Indexed In

- JournalTOCs

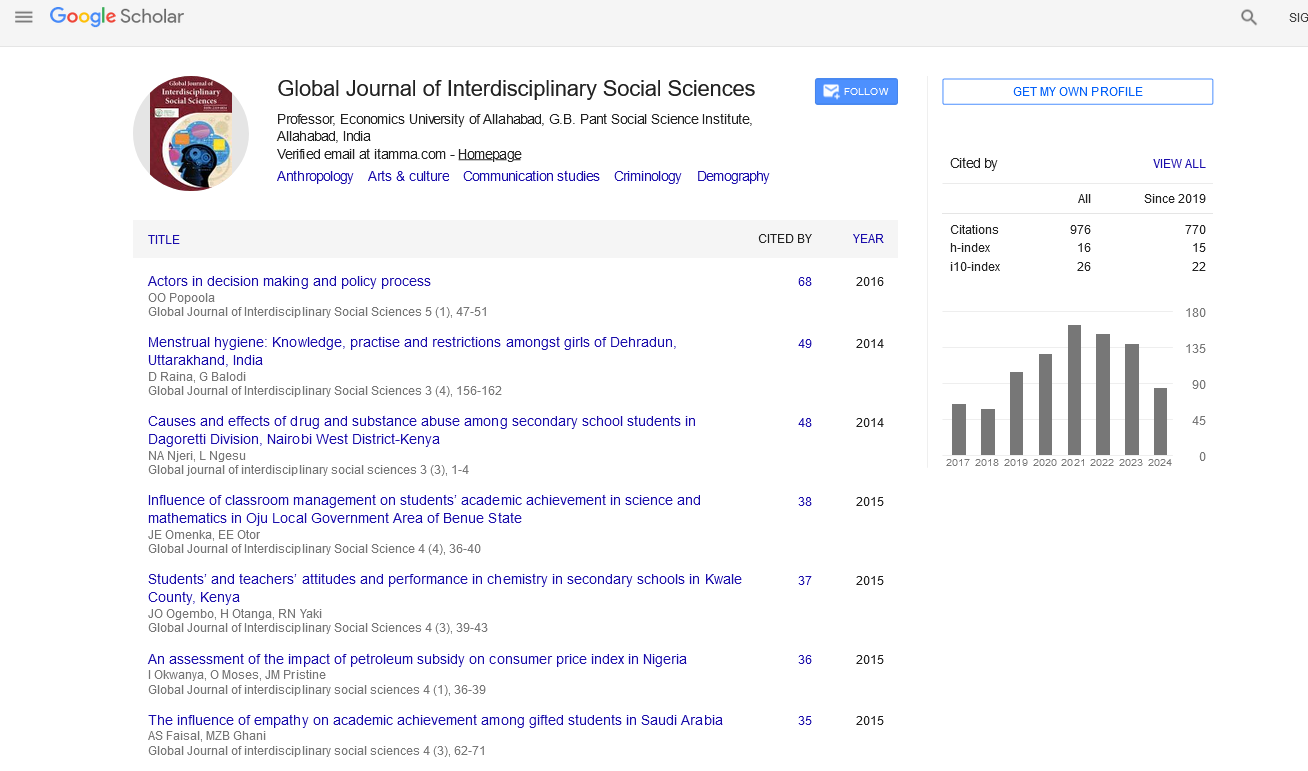

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Commentary - (2022) Volume 11, Issue 4

Consequences of Britain on Brexit Issue

Jason Mike*Received: 04-Jul-2022, Manuscript No. GJISS-22-17843; Editor assigned: 07-Jul-2022, Pre QC No. GJISS-22-17843(PQ); Reviewed: 22-Jul-2022, QC No. GJISS-22-17843; Revised: 29-Jul-2022, Manuscript No. GJISS-22-17843(R); Published: 08-Aug-2022, DOI: 10.35248/2319-8834.22.11.027

Description

In the referendum held on June 23, 2016, the United Kingdom decided to leave the European Union by a margin of 51.9 percent to 48.1 percent. Although opinion polls had been close, the betting markets had expected a victory for the campaign to remain, so markets were caught by surprise. Sterling collapsed, from $1.50 to $1.33, within hours after the early results have been announced. There are many elements in making such an assessment, and lots of unknowns. Focus on Brexit’s impact through the possibly modifications in trade patterns, that is the maximum obvious aspect that will change at Foreign Direct Investment (FDI), immigration, and regulations. Special focus on average effects, but also say some words on the distribution of the costs and advantages. Abstract from short-run results preceding Brexit surely occurring it is clearly probable that there could be some costs of coverage uncertainty. To try this it would require a greater formal macro econometric version incorporating adjustment prices. These elements are obviously crucial and might increase the losses mentioned here.

Brexit will make Britain poorer as compared with remaining in the European Union. This is due to the fact the United Kingdom will have higher trade expenses with its closest neighbours in Europe (which account for approximately half of all U.K. trade), and this could reduce its trade and consequently welfare. The importance of these losses will outweigh the modest advantages of lower net monetary transfers to the EU budget. Brexit’s general net price will depend crucially on Britain’s final trading association with Europe. Membership in the European Union has reduced change expenses between the United Kingdom and the rest of Europe. Most obviously, there is a customs union between EU members, which means that all tariff obstacles had been removed in the EU, permitting for free trade in goods and services.

These reductions in trade barriers have extended trade between the United Kingdom and the other countries of the European Union. Before the UK joined the European Economic Community (EEC) in 1973, about one-third of U.K. trade was with the EEC. This higher trade benefits U.K. consumers through lower expenses and access to better goods and services. At the same time, people and organizations benefit from new export opportunities that result in higher income and profits, and allow the United Kingdom to specialize in those industries in which it has a comparative advantage. Through these channels, improvement in trade increases output, earning, and living standards in the United Kingdom. To forecast the consequences of the United Kingdom leaving the European Union, we must make assumptions approximately how trade expenses will change following Brexit.

Conclusion

Joining the European Economic Area, like Norway, is the option closest to remaining a member of the European Union. EEA participants are part of the European single market, which means they decide to its four freedoms: free movement of items, services, capital, and labor. EEA members must undertake all EU legislation concerning the Single Market, which covers regions that include employment law, consumer protection, product requirements, and competition policy. EEA members additionally pay to be a part of the Single Market through contributing to the EU budget. Absent a new deal, Britain could trade with the EU under World Trade Organization terms, because the United States and China currently do. This version incorporates the channels through which trade influences consumers, firms, and workers, and provides a map from trade information to welfare. The model offers numbers for how much real incomes change under special trade policies, using readily available records on trade volumes and potential trade boundaries.

Citation: Mike J (2022) Consequences of Britain on Brexit Issue. Global J Interdiscipl Soc Sci. 11:027.

Copyright: © 2022 Mike J. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.