Indexed In

- JournalTOCs

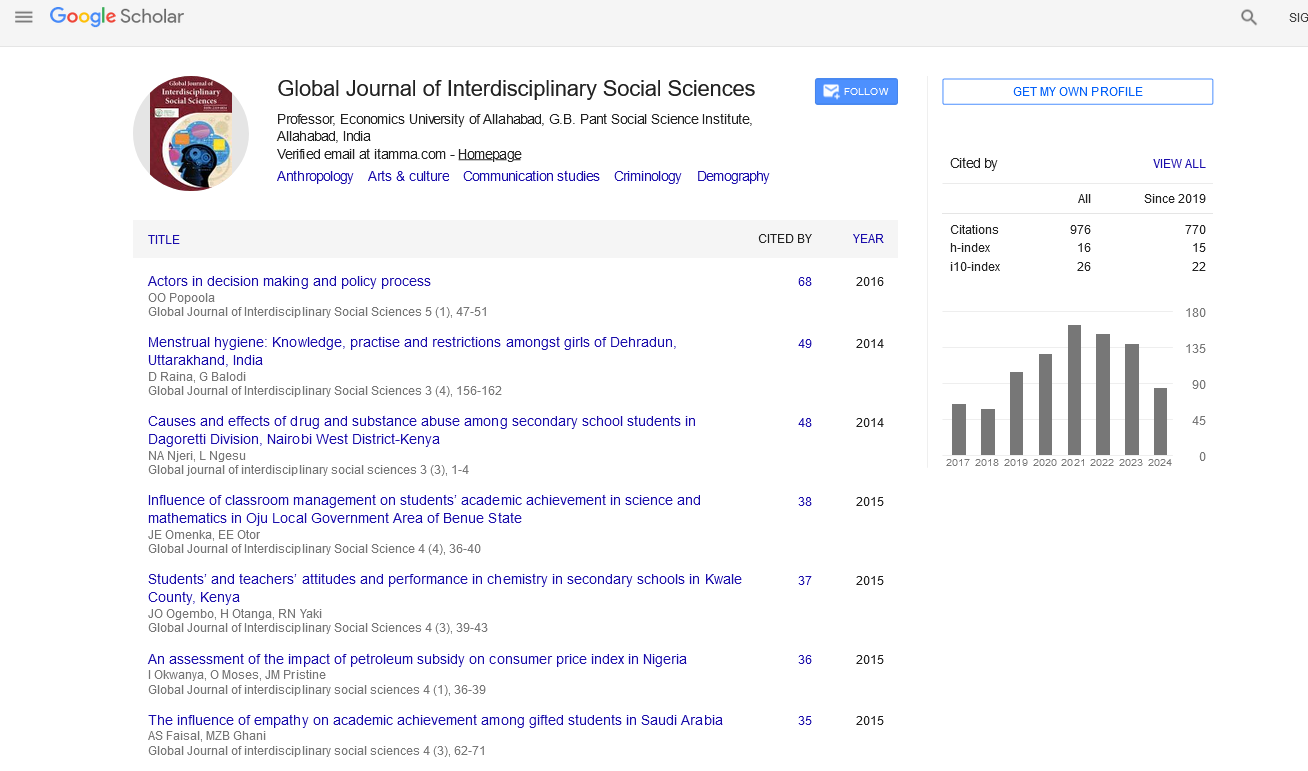

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Perspective - (2022) Volume 11, Issue 5

Conceptualization and Procedures of Income Taxation in India

Stefan Tiang*Received: 02-Sep-2022, Manuscript No. GJISS-22-18445; Editor assigned: 05-Sep-2022, Pre QC No. GJISS-22-18445 (PQ); Reviewed: 20-Sep-2022, QC No. GJISS-22-18445; Revised: 26-Sep-2022, Manuscript No. GJISS-22-18445 (R); Published: 04-Oct-2022, DOI: 10.35248/2319-8834.22.11.030

Description

The economy of India faced major policy changes after independence. Right after independence, it had innumerable problems and challenges on social and economic fronts. Economically as well as socially, India’s situation was miserable and a number of problems were being faced by the country. On that point of time, the state was not even expected to have an active part in economic and social development because of lack of funds. The government of any country whether developed, developing or under-developed needs revenues to have economic growth and development. It is the sound financial system of a country which helps in the fulfillment of the social and economic responsibilities.

India being a developing and second largest populated country in the world needs huge funds to transform the socio-economic conditions of the country. Taxation is very important means of revenue generation for igniting the engine of economic growth. The planning and implementing the tax structure depends on several factors such as, the available resources and the targeted figures which is to be bridged with the help of the fiscal design of the country. Income tax is the tax that is laid down by the government, on the income earned by the corporate and individuals, for financing its various operations. Apart from that, income tax also acts as a financial stabilizer that helps in equal distribution of wealth among the population of the country. In India, the income tax is paid as per the rules and provisions of Income Tax Act, 1961 by the assessee on the income so earned.

Different countries globally have their own income tax practices depending on the local economic conditions and consequent upon comparison some similarities/dissimilarities are also visible such as, the tax rates pertaining to personal income tax around the world vary from 0 (United Arab Emirates, Kuwait, Qatar and Saudi Arabia, etc.) to 60 percent (Ivory Coast). But the Indian tax system lies in between the two limits where frequent changes are being made from time-to-time to cop up with the changing circumstances and the same thing applies on the systems of other countries as well. The taxation system which ensures higher take-home pay is considered as better by the taxpayers around the world. Based on favorable tax environment, Panama was adjudged as the Best country in the World.

Conclusion

Sir James Wilson introduced the concept of Income Tax in India in 1860 for the first time to mitigate the losses of the government. Numerous amendments were made in it before independence. It was changed drastically after the independence of the country by keeping in view the social and economic conditions of the people of India. The new Income Tax Act of India was framed and implemented with effect from 1st April, 1962. Several amendments have been made in it till date as per the requirements of the GOI. The fundamental principle of Indian Taxation system is more taxes with high income generation. It is stated in the Indian constitution that the concerned authority. Income tax is one of the major sources of revenue generation for the government. The contribution made by income tax collection is higher in comparison to non-income tax collection in the common pool of the taxes of GOI. As stated above, the total income tax collection is raising year over year drawing the attention towards the one of the major sectors providing finance to the government.

Citation: Tiang S (2022) Conceptualization and Procedures of Income Taxation in India. Global J Interdiscipl Soc Sci. 11:030.

Copyright: © 2022 Tiang S. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.