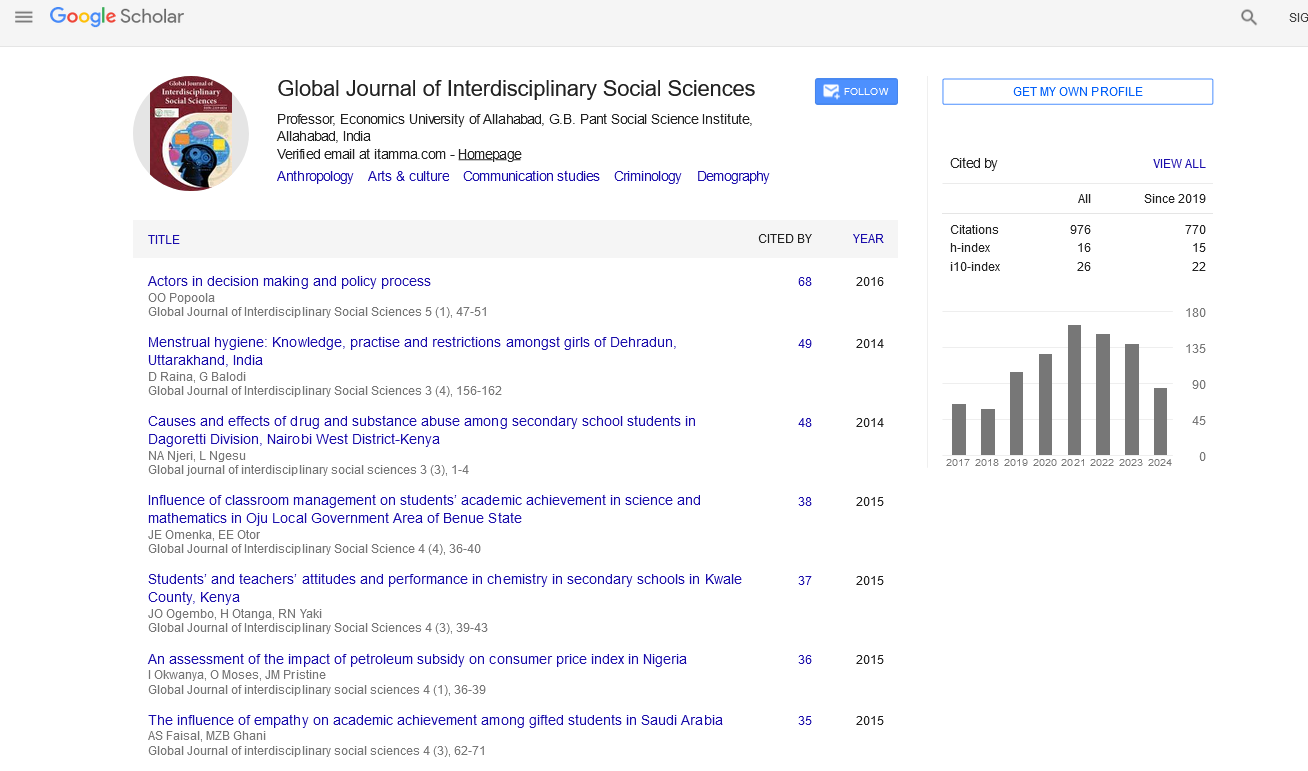

Indexed In

- JournalTOCs

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Review Article - (2023) Volume , Issue

A Study on Objectives of Demonetisation and Its Impact on Banking Patterns and E-Transactions

Nidhi Sharma*Received: 12-Apr-2023, Manuscript No. GJISS-23-21007; Editor assigned: 14-Apr-2023, Pre QC No. GJISS-23-21007 (PQ); Reviewed: 28-Apr-2023, QC No. GJISS-23-21007; Revised: 12-Jun-2023, Manuscript No. GJISS-23-21007 (R); Published: 19-Jun-2023, DOI: 10.35248/2319-8834.23.12.062

