice: As revealed in the table gender of private trader the only statistically significant factor from owner characteristics having the odds ratio of 3.24 and the p-value of 0.02. It implies that 3.24 times more likelihood that male private trader who uses trade credit than female private trader who uses trade credit. The probability of male private trader to use trade credit is 76% (odds/1+odds) whereas the probability of female private trade who use trade credit is 24% (1-(odds/1+odds)). Former empirical work on gender and accessibility of trade credit recognized that female possessed business were statistically significantly more likely to be use bank loan instead of trade credit source of funds. The result of this study is similar to study done by Carrington, et al. that women were lagged behind men in trade credit usage. However, it is inconsistent with Cole, et al. and Getachew, et al.

Age of business and trade credit practice: A significant influence of age of business on trade credit practice has been found with a p-value 0.024 and odds ratio of 0.799. It was assumed that age of the business is negatively correlated with trade credit practice due to that newly established businesses may need trade credit to avoid their liquidity problem. It implies that, for every additional year of business age, private traders were 0.799 times less likely to use trade credit. Empirical findings of Fatoki, et al. and Nikanen J, et al. that older and bigger companies are less likely to use trade credit than smaller and younger firms. It is also consistent with Getachew, et al. Moreover, the findings of the study approved with the insights in literature that infant stage business have less access to bank loan because they have not experience in business practice.

Access of bank loan and trade credit practice: As revealed in the above table the availability of bank loans has significant effect on trade credit practice of private traders having the odds ratio of 0.199 and a p-value of 0.004. It was assumed that availability of bank loan is inversely connected with trade credit practice based on demand perspective because if private traders have an access of formal bank loans they are less likely to use trade credit. The findings of this study indicates that, those private traders who have access to a bank loan, a 0.199 times less likelihood to use trade credit than those who have no access of bank loan controlling for other factors in the model. The probability of private traders who have access to bank loans using trade credit is 16.5% (odds/1+odds). The probability of private traders who have no access to bank loans using trade credit is 83.5% (1-(odds/1+odds)). It is similar to Vaidya, et al. This fits with the transaction cost advantage hypothesis, which postulates that more transactions would lead to a higher demand for trade credit as a result of buyers' needing more time to gather the funds necessary to make a purchase. This is further supported also by liquidity theory in which buyers of large volume.

Length of trade relationship with suppliers and trade credit practice: The length of the trade relationship with the supplier is another business related factor. The outcome shows that, at a p-value of 0.008, the duration of the trading relationship has a statistically significant beneficial impact on the use of trade credit. The odds ratio indicated that trade credit are 1.343 times more likely used for every additional year of trade relationship with suppliers. That means there's a 1.343% rise in the likelihood of using trade credit for every year that goes by in the duration of the trading partnership. This finding is quite similar to the financing advantage theory which says that the length of the trade relationship is a foundation to use trade credit the reason that stock supplier gets more awareness about the credit trustworthiness of the customer. Besides, it is similar to the result of Fisman, et al.; Bussoli, et al. and Getachew, et al.

Frequency of purchases and trade credit practice: As the regression model results indicated, the frequency of purchases is a statistically significant factor to use trade at p<0.033 and odds ratio of 1.258. Thus, trade credit is 1.258 times more likely to be used for each additional purchase per month, while other factors remain unchanged. It is consistent with Getachew, et al. The result of the study is also similar to empirical evidence in which the frequency of purchases is found significant determinant to positively influence trade credit use since frequent purchase implies the likelihood of default is less but rare purchase signs the contrary situation and shrinks trade credit postponement, thus, stock suppliers are assured about their credit customers when they purchase Hermes, et al.

Number of suppliers and trade credit practice: As the regression model results indicated that, the number of suppliers is a positive statistically significant factor to use trade at p<0.00 and odds ratio of 1.378. It indicates trade credit is 1.378 more likely practices for each additional number of credit suppliers, other things remain constant. The result is similar to Li X, et al. The following table condenses the hypotheses tests conducted and their respective decisions passed concerning the variables argued.

The result of this study is consistent with the financing theory which states that the inaccessibility of bank loans is the significant factor influencing trade credit practice. Conversely, the result is inconsistent with the empirical evidence of Isaksson, et al. that found a positive connection between firm size and trade credit practice for Kenyan firms. This study has found consistent results with those Demirguc-Kunt, et al.; in which company size is not related to the use of trade credit to finance purchases. The economic justification for the finding is that the start-up or small companies rely more on trade credit (small-scale businesses do have not an option, while the medium and largest size company may have the bargaining power to use delayed reimbursement of accounts. According to financial literature, one of the main justifications for using trade credit is to get over financial limitations. Businesses that are likely to have trouble getting bank credit tend to depend more on trade credit (substitution hypothesis). Although the proxy variable (i.e., access to a bank loan) taken to test this hypothesis is found significant, the descriptive analysis discussed earlier provides that the vast majority of businesses that utilize trade credit are privately funded (bank loans).

