Indexed In

- JournalTOCs

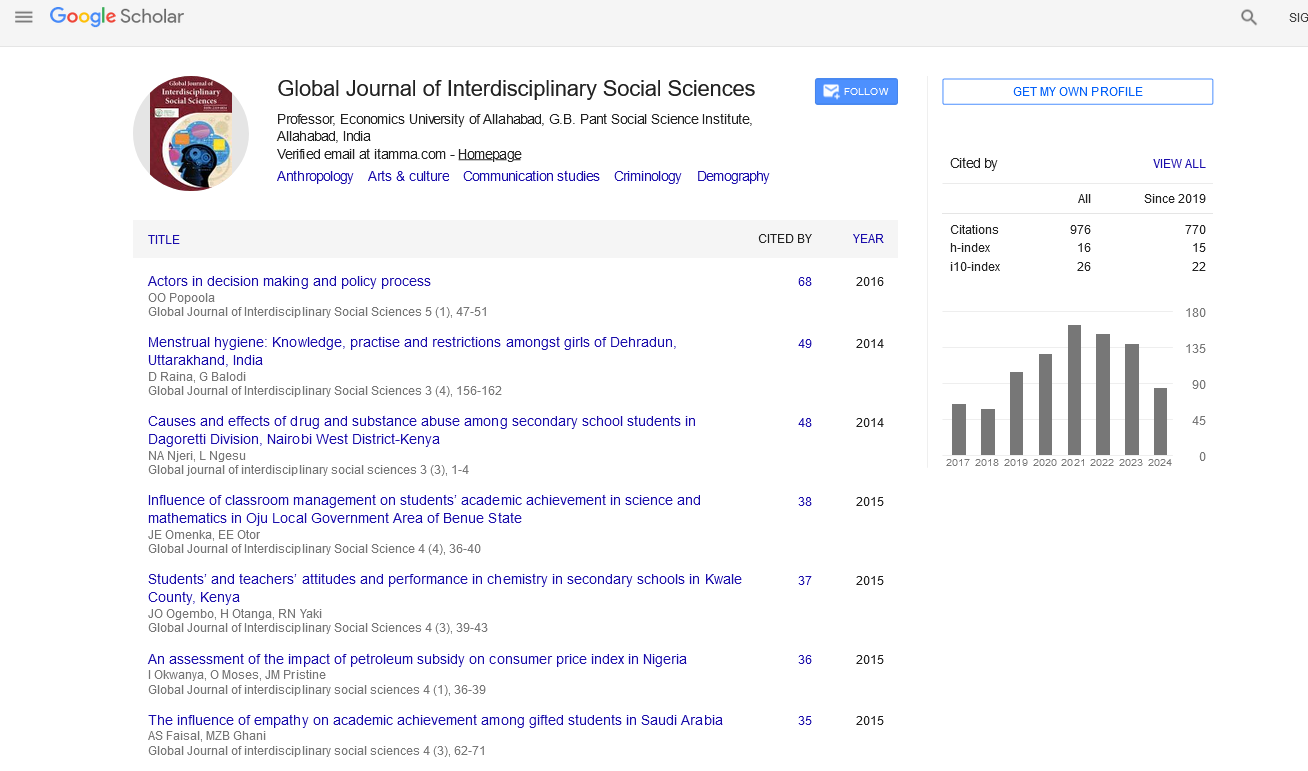

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Abstract

Growth of Micro Finance in India: A Descriptive Study

Dr Swati Sharma

Indian economy is portrayed by low rate of development, predominance of rural population, overwhelming dependency on horticulture, unfavourable land mass proportion, exceptionally skewed income distribution and wealth beside, high frequency of destitution and joblessness. The last two variables poverty and joblessness posture real difficulties to the development and success of the nation. To conquer this issue, some recently created parts like micro finance are assuming an essential part. Microfinance has been viewed as a capable tool to battle poverty through the arrangement of essential financial services including reserve funds, protection, credit and transfer of funds. Microfinance has changed from being an experiment alternative option to formal or casual sources of credit to be a model for lending projects to the poor of developing nations. Microfinance has permitted giving credit to poor people who were not given the credit by the financial institutions reason for lacking of collateralizable assets. The target of microfinance establishments is to serve needy individuals and empower them to get to credit and fight poverty. Against such upgrades, the present investigation has been done to investigation of review of literature in microfinance part with the target of studying development of small scale fund in India throughout the years.