Abstract

Economic histories are replete with examples of demonetisation done in various countries. While in some countries demonetisation scripted success stories, it proved to be disastrous elsewhere. Countries like America, Ghana, Nigeria, Myanmar, Soviet Union, North Korea and Iraq opted for demonetisation due to political motives or economical reforms. In India, Prime Minister Narendra Modi announced ban on currency notes of Rs. 500 and Rs. 1000 on November 8, 2016. The event was widely covered by the newspapers in the country and hence played a larger role in shaping the public perception about demonetisation. The major objective of this paper is to acquire a better understanding of public perception about objectives of demonetisation besides assessing the changes in banking patterns and advent of digitalization of economy. For the study, a sample of 600 respondents was taken from Punjab with equal representation of males and females. A questionnaire was served to them to understand the respondents’ perception they developed after reading newspapers about demonetisation in India. The study revealed that an overwhelming majority i.e. 76.2 percent perceived ‘elimination of black money and corruption’ as the prime objective followed by wiping of fake currency. A little more than half of the respondents believed that the main objective behind currency ban was to weed out drugs and terrorist funding. Interestingly, only 27 percent perceived that promotion of digital India and curbing tax evasion was the key objective of demonetisation. Still, a vast majority i.e. 72 percent people agreed that use of various banking apps reduced personal visits to banks and the cashless transactions lowered the risks of theft and snatchings. On the other hand, the study also revealed that over 72.8 percent of the respondents believed that digitalization of economy led to increase in online frauds. Highlighting another issue, more than 70 percent of the respondents believed bank employees adopted ‘pick and choose’ policy while dealing with general public as well as they found the cash withdrawal and deposit process toughest ever. As many as 84.5 percent among respondents opined that digital transactions increased substantially post demonetisation thus resulting in more benefits in terms of discounts, cash backs for common man during E-transactions. Interestingly, while 78.3 percent respondents expressed privacy concerns about modes of e-transaction, 67.8 percent found security violations as key challenge in adopting digitalization of payment methods. An in-depth analysis of the responses brought to the fore that nearly 40.7 percent of respondents were unaware about techniques of digital modes of transactions and 49.6 percent of the respondents believed that digital payment methods were too complex and confusing.

Keywords

Demonetisation; Black money; Fake currency; Corruption; Currency ban; Digital transactions; Banking pattern; Challenges; Public perception; Newspaper coverage; Discounts; Digital payments; Banks; Benefits; Banking apps; Internet banking; Cash

Introduction

In general terminology demonetisation denotes compulsive retirement of old unit of currency by bringing in new currency. It is also labeled as one of the most effective tool to wipe out the circulation of fake currency. Several countries in the world have opted for the ban on a particular currency like America in 1969 discontinued $500, $1,000, $5,000 and $10,000, Ghana in 1982, Nigeria in 1984 with different colored notes, Myanmar in 1987 leading to widespread bloodshed across the country, Soviet Union in 1991 and European Union in 1999 adopted a united currency i.e. euro, North Korea in 2010, Iraq in 2003 introduced a unified currency known as Iraqi dinar [1].

The reasons behind adoption of this extreme move varied from country to country and from political motives to economical reforms. For Indians too, the term demonetisation is not an unknown term for the fact that India has exercised this extreme option of currency ban twice in the past. While demonetisation of ₹1,000 and ₹10,000 notes was done in 1946 during the prepartition era, Morarji Desai government in 1978 also imposed a ban on circulation of ₹1,000/-, ₹5,000/- and ₹10,000/- notes with a declared objective of wiping out the unaccounted cash i.e. black money [2]. The third time, it was Prime Minister Narendra Modi who took the country men by utter surprise and shock when, during a televised address to the nation on November 8, 2016, he declared to ban currency notes of ₹500 and ₹1,000 beginning midnight hours the same day. While announcing the move, prime minister cited a series of reasons including elimination of parallel economy i.e. black money besides snapping the sources as well squeezing financial resources for the funding of illegal activities such as smuggling of arms, weapons, drugs and other contrabands. Maintaining that the currency ban will break the financial backbone of terrorist activities in the country, the prime minister had also unveiled his vision of making Indian economy “digital” by encouraging cashless transactions. As expected, the demonetisation virtually turned out to be one of the biggest events for Indian media. While the TV channels remained abuzz with demonetisation related bulletins for days together, the newspapers also devoted a major chunk of their available space to demonetisation related news, articles and features etc. for not less than two consecutive months [3]. This wide and varied range of coverage of demonetisation in newspapers, but obviously, made a large impact on the minds of readers thus shaping up their perception about demonetisation. At the same time, the demonetised economy had a long lasting impact on the banking sector. Not only the banking habits of common man had to undergo a drastic change but the move also prompted a sudden spurt in the usage of various forms of plastic money and digital applications such as PayTM, Google pay etc. This study seeks to acquire a better understanding of public perception about demonetisation besides assessing these changes in banking patterns and advent as well as the extent of digitalisation of economy [4].