Conclusion

The goal of this research was to identify the variables that influence private merchants' use of trade credit in Burie, Ethiopia. The effect of ten predictor variables on the dichotomous dependent variable was measured using a binary logistic regression model. In relation to trade credit practice, it has been found that more than 61% of private traders used trade credit as a source of funding, although about 39% did not use trade credit to finance their working capital in Burie town, Ethiopia. In a binary logistic regression analysis, the six predictor factors accounted for more than 68% of the variation in trade credit practises: Private trader gender, availability of bank loans, length of trade relationship with suppliers, age of business, frequency of monthly purchases, and a number of suppliers. Among all the predictor variables, six of them have a statistically remarkable relationship with the trade credit practice of private traders. The remaining four predictor variables, particularly the education status of private traders, the marital status of private traders, the volume of purchases, and the size of the business, have a statistically insignificant effect on trade credit practice.

Author Contributions

Conceptualization: Yesuf Ahmedin and Dr. Dhiraj Sharma

Data collection: Yesuf Ahmedin

Formal analysis: Yesuf Ahmedin and Dr. Dhiraj Sharma

Acquisition: Yesuf Ahmedin and Dr. Dhiraj Sharma.

Investigation: Yesuf Ahmedin and Dr. Dhiraj Sharma.

Methodology: Yesuf Ahmedin and Dr. Dhiraj Sharma.

Project administration: Dr. Dhiraj Sharma

Resource: Yesuf Ahmedin

Software: Yesuf Ahmedin and Dr. Dhiraj Sharma.

Validation: Yesuf Ahmedin and Dr. Dhiraj Sharma.

Visualization: Yesuf Ahmedin and Dr. Dhiraj Sharma.

Supervision: Dr. Dhiraj Sharma

Writing: Yesuf Ahmedin.

Writing-review and editing: Dr. Dhiraj Sharma

References

- Altunok F, Mitchell K, Pearce DK. The trade credit channel and monetary policy transmission: Empirical evidence from US panel data. Q Rev Econ Finance. 2020;78:226-250.

- Andrieu G, Stagliano R, van Der Zwan P. Bank debt and trade credit for SMEs in Europe: Firm, industry, and country level determinants. Small Bus Econ. 2018;51(1):245-264.

- Beck T, Hoseini M, Uras B. Trade credit and access to finance: Evidence from Ethiopian retailers. J Afr Econ. 2020:29(2):146-172.

- Bussoli C, Marino F. Trade credit in times of crisis: Evidence from European SMEs. J Small Bus Enterp Dev. 2018;25(2):277-293.

- Canto-Cuevas FJ, Palacin-Sanchez MJ, Di Pietro F. Trade credit as a sustainable resource during an SME’s life cycle. Sustainability. 2019;11(3):670.

- Carbo‐Valverde S, Rodriguez‐Fernandez F, Udell GF. Trade credit, the financial crisis, and SME access to finance. J Money Credit Bank. 2016;48(1):113-143.

- Ezzedeen SR, Zikic J. Entrepreneurial experiences of women in Canadian high technology. Int J Gend Entrep. 2012;4(1):44-64.

- Carvalho CJD, Schiozer RF. Determinants of supply and demand for trade credit by micro, small and medium-sized enterprises. Rev Contab Financ. 2015;26(68):208-222.

- Dary SK, James Jr, HS. Trade credit supply in African agro-food manufacturing industry: Determinants and motives. Agric Finance Rev. 2018;78(3):312-329.

- Hasan MM, Habib A. Social capital and trade credit. Int Rev Financial Anal. 2019;61:158-174.

- Huyghebaert N. On the determinants and dynamics of trade credit use: Empirical evidence from business start‐ups. J Bus Finance Account. 2006;3(1‐2):305-328.

- Elliehausen GE, Wolken JD. The demand for trade credit: An investigation of motives for trade credit use by small businesses. Fed Res Bull. 1993;79:929.

- Emery GW. A pure financial explanation for trade credit. J Financ Quant Anal. 1984;19(3):271-285.

- Martinez-Sola C, Garcia-Teruel PJ, Martinez-Solano P. Trade credit and SME profitability. Small Bus Econ. 2014;42(3):561-577.

- Olawale F, Akinwumi O. The determinants of access to trade credit by new SMEs in South Africa. Afr J Bus Manage. 2010;4(13):2763-2770.

- Fisman R, Love I. Trade credit, financial intermediary development, and industry growth. J Finance. 2003;58(1):353-374.

- Fisman R, Raturi M. Does competition encourage credit provision? Evidence from African trade credit relationships. Rev Econ Stat. 2004;86(1):345-352.

- Getachew D, Sahlu T, Kebede H. Determinants of trade credit use by private traders in Ethiopia: Case of Mekelle city. Tigray regional State. Res J Finance Account. 2013;4(10):1-7.

- McGuinness G, Hogan T, Powell R. European trade credit use and SME survival. J Corp Finance. 2018;49:81-103.

- Myers SC, Majluf NS. Corporate financing and investment decisions when firms have information that investors do not have. J Financ Econ. 1984;13(2):187-221.

Citation: Salih YA, Sharma D (2024) Factors Affecting Credit Purchase Practice in Ethiopia. Int J Account Res. 12:373.

Copyright: © 2024 Salih YA, et al. This is an open access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.