Indexed In

- Open J Gate

- Genamics JournalSeek

- JournalTOCs

- China National Knowledge Infrastructure (CNKI)

- Electronic Journals Library

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- SWB online catalog

- Virtual Library of Biology (vifabio)

- Publons

- MIAR

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Research Article - (2022) Volume 13, Issue 2

A Review of Oil and Gas Midstream Operations in Kenya: Progress and Challenges

Antony Fundia Simbiri*Received: 03-Jan-2022, Manuscript No. JPEB-22-15350; Editor assigned: 07-Jan-2022, Pre QC No. JPEB-22-15350(PQ); Reviewed: 21-Jan-2022, QC No. JPEB-22-15350; Revised: 26-Jan-2022, Manuscript No. JPEB-22-15350(R); Published: 02-Feb-2022, DOI: 10.35248/2157-7463.22.13.449

Abstract

Since 1960, Kenya has been refining imported crude oil and gas for its domestic needs. However, in 2012, it discovered its own oil resources. Huge expectations from this discovery among all the stakeholders have ignited unmatched interested both locally and internationally. The expected socio-economic changes for the nation however need to be surgically addressed and assessed. This paper therefore aims to explore the refining of oil and gas operations in Kenya. It analyses the history, development and future potential of the midstream sub-sector of the oil and gas industry. Furthermore, it evaluates the challenges facing the oil refining industry and makes recommendations for its successful operations.

Keywords

Refining; Petroleum imports; Resource curse; KPRL

Abbreviations

BPR: Business Process Reengineering; COFEK: Consumer Federation of Kenya; EPRA: Energy and Petroleum Regulatory Authority; GHG: Green House Gases; KEPTAP: Kenya Petroleum Technical Advisory Project; KPA: Kenya Port Authority; KPRL: Kenya Petroleum Refineries Limited; KNBS: Kenya National Bureau of Standards; UNEP: United Nations Environmental Program.

Introduction

Midstream oil and gas operations in the world

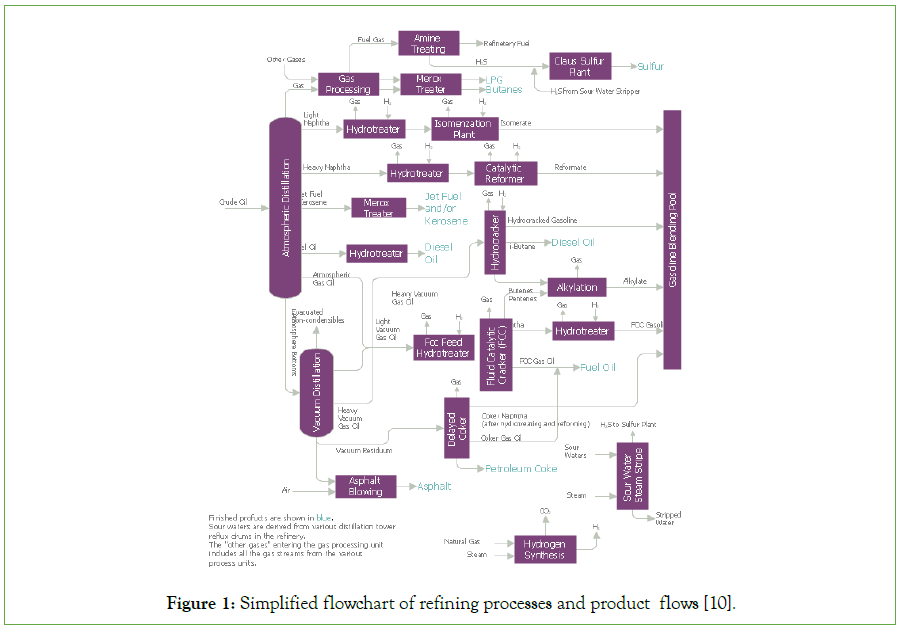

The midstream subsector of oil and gas value chain entails transporting and processing the crude from the upstream section into consumer suitable products. This processing is referred to as refining. Since crude oils are extremely complex, widely ranging mixtures of hydrocarbon and organic compounds of heteroatoms and metals, refining them needs many unique yet interconnected processes to separate crude into multiple streams, convert the heavier streams into lighter products, remove contaminants, improve product quality and make multiple different products in varying amounts from crude of varying quality [1-8].