Literature Review

Mohd, et al. conducted a study to assess the need for banning the ₹500 and ₹1000 notes and subsequent challenges arising out of this situation. The study concluded that the demonetisation process was romped in to stop the circulation of counterfeit currency allegedly used for terror strikes [5]. The data was thus sourced from various newspapers and websites to summarise that common man remained most affected by the demonetisation process as it largely impacted the lives and daily routine of almost every Indian citizen. Additionally, it resulted into bigger implications for the economy as a whole [6]. The study observed that though it was very early to pinpoint the impact on all sections of society and economy but found the politics, real estate and rural areas lacking in formal source of banking as the worst hit sectors. Another sector dealing with unorganized labour, domestic helps, who used to get payments in cash from their employers, were found to be severely impacted by demonetisation. Terming the government’s move as “bold in its intent and massive in its measure”, the study concluded that the advantages of this move, though, will be felt only in the longterm [7].

Mukherjee, et al. authored a paper and observed that demonetisation turned out to be a large shock to the economy. The paper categorically stated that the argument that the cash meant to be phased out under demonetisation would be “black money” is based merely on impressions rather than on facts. The authors opined that since the facts in this regard are not available to anyone, it was foolish to view this argument as the only possibility [8]. The authors further pointed out that post implementation of demonetisation it was likely that bank deposits would see sudden spurt but arguably the larger parts of these deposits were those which earlier were being used for daily transactional purposes and not essentially the black money. The authors further stressed upon the fact that it was imperative to evaluate the short run and medium-term impacts. The paper, however, elucidated the impact of demonetisation on the availability of credit, spending level of activity and government finances [9].

Shanbhogue, et al. published their ‘study on demonetisation of 500 and 1000 rupee notes and its impact on various sectors and economy’. With an objective to identify the reason for the withdrawal of INR 500 and INR 1000 currency besides measuring its impact on the economy, the study concluded that demonetisation was an effort by government to stop faking of banknotes which is alleged to have been used in terror and other anti-social activities besides promoting black money culture [10]. The study found that after the demonetisation, the banks and ATMs underwent a severe cash crisis and thus led to negative impact on small business, agriculture and transportation. The cash crunch even caused chaos with people facing unprecedented problems and hardships in getting their old currency exchanged with new denominations. The study further observed that the demonetisation was a deep psychological strike on black money and was touted as biggest cleanliness drive against the black money in the history of Indian economy. The study opined that the move not only sought to reduce corruption, the use of drugs but pushed the countrymen towards digital economy. Mentioning the demonetisation as advantageous in short, medium and long term, the study suggested that it will bring in a sharp, sudden but long lasting behaviour changes in Indian economy [11].

Kumudah, et al. in their paper suggested that it was demonetisation which actually paved the way for digital economy in India by giving rise to digital marketing and brought the electronic or digi-payment mode in vogue. It observed that though before the demonetisation was announced, the digital marketing platform had not nurtured to a greater extent but soon after the demonetisation, the E-marketing and payment mode overtook the transactions taking place in cash [12]. The concept paper also highlighted as to how the demonetisation and cash crunch arising out of the measure guided the Indian economy towards a transformation from cash to digital economy. Besides, the paper also highlighted the intricacies and implications attached with the digital marketing such as online shopping and payments in rural sector. The concept paper opined that though the demonetisation has resulted in giving a push to new trend in the transaction, it suggested that empirical research should be conducted on the digital payments and its growth among the rural and the urban segments of the population in the periods before and after the demonetisation.

