Indexed In

- Open J Gate

- Genamics JournalSeek

- SafetyLit

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- Publons

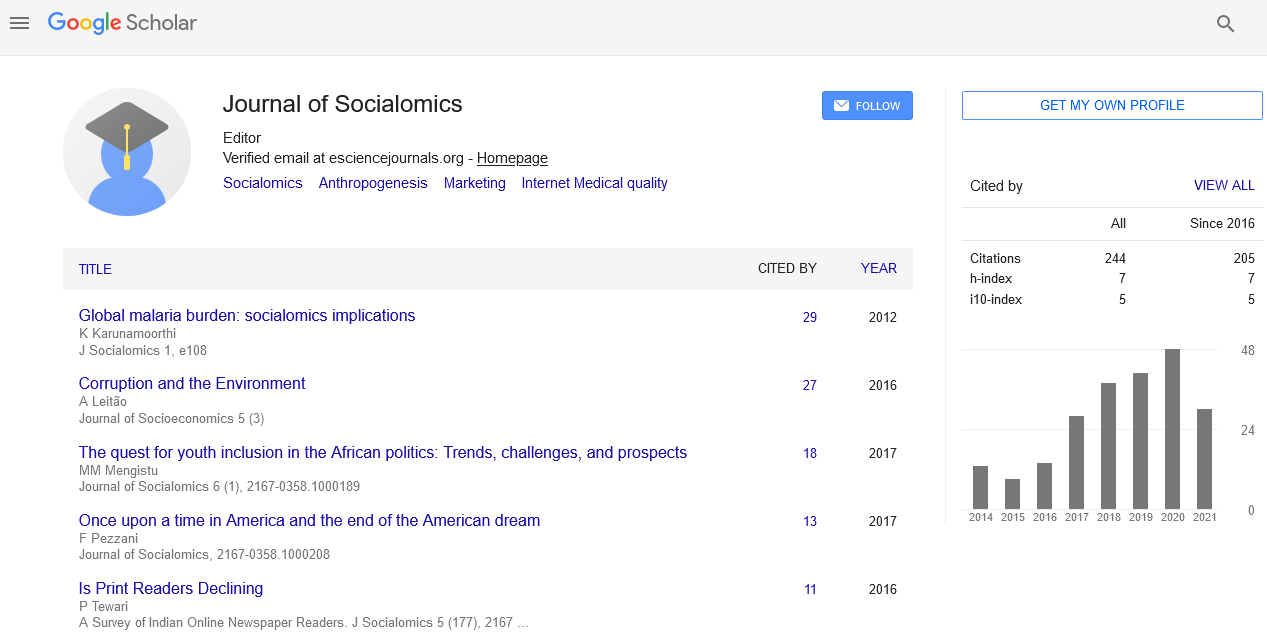

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Commentary - (2023) Volume 12, Issue 6

Economics Dynamics: Systemic Tax and its Influence on Bank Capital and Social Welfare

Hoicka Burcu*Received: 02-Oct-2023, Manuscript No. JSC-23-23487; Editor assigned: 05-Oct-2023, Pre QC No. JSC-23-23487 (PQ); Reviewed: 18-Oct-2023, QC No. JSC-23-23487; Revised: 25-Oct-2023, Manuscript No. JSC-23-23487 (R); Published: 02-Nov-2023, DOI: 10.35248/2167-0358.23.12.208

Description

The global economic reserve of exposed the vulnerabilities within the banking sector, leading to widespread economic disorder. One of the important instructions learned from this crisis was the need for banks to hold sufficient capital to absorb losses and prevent economic pollution. Regulators implemented capital requirements as a means to safeguard the stability of the economic system. However, the effectiveness of these capital requirements has been a topic of ongoing debate, with some arguing that they may not be sufficient to prevent future crises. This article explores the impact of a systemic tax on bank capital properties, its potential role in optimizing capital requirements, and its impact on social welfare.

Capital requirements are regulations imposed by economic authorities that mandate banks to hold a certain level of capital in proportion to their risk-weighted assets. The primary objective of these requirements is to ensure that banks maintain a buffer of capital to absorb losses in adverse economic conditions. Capital acts as a cushion against insolvency, reducing the risk of bank failures and the need for taxpayer-funded bailouts. Furthermore, higher capital requirements are believed to enhance economic stability by reducing the probability of systemic crises. However, there is ongoing debate about the appropriate level of capital requirements. Critics argue that regulatory capital requirements may not be sufficient to prevent systemic crises, as banks have incentives to minimize capital properties to maximize profitability. Additionally, different banks may have varying risk profiles and business models, making a one-size-fits-all approach to capital requirements less effective.

Impact on bank capital holdings

Capital adequacy: The tax would incentivize banks to maintain higher capital levels to offset the cost of the tax. This, in turn, would enhance their ability to absorb losses and reduce the risk of insolvency.

Risk-taking behavior: Banks may become more risk averse as they seek to avoid the tax, leading to a more stable economic system. However, there is a fine balance to strike, as excessive risk aversion could hinder economic growth by limiting lending and investment.

Business model adjustments: Banks might adjust their business models to minimize the impact of the tax, such as reducing their reliance on short term funding or reallocating their assets to lower-risk categories.

Optimal capital requirements

The introduction of a systemic tax on bank capital holdings raises the question of whether it could lead to a revaluation of the optimal level of capital requirements. The optimal level of capital requirements should strike a balance between ensuring economic stability and promoting economic growth. A systemic tax could influence this balance by affecting banks behavior. To determine the optimal capital requirements, regulators should consider the following factors:

Economic impact: Analyze the potential economic impact of higher capital requirements, including the effect on lending, investment, and economic growth.

Cost-benefit analysis: Conduct a cost-benefit analysis to determine the trade-offs between enhanced stability and reduced economic activity.

International co-ordination: Consider the need for international coordination in setting capital requirements, as capital flows across borders and regulatory disparities can create arbitrage opportunities.

Social welfare implications: The impact of a systemic tax on bank capital holdings on social welfare is complex and multifaceted. It involves weighing the benefits of enhanced economic stability against the potential costs of reduced economic growth.

The impact of a systemic tax on bank capital holdings, optimal capital requirements, and social welfare is a complex issue that requires careful consideration. While such a tax has the potential to enhance economic stability by incentivizing banks to maintain higher capital levels, it may also have unintended consequences on economic growth and income inequality. Striking the right balance between these objectives is essential, and policymakers must conduct thorough analyses to determine the optimal level of capital requirements and the design of any systemic tax. Ultimately, the goal should be to create a economic system that maximizes social welfare by mitigating systemic risks while fostering sustainable economic growth.

Citation: Burcu H (2023) Economics Dynamics: Systemic Tax and its Influence on Bank Capital and Social Welfare. J Socialomics. 12:208.

Copyright: © 2023 Burcu H. This is an open access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.