Refineries convert crude oils and other input streams into dozens of refined (co-) products including: Liquefied Petroleum Gases (LPG), gasoline, jet fuel, kerosene, diesel fuel, petrochemical feedstock, lubricating oils and waxes, home heating oil, fuel oil and asphalt. Of these fuel oils and asphalt have the lowest value while transportation field have the highest value. Currently 660 refineries are in operation globally, producing more than 85 million barrels of refined products per day, with USA having the largest capacity, closely followed by China and India [9]. Basically, there are three types of refineries: topping refineries, hydro-skimming refineries and upgrading refineries (also known as complex or conversion refineries). Whereas topping refineries have a crude distillation column, and produce naphtha and other intermediate products apart from gasoline, hydro-skimming refineries have mild conversion units like hydro-treating units and or reforming units to produce finished gasoline products but don’t upgrade heavier components of the crude oil and exit near the bottom of the distillation column. On the other hand, upgrading/conversion refineries have cracking or coking operations that convert long-chain, high molecular weight hydrocarbons into smaller hydrocarbons for gasoline products and other petrochemical feedstock.

In many parts of Africa, refineries are under operating, with some running at up to 40% their capacity. In Nigeria, for instance, the four refineries have been operating at an average of 18% capacity. This attributed to black market importation of crude products, lack state control, insufficient enforcement of oil and gas polices security concerns, etc.

Midstream oil and gas operations in Kenya

The Kenya Petroleum Refineries Limited was formed in the year 1963, with an aim of processing imported crude oil for the Kenyan and East African market. Located in Mombasa, Changamwe, this entity was originally designed as a mild hydro-skimming establishment whose feedstock would be imported Middle East Murban blend. Simplified version of the same is presented in Figure 1 below.

Figure 1: Simplified flowchart of refining processes and product flows [10].

Laws and Regulations

Midstream oil and gas operations in the world

The midstream subsector of the oil and gas value chain, in Kenya has several legal instruments operationalizing it. Apart from the Petroleum Act of 2019, the Sessional Paper Number 4 of 2004 is more specific on the midstream subsector of the oil and gas industry. Some of these objectives for the midstream subsector include:

• Offload the government’s interest in oil refining and marketing of petroleum products. This, however, hasn’t been affected.

• Promotion of investments in oil refining including supply and distribution of petroleum products throughout the country.

• Financing of strategic energy reserves by the government and private sector, equivalent to 90 days’ demand in medium to long term.

Policy making institutions in the midstream oil and gas sub-sector

Ministry of petroleum and mining: The Ministry of Petroleum and Mining (formerly vested in the Ministry of Energy) is responsible for overall policy coordination and development in the oil and gas sector in Kenya. It’s responsible for setting policy upon receipt of advice from the EPRA and the Energy Tribunal. The Energy Tribunal, established under the Energy Act 2006, hears appeals from decisions made by the EPRA. In the midstream section, the functions of the authority as provided in Section 10 of the Energy Act 2019 are to: Regulate, Importation, refining, exportation, transportation, storage and sale of petroleum and petroleum products with the exception of crude oil.