In an article ‘the big picture-impact of demonetisation’ termed demonetisation as “historical step” and emphasised that it should be supported by all. The report opined that one should look at the bigger picture which will definitely fetch results in the long term [13]. It stated that demonetisation is exactly what the people of India have been asking for a long time while mentioning demonetisation “an established practice” in monetary policy to tackle black money. The authors also stated that in the past, demonetisation had taken place twice but it failed because the idea was to tackle the existing black money only. Later, the paper argued that if announcement and time would have been given in advance, this step might not have been successful in controlling black money and counterfeit currency in circulation coming from Pakistan, Nepal or other countries. Talking about the problems in the period following demonetisation, the authors opined that public faced problems because the limit of withdrawal had not been kept at a higher level. If this would have been kept at a higher level, there were chances that the recycling of black money might begin. It also mentioned the measure as a terrible setback for the international standing of the Indian economy.

Deodhar, et al. in his E-book ‘black money and demonetisation’ has sought to present a viewpoint on whether demonetisation would actually help in eliminating black money? He opined that alone demonetisation was not a concrete measure to curb the black money menace. Referring it as “just one move of one piece in the chess board”, it suggested that various steps are required. It opined that the efforts have brought massive amounts of cash into the banking system. The suggestions that have been made in E-book include the introduction of reforms in income tax which will tackle the remaining 1/3rd of the revenue. It suggested that once it is done entire loopholes in system will be plugged.

Rudra, et al. published an article ‘demonetisation escalated malware and cyber security threats on micro-ATMs and ATMs’ and noted that demonetisation had increased the usage of micro-ATMs, PoS and digital wallet payments to 75 percent thereby increasing the risk levels of cyber frauds. In this regard India’s cyber security agency CERT-In, also warned customers, bankers, and traders against skimming and malware attacks on their systems and recommended use of high-end encryption to stop these probable fissures. Following demonetisation, various banks including The State Bank of India (SBI), HDFC bank, ICICI bank, Axis bank and YES bank reported that several of their customers’ debit cards faced cyber-attacks due to a malware-related security breach in an ATM network and as a result nearly 6,00,000 debit cards had to be blocked by SBI alone.

Veerakumar, et al. in ‘a study on people impact on demonetisation’ published in international journal of interdisciplinary research in arts and humanities found that demonetisation left a bigger, notable and instant impact on Indian economy. The study aimed at finding the impact and perception of demonetisation on the general public through a study on a sample of 100 respondents. Sample was randomly selected from Coimbatore district and it was found that four variables namely gender, age, annual income, occupation differently perceived demonetisation as the process that impacted their lives in different manners. The study concluded that majority opined that demonetisation primarily helped in destroying black money followed by corruption, terrorism etc.

Objectives of the study

• To ascertain the public perception about objectives of

demonetisation after reading newspaper content.

• To identify the changes perceived to have been observed in

banking patterns.

• To explore the public perception regarding digitalization of

economy and challenges faced in its adoption.

Research methodology

A random sample of 600 respondents was chosen, equally represented by males and females across Punjab.

The data was collected with the help of a questionnaire to understand the respondents’ perceptions about demonetisation in India, being largely influenced and shaped by the newspaper coverage. The questionnaire consisted of four questions having 4-6 statements each. The responses were plotted on a 5 point Likert scale viz. strongly agree, agree, neutral, disagree and strongly disagree with respective scores of 5,4,3,2,1.

The data was tabulated, analysed and interpreted by applying statistical tools on SPSS.

Analysis and interpretations

| S. no. | Statement | Strongly disagree |

Disagree | Neutral | Agree | Strongly agree |

|---|---|---|---|---|---|---|

| 1 | To eliminate black money and corruption. | 6.5 | 17 | 0.3 | 48.5 | 27.7 |

| 2 | To wipe off counterfeit currency. | 8.7 | 20.5 | 1.5 | 49.5 | 19.8 |

| 3 | To check drug and terrorist funding. | 11 | 29.8 | 22 | 40.5 | 16.5 |

| 4 | To promote digital India and discourage tax evasions. | 30 | 42.2 | 0.8 | 23.2 | 3.8 |

Table 1: Showing the perception gained by reading newspapers’ content regarding objectives of demonetisation (Figures in percentage).

As objectives behind such moves are stated to be varying widely, so did the public perception. The study revealed that an overwhelming majority 76.2 percent i.e. more than ‘three fourths’ of the respondents perceived ‘elimination of black money and corruption’ as the prime objective, followed by wiping out of fake currency with 69.3 percent. Having read the newspaper content, 57 percent of the respondents developed a perception that the main objective behind currency ban was to weed out drugs and terrorist funding. Interestingly, the promotion of digital India and curbing tax evasion were perceived to be key objectives by the lowest number of respondents i.e. 27 percent among the chosen sample.

