Indexed In

- JournalTOCs

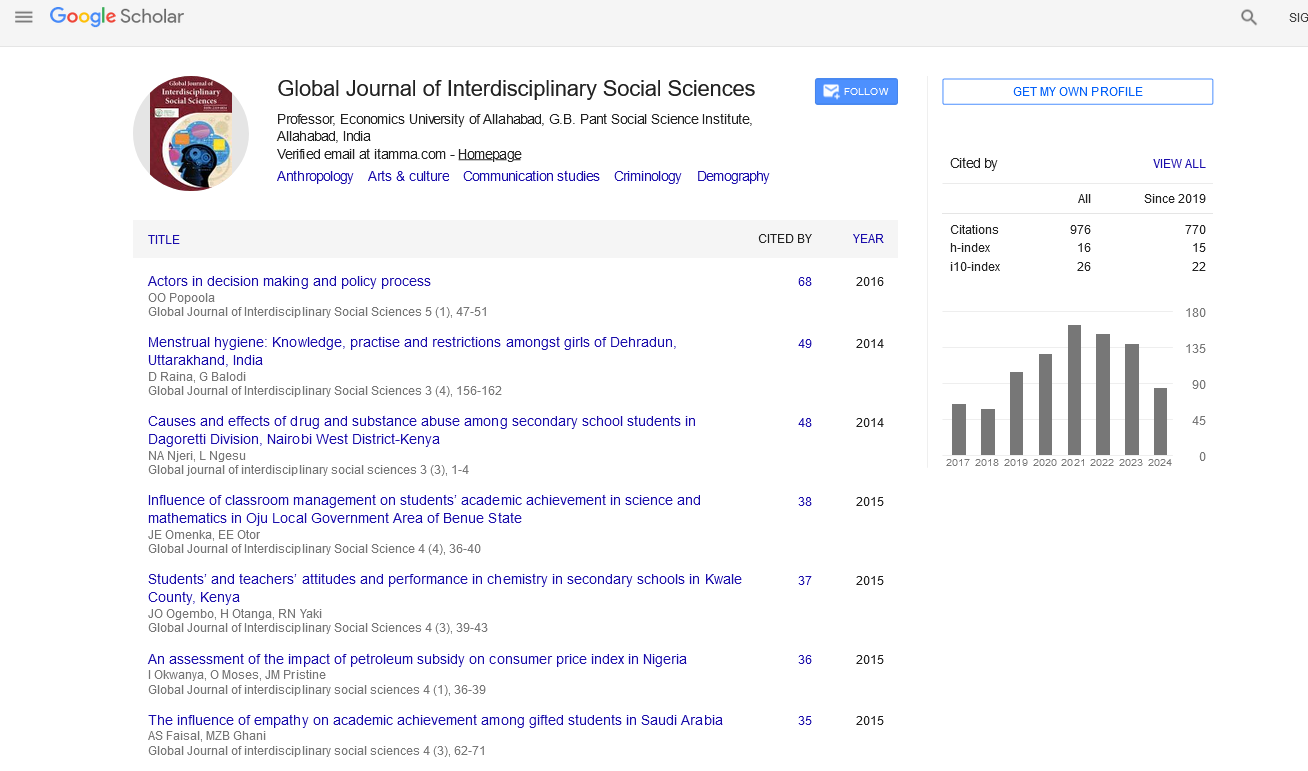

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Abstract

Voluntary Delisting: The Reasons Behind

Douglas Muyeche

Delisting from a securities exchange has often been viewed as evidence of tough times within an organisation. The purpose of this paper is to unravel the reasons behind voluntary delisting. The study has made use of published literature with examples from different countries. In as much as most delisting(s) are involuntary, there are good reasons for a counter to opt for voluntary delisting in light of enhancing shareholder value. The cost of remaining public versus the cost of going private has been cited as the most determinant factor in voluntary delisting. Another notable reason has been found to be the inability to raise equity capital by the listed firm owing to a relatively lower share price compared to the real net asset value of the firm. The need to merge, demerge or restructure a firm may be drivers of voluntary delisting. Delisting may however tend to reduce the universe of liquid shares thereby affecting the depth and breadth of the market especially if there are no new listings. Delisting may be considered a viable option if the firm is to restructure via merging with a non-listed entity.