Major implementing institutions-midstream oil and gas subsector: Kenya Petroleum Refineries Ltd (KPRL)

Midstream: Kenya Petroleum Refineries LTD

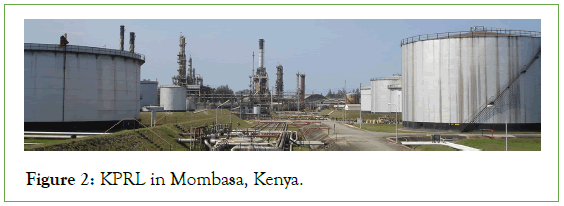

This is a state-owned refinery, in conjunction with three private companies-Shell (17.1%), Caltex (15.8%) and BP (17.1%), on 50%- 50% equity basis. KPRL has oil storage facilities at Kipevu, with a capacity of 1.5 million. KPRL has distillation, hydro-treating, catalytic reforming, bitumen production and crude storage facilities at its site. KPRL has 45 tanks with a total storage capacity of 484 million liters, of which 254 million liters is reserved for refined products while the left 233 million liters is reserved for crude oil.

Several scholars describe an oil refinery as a group of manufacturing plants that are used to separate petroleum into valuable fractions [11-13]. In the process of distillation, for example, the crude oil is heated in a furnace so that the hydrocarbons are separated via their boing points [14].

In the last two decades, oil refining has grown so complex. Low quality crude oil (like tar sand bitumen, heavy crude oil, and even extra heavy oil), aggressive oil price volatility and ecological and environmental challenges have placed huge demands on the need for cleaner processing technologies that produce higher performing products. The products must meet specified quality and quantity levels [15]. Consequently, the modern refinery has to keep evolving technically and technologically to survive. Current versatile refineries are now referred to as conversion refineries, incorporating all the basic units found in both topping and hydro skimming refineries, and also have gas oil conversion technologies like hydrocracking, catalytic cracking, olefin conversion plants such as polymerization and alkylation and even coking units for reduction of residual fuels. The final products produced by refineries usually vary from one refinery to another depending on their technical orientation. While some refineries have focused on gasoline (with large investments in reforming and catalytic cracking), others have orientated their production facilities towards the production of middle distillates like jet fuel and gas oil. Since its inception KPRL had operated as a toll refinery, meaning all oil marketers in Kenya were mandated to refine their crude in it at a designated processing fee.

Upgrading of largest refinery in Kenya: A case study

For several years, KPRL performed dismally on technical basis. Efforts to upgrade it remained a non-priority for quite some time. In 2005, a tender to consult for upgrading KPRL was announced. Several firms including Nexans, Forster Wheeler Energy Ltd etc. showed interest in and applied for it. Consequently, Forster Wheeler Energy Ltd won the tender to prepare the basis of design for upgrading the refinery to allow the production of products that would meet specifications that meet the Dakar Declaration which specified the use of unleaded gasoline and low-sulfur diesel by January 2006. The project description included the production of a technical definition and duty specifications for licensed units, a project execution plan and the cost estimate for the upgrade. Precisely which methodology was adapted is unclear. Advocates for simultaneous analysis of process network integration within a multisite refinery and petrochemical system, and this provides refinery expansion requirements, production levels and blending levels [16]. Additionally, they propose the use of mathematical programming on an enterprise-wide scale to address strategic decisions considering various process integration alternatives, which yields substantial benefits.

In 2009, Essar (an Indian conglomerate) purchased a 50 percent stake in Kenya Petroleum Refineries Ltd (KPRL) for $7 million from a group of oil marketers BP, Chevron and Royal Dutch Shell. The initial plans of Essar were to increase the refinery’s crude handling capacity to 4 million tons of crude per year (79,000 barrels per day) by 2018 from the then 1.6 million. However, oil marketers in Kenya, unhappy with the refinery’s products and costs, called for its closure. Essar on its part stated that the government was unwilling to enforce a deal that required local suppliers to buy a certain portion of fuel from the plant, but Kenyan officials on their part said that Essar should have reported to them that the oil marketers were unwilling to buy from the refinery. The unending intrigues in the downstream petroleum sub-sector finally came down on KPRL. After agreeing to modernize KPRL, Essar, hired a consultant who advised the firm against revamping it. If this was necessary when Forster had already undertaken a similar exercise in 2006, is unclear. Consequently, Essar breached the contract by rejecting KPRL’S liabilities. According to Essar, it was now up to the Kenya government to shoulder all the liabilities of KPRL which included, bank loans, employee salaries and decommissioning costs if the facility was to be closed down.