The detailed analysis pointed out that while a vast majority of 76.2 percent respondents agreed that, as stated by the prime minister, the elimination of black money and corruption was the main objective behind the demonetisation, 23.5 percent chose to disagree nevertheless. The data analysis pointed out that among those 69.3 percent of the respondents who chose wiping out of counterfeit currency as the key objective, 19.5 percent had a strong opinion, and nearly half of the sample size chose to agree with the statement. Among the respondents, while 29.2 percent straightway expressed their disagreement with the statement on wiping out of fake currency, the remaining 1.5 percent remained neutral. It was further found that a curb on drug and terrorist funding was perceived to be demonetisation’s main driver, by 57 percent of the respondents. Of these, while 40.50 percent agreed, another 16.5 percent strongly agreed. The percentage of those, who did not perceive drug and terrorist funding as key reason for demonetisation, stood at 40.8 percent. Notably, a very less percentage of sample population assumed that the government wanted to promote digital India besides discouraging tax evasions through demonetisation. Over 72.2 percent of the respondents refused to agree that currency ban was introduced to give a push to digital India mission. Of the total sample, merely one fourth i.e. 27 percent developed a perception of digitalisation of economy being the objective of demonetisation.

| S. no. | Statement | Strongly disagree | Disagree | Neutral | Agree | Strongly agree |

|---|---|---|---|---|---|---|

| 1 | Use of apps reduced visits to the banks. | 5.5 | 19 | 3 | 51 | 21.5 |

| 2 | Use of cashless transactions reduced risk of robbery/theft/snatchings. | 12.8 | 19 | 5.2 | 42.2 | 20.8 |

| 3 | Banks became very supportive and helpful. | 14.5 | 30.3 | 5.8 | 35 | 14.3 |

| 4 | Deposit/withdrawal process at banks became toughest ever. | 4.8 | 17.5 | 4.3 | 49.7 | 23.7 |

| 5 | Most of banks failed to re-fill ATMs as per need of people. | 10.7 | 16.7 | 0.8 | 54.2 | 17.7 |

| 6 | Bank employees adopted ‘pick and choose’ policy to help rich and influential people. | 11.5 | 29.2 | 6.2 | 37 | 16.2 |

Table 2: Showing perception gained by reading newspapers content regarding banking patterns after demonetisation (Figures in percentage).

With a thumping majority i.e. as many as 72.5 percent audience developing a perception that introduction of various apps and its subsequent usage in daily life significantly reduced the personal visits to banks, the respondents opined that adoption of such cashless transactions reduced the risk of robbery, theft or snatching to a greater extent. While 63 percent of the respondents agreed to the statement that online banking reduced thefts, 5.2 percent of them neither agreed nor disagreed by preferring a neutral stance and 31.8 percent disagreed. When asked about their perception towards the behavioural attitude of bankers towards the general public, the respondents were found to have a spilt opinion, with almost equal number of respondents agreeing as well as disagreeing with the statement that banks became very supportive and helpful postdemonetisation. Statistically, while 44.8 percent of total sample size agreed, a slightly higher number i.e. 49.3 percent among them disagreed. Having read the newspaper content, the majority of respondents also developed a strong perception that during demonetisation period, the withdrawal process at bank counters had become toughest ever, and most of banks also miserably failed to re-fill the ATMs in accordance with the need of people. The study revealed that by reading newspaper content, while 73.4 percent of respondents perceived the money withdrawal process to be toughest ever, 71.9 percent of them also agreed to the statement that affirmed the banks’ failure in re-filling the ATMs as per the new-born demand.

