Indexed In

- Open J Gate

- Genamics JournalSeek

- SafetyLit

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- Publons

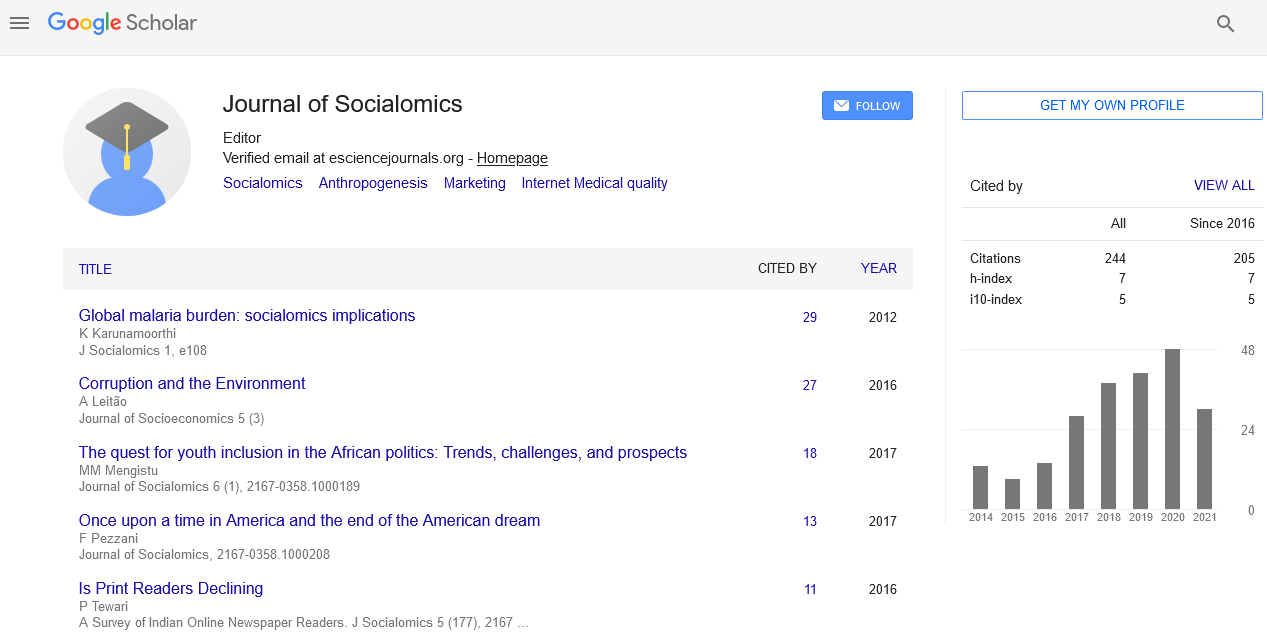

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Commentary - (2022) Volume 11, Issue 11

Designs and Effects of Road Tolling on Equality and Social Welfare

Kai Ollinheimo*Received: 04-Nov-2022, Manuscript No. JSC-22-18990; Editor assigned: 07-Nov-2022, Pre QC No. JSC-22-18990 (PQ); Reviewed: 21-Nov-2022, QC No. JSC-22-18990; Revised: 28-Nov-2022, Manuscript No. JSC-22-18990 (R); Published: 05-Dec-2022, DOI: 10.35248/2167-0358.22.11.151

Description

One of the crucial sectors in the development of the economy is the transport of people and products. The demand for transportation is often sensitive to GDP growth, and this is especially true for road transportation. However, the expansion of the road transportation sector may result in externalities like noise, mishaps, or carbon emissions that might have a negative impact on the economy and the welfare of both users and nonusers. This harmony between transportation and the economy is evident in congested areas. Congestion relief through pricing has been demonstrated to be effective. Although its impact could only be notable in the near term, its advantages are substantial. Tolling has the potential to produce income while reducing negative externalities and congestion. The adoption of road pricing, however, may be hampered by the low level of acceptance that it often enjoys. In reality, tolls may hurt those with low incomes and restrict their ability to engage in society. The ideal toll may differ significantly depending on the goal function to be maximized (such as maximizing welfare, maximising social equality, maximising revenues, etc.)

There is a huge and varied body of academic research on equality and wellbeing in road pricing. The authors were unable to locate any studies that calculated the ideal pricing in a fully charged corridor with the goal of optimizing transportation cost equality while altering the average VTT and its dispersion circumstances. Additionally, there is a shortage of studies examining the variations between welfare and equality pricing for such networks. Therefore, this study's value resides in bridging that knowledge gap and exploring how road pricing affects inequality. By enhancing an indicator that assesses the equality of transportation costs for various travellers, the major contribution of this research is to shed light on this issue. These will serve as the foundation for the analysis of the findings and Results will be compared to those obtained when the major goal of tolls is to maximise socioeconomic efficiency in order to support the analysis of the findings. The document has six further sections after the introduction. Section provides an overview of the relevant literature and outlines the goals of this study. The objective function to be optimised, the technique, and the accepted assumptions are all covered in detail by the authors. In this section, the indicator used to quantify transport equality is described and analysed. The factors and variables that should be used in a particular and realistic case study are described in section. Section displays the outcomes in accordance with the goals previously set, including a Vehicle Miles Traveled (VMT) distribution that reflects the socioeconomic traits. Finally, a summary of findings and policy takeaways is provided.

Social equality is typically described from two angles: vertical equity considers a positive discrimination for individuals with less money, thus people with greater income should pay more taxes, and horizontal equity thinks the same treatment is provided to persons in identical situations. The first is about social justice, while the second is about equality. These are not the only definitions of equity that exist, though; it also relies on how it is calculated. The Gini index, which evaluates income inequalities across groups of individuals but it may also measure differences in other characteristics, is one of the most important instruments for evaluating equality. Several pieces of research have connections between the issues of equality and road pricing. For instance, several studies investigated the effects of Vehicle Miles Traveled (VMT) on Users and the Impact of Fuel Tax on Users were Compared. On the other hand, it was discovered that the regular gasoline tax would be preferable for low-income travellers than Vehicle Miles Traveled (VMT), making the Vehicle Miles Traveled (VMT) the best alternative for low-income users. The toll system produced the fairest outcomes when compared to taxes in the instance of State Route 91. On the other hand, the city's urban design may have a significant impact on how tolls progress. Strict tolls, for instance, might encourage certain users in Paris to switch from private vehicles to public transportation, with the poorest users benefiting the most. Investigates the scenario of rehabilitating a bridge and adding toll lanes. a new tax unless the proceeds from the toll system are dispersed to those with limited means. Congestion pricing may have a progressive effect on welfare, even though in some cases the private concession may favour a toll that is lower than the one that maximises welfare. Tolls can have an impact on users in three different ways: through revenue use, modifications to mobility patterns and travel time savings of these three, the first two are most important in determining equity.

Citation: Ollinheimo K (2022) Designs and Effects of Road Tolling on Equality and Social Welfare. J Socialomics. 11:151.

Copyright: © 2022 Ollinheimo K. This is an open access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.