Of a contrary opinion was the Consumer Federation of Kenya (Cofek), who noted that lack of transparency in the petroleum sub-sector (downstream) contributes to high prices of fuel. Cofek highlighted the failure of Essar to transform KPRL due to the opaqueness of the agreement between Essar and the government. KPRL on its part blamed the oil marketers for frustrating its operations by declining to sign product purchase agreements and the government for absconding its mandate of holding the oil marketers to account despite the presence of legal requirements regarding the same. A report by ERC to the Ministry of Energy alleged losses of $4.9 million due to loss of products during the refining processes. Indeed, the author captured the essence of the petroleum sub-sector with this title-Oil Marketers fail to share “loot” with consumers” (Figure 2).

Figure 2: KPRL in Mombasa, Kenya.

After years of poor maintenance, negative annual balance sheets, KPRL top management chose to reengineer the business model of their operations. From January 2012, it changed into a merchant refinery. This was part of the modernization plan to revamp the facility. Early cost estimates of this plan put the figure at around $1 million. And this plan was to run until 2015. According to the planned modernization, it would produce four million metric tons of petroleum products annually from 1.6 million metric tons that it was producing then. With Standard Chartered Bank as the Financial Advisor of the business process reengineering, it was hoped that within three years, this dream would be achieved. However, this didn’t save KPRL from litigations. Pure incompetence, mediocre strategy formulation and poor management ran the day in KPRL. At one point, one of the oil marketers accused KPRL of blocking its products at the facility. Consequently, two years down the line, this oil marketer sued KPRL for a record-breaking sum of $20 million.

The unlimited management troubles at KPRL brought an invoice of $95 million to the Kenyan tax payer as unveiled by price water house Coppers forensic audit report. This amount was claimed by both financial (Citibank and Barclays Banks) and energy (Total Kenya) creditors. Additionally, former employee-initiated litigations multiplied KPRL troubles as four of them won an unfair dismissal court case against it. By April 2013, oil marketing companies and some other state agencies (including EPRA) campaigned for the closure of KPRL. As per their claim, this would lead to a drop in retail prices of petroleum products by $0.1 per liter. On the contrary, the prices went up. At the core of this campaign, lay the open hands of beneficiaries of direct imports of processed fuel that annually runs into millions of dollars. Even more interesting were the recommendations of EPRA for the complete closure of KPRL and its transformation into a storage facility. By December 2020, the President of the Republic of Kenya discussed with the Chief Executive Officer of Eni (the Italian energy giant) on plans to convert KPRL into a bio-refinery, extinguishing any hopes of revamping the crude oil refinery.

Understand the perception of the management of Kenyan oil marketing companies towards green marketing practices by KPRL and the factors that contributed to the failure of the merchant mode [17,18]. These studies show that while most of the oil marketing firms felt exploited by KPRL, however, even the business process reengineering adopted by KPRL for its employees was never properly managed. From inadequate induction, poor communication and incompetent change management, KPRL failed to achieve its objectives which confirms findings from scholars like among others, who report that as many as 70% of BPR efforts fail to meet their goals [19,20]. While KPRL was long overdue for a shakeup in their management system, the need for a proper approach was paramount. Research work has shown that a BPR project needs deployment of success factors such as preparation for change, planning, recognition and design, evaluation, culture and change, and information technology from early stages before its execution [21,22].