The content that appeared in the newspapers during the period of study also left an impression among audience that bank employees were adopting ‘pick and choose’ policy to help rich and influential people. A little higher than half of the respondents i.e. 53.2 percent among them agreed to the statement while 40.7 percent disagreed.

| S. no. | Statement | Strongly disagree | Disagree | Neutral | Agree | Strongly agree |

|---|---|---|---|---|---|---|

| 1 | Infrastructure required for digital transactions was easily available in India. | 11.3 | 34.2 | 4.3 | 33.8 | 16.3 |

| 2 | After demonetisation, digital transactions increased substantially. | 4 | 10.7 | 0.8 | 56.5 | 28 |

| 3 | Cashless payments resulted in increase in tax collections. | 8.3 | 18.3 | 6.5 | 48 | 18.8 |

| 4 | Common man was largely benefitted by digital transaction(s) in terms of discounts, cash backs etc. | 11.5 | 35.7 | 5.7 | 34.7 | 12.5 |

| 5 | Digitalization of economy led to increase in online frauds. | 7 | 17.5 | 2.7 | 51.8 | 21 |

Table 3: Showing perception gained by reading newspapers content related to digitalisation of Indian economy after demonetisation (Figures in percentage).

As represented in the above Table 3, the data revealed that an important aspect of the perception gained by reading newspapers content turned out to be the fact that nearly 84.5 percent of the respondents unanimously agreed to the statement that digital transactions increased substantially post demonetisation. Those who chose to disagree with this statement accounted for mere 14.7 percent. As far as availability of infrastructure required for digital transactions after demonetisation is concerned, a majority of 50.1 percent respondents agreed to the statement, but 45.5 percent respondents had a clear cut perception that infrastructure was not available in country. It was found that news content offered by newspapers during the period of study made 66.8 percent readers believe that cashless mode of payments resulted in increase in tax collections, whereas 26.6 percent of respondents refused to agree with the statement. As many as 6.5 percent of them maintained a neutral stance.

When asked to respond as to whether the common man was benefitted by digital transactions in terms of discounts, cash back schemes etc., nearly 47.2 percent of respondents drove an impression from newspaper content that common man was benefitted. Equal number of respondents i.e. 47.2, however, had developed an opinion that common man did not get any benefits. About 5.7 percent of respondents remain neutral about this statement.

Highlighting yet another important perception of common man towards digitalised economy, the study revealed that over 72.8 percent of the respondents gained a perception that digitalization of economy led to an increase in online frauds. On the other hand, while 24.5 percent of respondents disagreed with the statements ascribing digitalization of economy as a cause of increase in online frauds, the remaining 2.7 percent of respondents acted neutral.

| S no. | Statement | Strongly disagree | Disagree | Neutral | Agree | Strongly agree |

|---|---|---|---|---|---|---|

| 1 | Unaware about apps/internet usage. | 12 | 28.7 | 2.3 | 37 | 20 |

| 2 | Privacy concerns. | 4.8 | 12.8 | 4 | 57.5 | 20.8 |

| 3 | Security violations. | 8.5 | 21 | 2.7 | 47.5 | 20.3 |

| 4 | Digital payment methods were confusing and too complex to understand. | 15.8 | 28.7 | 5.8 | 30.3 | 19.3 |

Table 4: Depicting perception gained from newspaper content regarding the challenges faced in adopting digital mode of payments or banking after demonetisation (Figures in percentage)

Discussion

The study pointed out that the newspaper readers had developed a perception that privacy concerns as well as fear of security violations were the main bottlenecks in adopting digital mode of payments or banking after demonetisation. An indepth analysis of the responses obtained from the respondents brought to the fore that while 57 percent of the respondents were aware about the usage of internet banking or other apps, nearly 40.7 percent of them were caught unaware about techniques of digital modes of transactions. Interestingly, an overwhelming majority i.e. nearly 78.3 percent of the sample size had gained an impression that usage of digital or internet banking through apps or mobile posed a serious threat to their privacy. A very less percentage among the respondents i.e. 17.6 percent did not find privacy concerns as a challenge in adopting digital mode of payments and banking.

It was found that the users also had fear of security violations and thus found it hard to easily shift to digital mode of banking or payment. Having read the content offered by newspapers, nearly 67.8 percent of the readers had developed a perception that usage of mobile apps or internet banking could result in security violations. While 29.5 percent of respondents did not show any concerns about security violations, nearly 4 percent of respondents remained neutral.

In the perception gained from newspaper content regarding the impact of demonetisation on security violations, nearly 47 percent of respondents agreed, and 20.3 percent respondents strongly agreed on security violations. Nearly 21 percent respondents expressed their disagreement and 8.5 percent strongly disagreed on security violations. About 2.7 percent of respondents remain neutral on security violations.

Highlighting yet another major challenge in adoption of internet banking and digital mode of transactions, the study revealed that nearly 49.6 percent of the respondents were of the view that digital payment methods were too complex and confusing. Among half of the remaining respondents while nearly 44.5 percent disagreed with the statement, another 5.8 percent acted neutral.

Conclusion

The topic of demonetisation remains most talked about topic in recent years and has had far reaching consequences in almost every sphere of life. ‘Three fourths’ of the respondents perceived that demonetisation that shook the entire country was taken with an objective of eliminating the black money and corruption. Wiping out fake currency was perceived as the second important objective followed by weeding out drugs and terrorist funding. Least people believed that demonetisation aimed at promoting digital India besides curbing tax evasion.

The study found that newspaper content on demonetisation, however, made them develop a clear perception that personal visits to the banks got reduced to a minimal level due to options of digital payment gateways. Resultantly, the risk of robbery/ theft/snatchings of cash too got reduced to minimal. The newspaper content made majority of its readers gain a clear cut impression that banks did not re-fill ATMs as per the needs of the people and more than 70 percent finding deposit and withdrawal process toughest ever. Significantly, a slightly higher than the half of the respondents developed a perception that bank employees were adopting a ‘pick and choose’ policy to help the rich and influential.

The research highlighted that even though the readers had an impression that infrastructure required for implementing digital India mission was not readily available, still it was a common perception that digital transactions increased substantially after demonetisation was announced. However, at the same time, the increase in digital payments was found to have a correlation with increase in online financial frauds as majority of readers were found amply convinced that this increase in online payment methods heightened the risk of online frauds. Majority of newspaper readers developed a strong perception of digitalisation of payment gateways leading to increased tax collections.

Privacy concerns and fear of security violations during use of online transaction methods were perceived as a major challenge which readers faced in shifting from cash payment methods to digitalised mode of financial transactions. A larger section of readers, particularly retirees, found the digital payment methods complex and perplexing.

References

- Kumar A. Economic consequences of demonetisation: Money supply and economic structure. Econ Polit Wkly. 2017;52(1):14-17. [Google Scholar]

- Clark T, Kulkarni V, Barat S, Barn B. A homogeneous actor-based monitor language for adaptive behaviour. Programming with Actors: State-of-the-Art and Res Persp. 2018:216-244.

- Jha R. Modinomics: Design, implementation, outcomes, and prospects. Asian Econ Policy Rev. 2019;14(1):24-41.

- Kumudha A, Lakshmi K. Digital marketing: Will the trend increase in the post demonetization period. J Res Bus Mgmt. 2016;4(10):94-97.

- Khando K, Islam MS, Gao S. The emerging technologies of digital payments and associated challenges: A systematic literature review. Future Internet. 2022;15(1):21.

- Ghosh J. The political economy of being ‘modern’ in 21st century India. Exploring Indian Modernities: Ideas and Practices. 2018:59-79.

- Sarkar S. The parallel economy in India: Causes, impacts and government initiatives. Econ J Devel Issues. 2010;11(12):124-134.

- Liebana-Cabanillas F, Japutra A, Molinillo S, Singh N, Sinha N. Assessment of mobile technology use in the emerging market: Analyzing intention to use m-payment services in India. Telecomm Policy. 2020;44(9):102009.

- Shanbhogue GK, Shettigar C. A study on demonetization of 500 and 1000 rupee notes and its impact on the various sectors and economy. Int J Res Econ Social Sci 2016;6(12):274-284.

- Tandon D, Kulkarni B. Demonetization in India: The good, bad and ugly facets. Asian J Res Bus Eco Mgmt. 2017;7(1):41-47.

- Ng D, Kauffman RJ, Griffin P, Hedman J. Can we classify cashless payment solution implementations at the country level?. Electron Commer Res Appl. 2021;46:101018.

- Chakrabarty M, Jha A, Ray P. Demonetization and digital payments in India: Perception and reality. Appl Econ Lett. 2021;28(4):319-323.

- Veerakumar K. A study on people impact on demonetization. Int J Interdiscip Res Arts Humanit. 2017;2(1):9-12.

Citation: Sharma N (2023) A Study on Objectives of Demonetisation and Its Impact on Banking Patterns and E-Transactions. Global J Interdiscipl Soc Sci. 12:062.

Copyright: © 2023 Sharma N. This is an open access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.