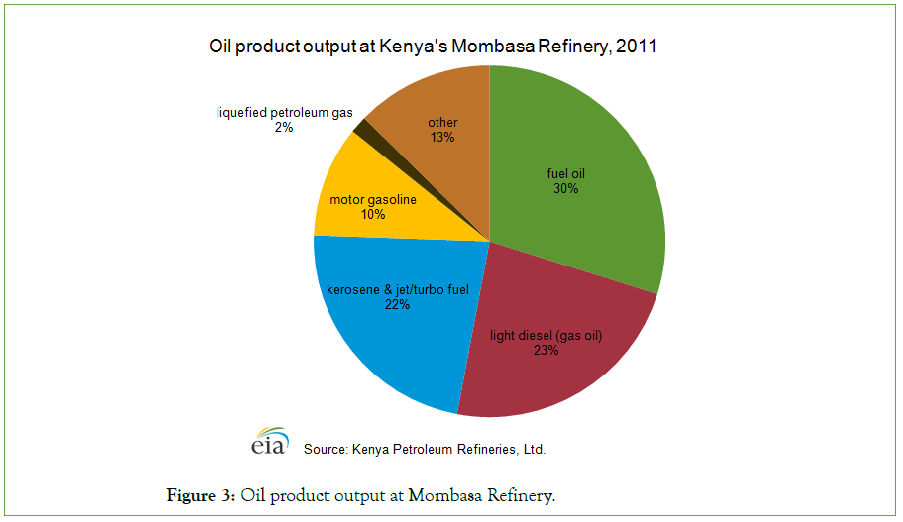

Despite the unending challenges, KPRL still managed to operate. Tables 1A and 1B and Figure 3 below shows the crude oil intake at the refinery during the period of 2011 and 2012 and consecutive product line. Table 2 demonstrates the oil products deficit prevailing in Kenya. It had a decrease from 1,742.2 tons to 992.1 tons. This drop is attributed to the change in the business model which enabled KPRL to procure and process crude oil and sell its refined products to oil marketers. Evidently from Table 1, the production of the main products of KPRL namely gasoline, kerosene, light diesel and fuel oil decreased by 37% to 60%. Inept management ultimately led to the cost of producing petroleum products at KPRL to be higher than importing the same products, consequently giving the same political lobbyists the leeway, they had always sought for: total closure of KPRL.

| Product | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 |

|---|---|---|---|---|---|---|---|

| Liquid Petroleum Gasoline | 29 | 27.1 | 34 | 28.1 | 24.1 | 14 | 16.9 |

| Motor Gasoline - Premium | 158.9 | 157.9 | 201.6 | 154.4 | 150.7 | 149 | 205.2 |

| Motor Gasoline - Regular | 137.4 | 127.4 | 133.2 | 119 | 102.1 | 79.8 | 70.3 |

| Illuminating Ker. & Jet Fuel | 355.1 | 337.4 | 400.4 | 320 | 272.9 | 279 | 306.7 |

| Lig. Dis. Oil | 401.2 | 406 | 482.2 | 406.8 | 379.1 | 301.4 | 361 |

| Heavy & Mar. Distillate | 27.6 | 25.1 | 28.6 | 29.6 | 25.4 | 40.7 | 26.3 |

| Fuel Oil | 499.1 | 507.2 | 615.8 | 534.6 | 533.1 | 534.4 | 619.9 |

| Bitumen | 19.8 | 20.3 | 215 | 22.3 | 16.4 | 10.7 | 65 |

| Additives | -0.6 | -0.6 | -0.8 | -0.6 | -0.4 | -0.4 | -0.5 |

| Refinery Usage | 94.1 | 90.2 | 96.3 | 81.3 | 77.4 | 64.4 | 80.6 |

| Total | 1721.60 | 1698 | 2012.80 | 1695.50 | 1580.80 | 1492 | 1720.90 |

Table 1A: Finished petroleum product (â??000 tons) since 1998-2004.

| Product | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|---|---|---|

| Liquid Petroleum Gasoline | 28.5 | 30.1 | 33.2 | 32.7 | 29.4 | 29.2 | 27.6 |

| Motor Gasoline - Premium | 175.2 | 127.1 | 156 | 134.9 | 109.5 | 153.1 | 151.5 |

| Motor Gasoline - Regular | 61.8 | 51.4 | 50.7 | 46.7 | 47.7 | 46.3 | 36.9 |

| Illuminating Ker.& Jet Fuel | 325.6 | 343.7 | 338.5 | 316.9 | 359.3 | 349.3 | 393.3 |

| Lig. Dis. Oil | 344 | 334.2 | 364 | 350 | 371.9 | 367.3 | 402.8 |

| Heavy & Mar. Distillate | 22.8 | 33.3 | 32.5 | 24 | 17.8 | 25.8 | 26.6 |

| Fuel Oil | 589.5 | 596.2 | 534.2 | 515.2 | 479.9 | 449.6 | 520 |

| Bitumen | 20.4 | 17.4 | 16.6 | 12.4 | 0.3 | 15.9 | 5.4 |

| Additives | -3.8 | 24.3 | 40.5 | 58.6 | 78.8 | 82.3 | 115.2 |

| Refinery Usage | 81.3 | 93.3 | 96.5 | 91.3 | 92.4 | 101.4 | 83.7 |

| Total | 1645.3 | 1651 | 1662.7 | 1582.7 | 1605 | 1602.2 | 1752.2 |

Table 1B: Finished petroleum product (â??000 tons) since 2005-2011.

| Product | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|

| Domestic | 2.3 | 37.4 | 174.2 | 170.2 | 216.1 | 99.8 | 97.4 | 95.1 | 125.3 | 55.99 |

| Re-Export | 1313.6 | 1455.8 | 1116.1 | 323 | 18 | 76 | 113.4 | 121.3 | 115.7 | 128.7 |

Table 2: Domestic and re-export of petroleum (â??0000 tons).

Figure 3: Oil product output at Mombasa Refinery.

In February 2019, the Kenyan government announced that it will not construct a local refinery to process crude oil from the Turkana oil fields, opting instead to export all its oil in total disregard of its own Agenda 4 Program, whose pillar components include manufacturing. Instead, against all economic soberness, chose to continue importing refined petroleum products for domestic use despite it being the highest consumer of the country’s scarce foreign reserves.

Challenges

Policy mismatch

Several articulate and well molded midstream policies abound in the Ministry of Petroleum and Mining’s steel document safes. The will to design and formulate world class smart white government papers is prevalent while the zeal to execute the same is largely absent. The overbearing visibility of these policy mismatch means it will take quite some time and out of the ordinary experience before the state realizes the dire need to locally refine crude oil for its own increasing petrochemical needs, rising domestic fuel demand, economic empowerment of its largely unemployed youth, industrialization drive among other affected variables.

Environment

Since the refining industry consumes huge amounts of energy with a majority of the energy consumed being fossil fuel for combustion, it is therefore a significant source of GHG emission [23]. Sources of GHG emissions on a refinery are numerous. Approximate percentages would include: Combustion-63.3%, Hydrogen Plant 5.2%, Sulfur Plant 1.8%, Flaring 2.5%, FCCU Coke Burnoff- 23.5%, Others (3.1%, CRU Coke Burn-off, Delayed Coking, Fluid/flexi-coking units, Coke Calcining, Asphalt blowing, Blowdown, Storage tanks, Equipment leaks, Waste-water treatment and Cooling towers) [24]. Such GHG breakdown from specific sources for KPRL is largely missing, compounding the inability to quantify the environmental effects of the past KPRL operations.

Governance

Governance issues plague the midstream sector of the oil and gas value chain. In their study of the challenges faced by oil and gas firms in Kenya, opines that strategy implementation in Kenya have a relationship to global oil industry and the prevailing state legal framework [25,26]. Additionally, the studies show that successful performance relies on the right strategy implementation. By using the appropriate technology, resource allocation and prioritization, periodic strategy evaluations, proper communications, involvement of stakeholders and adopting reward system can aid in overcoming these challenges. These conclusions are in line with whose study of Kenya’s oil governance regime: challenges and policies, concludes that the resource curse and Dutch disease are outcomes of bad economic decisions and they can be avoided by designing and implementing natural resource governance regimes that consider social costs of the extractive industry and incorporates a cost benefit view in the industry’s management [27]. And this affects not just the upstream but the midstream subsector as well [28].

Engineering expertise

Crude oil refining is a technically intensive field. Since the discovery of oil in Kenya in 2012, unlike the midstream sector, a lot interest has been elicited in technically equipping Kenyans in the upstream subsector of the oil and gas industry. International entities have largely been more than willing to aid in local capacity building of the requisite engineering expertise in successfully operating the upstream subsector. Unfortunately, the same passion has not been witnessed in the midstream subsector, with even some of the technical operations at the stalled KPRL being monitored remotely from South Africa [29]. For a successful and economically meaningful Kenyan midstream oil and gas industry, a holistic approach to technical training should be advocated, enhanced and implemented, now that in this era of climate change, every scarce foreign investor is very much interested in GHG emissions and carbon footprint in crude oil processing.

Legal framework

Kenya is a signatory to the Basel Conversion Plastic Waste Amendment (signed in May 2020). However, the American Chemistry Council must be privy to the weak legal framework in Kenya and sought to arm-twist the Kenyan government into accepting to become a dumping ground for their petrochemical industrial waste and plastic products, according to the New York Times. Kenya’s growing economic distress induced by the COVID-19 pandemic, its desire to renew a trade deal with the US, which is set to expire in 2025, coupled with a weak legal environment, makes Kenya an easy and vulnerable prey. And so while refraining from investing in petrochemical manufacturing; it is interesting that the same state is negotiating with foreign petrochemical businesses on how to turn Kenya into a dumping ground of petrochemical industrial products plastic waste.

Conclusion

Policy mismatch

This paper has reviewed the latest studies undertaken by various researchers in the midstream sector of the Kenyan oil and gas industry. And an attempt has been made to compare and contrast their results. It therefore concludes that if Kenya desires to industrialize, then it must invest its resources in developing its midstream oil and gas subsector, as this is a major pillar in the industrial base of any developing nation. Only then, will the 4th pillar of its Agenda program make sense to the populace of the count.

Recommendations

This paper has therefore, comprehensively explored the midstream subsector of the oil and gas industry in Kenya. And it has shown that this industry can either uplift a nation to very high standards of living or shove an entire community into the gallows of poverty unknown to human kind. It thus recommends the following measures as necessary without prejudice:

1. Initiate the construction of a petroleum refinery to process the Turkana crude as earlier envisioned and as a basis of petrochemical industrial complex, with an aim of archiving self-sustenance in the nation’s petrochemical feedstock needs and creating much needed jobs.

2. Undertake an environmental assessment of the industrial processes at the former KPRL facilities with a view of setting up procedures and operational quality standards for any future crude oil refining capacities in the country.

3. Sober public awareness campaigns by the civil society, community leaders and other stakeholders not just with strict focus on the upstream but also on the midstream, with special emphasis on the positive and negative contribution of refineries on the overall development and sustainable progress of the society.

4. With the onset of climate change, proper and adequate environmental adherence, supervision and mitigation measures should be adopted by all stakeholders to benefit the society, without the risk of stranded assets.

5. Further, sector-specific studies need to be undertaken to understand the intra and inter-dynamics of each sub-sector of the oil and gas industry, with clear legally permitted access to data and information. Despite the existence of an open government data portal, selective amnesia is present, with vital information on oil refining absurdly missing.

Disclosure Statement

No potential conflict of interest was reported by the authors.

REFERENCES

- Speight JG. The chemistry and technology of petroleum. CRC Press. 2006.

- Meyer RF, Attanasi ED, Freeman PA. Heavy oil and natural bitumen resources in geological basins of the world: Map showing klemme basin classification of sedimentary provinces reporting heavy oil or natural bitumen. US Geol Surv Open-File Rep. 2007; 2007:1084.

- Wang M, Lee H, Molburg J. Allocation of energy use in petroleum refineries to petroleum products. Inte J Life Cycle Assess. 2004; 9(1):34-44.

- Robinson PR, Dolbear GE. Hydrotreating and hydrocracking: fundamentals. Practical Adv Pet Proc. 2006: 177-218.

- Karras G. Combustion emissions from refining lower quality oil: what is the global warming potential? Environ Sci Technol. 2010; 44(24):9584-9589.

- Gunaseelan P, Buehler C. Changing US crude imports are driving refinery upgrades. Oil Gas J. 2009; 107(30):50-56.

- Petroleum Navigator. US energy information administration: washington, D.C. 1999-2008 refinery utilization and capacity; crude oil input qualities; refinery yield; fuel consumed at refineries; crude oil imports by country of origin. 2009.

- OGJ surveys. Worldwide refining. Oil Gas J. 2009.

- International Council on Clean Transportation. The production of ultra-low sulfur gasoline and diesel fuel. 2011.

- James HG, Glenn EH. Petroleum Refining: Technology and Economics. 2001.

- Parkash S. Refining processes handbook. 2003.

- Ancheta J, Speight JG. Chemical Industries. CRC Press. 2007; 117:281-311

- Hsu CS, Robinson PR. Springer handbook of petroleum technology. 2017.

- Ayhan D, Hisham SB. Optimization of crude oil refining products to valuable fuel blends. Pet Sci Technol. 2017; 35(4):406-412.

[Crossref]

- Purohit A, Suryawanshi T. Integrated product blending optimization for oil refinery operations. IFAC Proc Vol. 2013; 46(32):343-348.

- Elkamel A, Al-Qahtani K. Integration and coordination of multisite refinery and petrochemical networks under uncertainty. Int J Proc Syst Eng. 2011; 1(3-4):237-265.

- Kalama E. Green marketing practices by Kenya petroleum refineries: a study of the perception of the management of oil marketing companies in Kenya. 2007.

- Nicholas M G. The effect of green marketing strategies on consumer purchasing Pattern in Kenya. 2018.

[Crossref]

- Hammer M, Champy J. Reengineering the Corporation: Manifesto for Business Revolution. 2009.

- Marjanovic O. Supporting the “soft” side of business process reengineering. Bus Process Manag J. 2000.

- Luo W, Tung YA. A framework for selecting business process modeling methods. Ind Manag Data Syst. 1999; 99(7):312-319.

- Belmiro TR, Gardiner PD, Simmons JE, Rentes AF. Are BPR practitioners really addressing business processes? Int J Oper Prod Manag. 2000; 20(10):1183-1203.

- Pellegrino J, Brueske S, Carole T, Andres H. Energy and environmental profile of the US Petroleum refining industry. EERE Publ Pro Lib. 2007.

[Crossref] [Google Scholar]

- Coburn J. Greenhouse Gas Industry Profile for the Petroleum Refining Industry prepared for US. Environ Protec Agen. 2007; 11.

- Chege JK. Challenges of strategy implementation for firms in the petroleum industry in Kenya. 2012.

- Obuola O P. Strategy formulation and performance of selected firms in oil and gas industry in Kenya. 2017.

[Crossref]

- Mwabu G. Kenya’s oil governance regime: Challenges and Policies. 2018.

- Iheukwumere O, Moore D, Omotayo T. A meta-analysis of multi-factors leading to performance challenges across Nigeria’s state-owned refineries. Appl Petrochem Res. 2021; 11(2):183-197.

- Philip Mwakio. Business Daily. 2010.

Citation: Simbiri FA (2022) A Review of Oil and Gas Midstream Operations in Kenya: Progress and Challenges. J Pet Environ Biotechnol. 13:449.

Copyright: © 2022 Simbiri FA. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.