Indexed In

- JournalTOCs

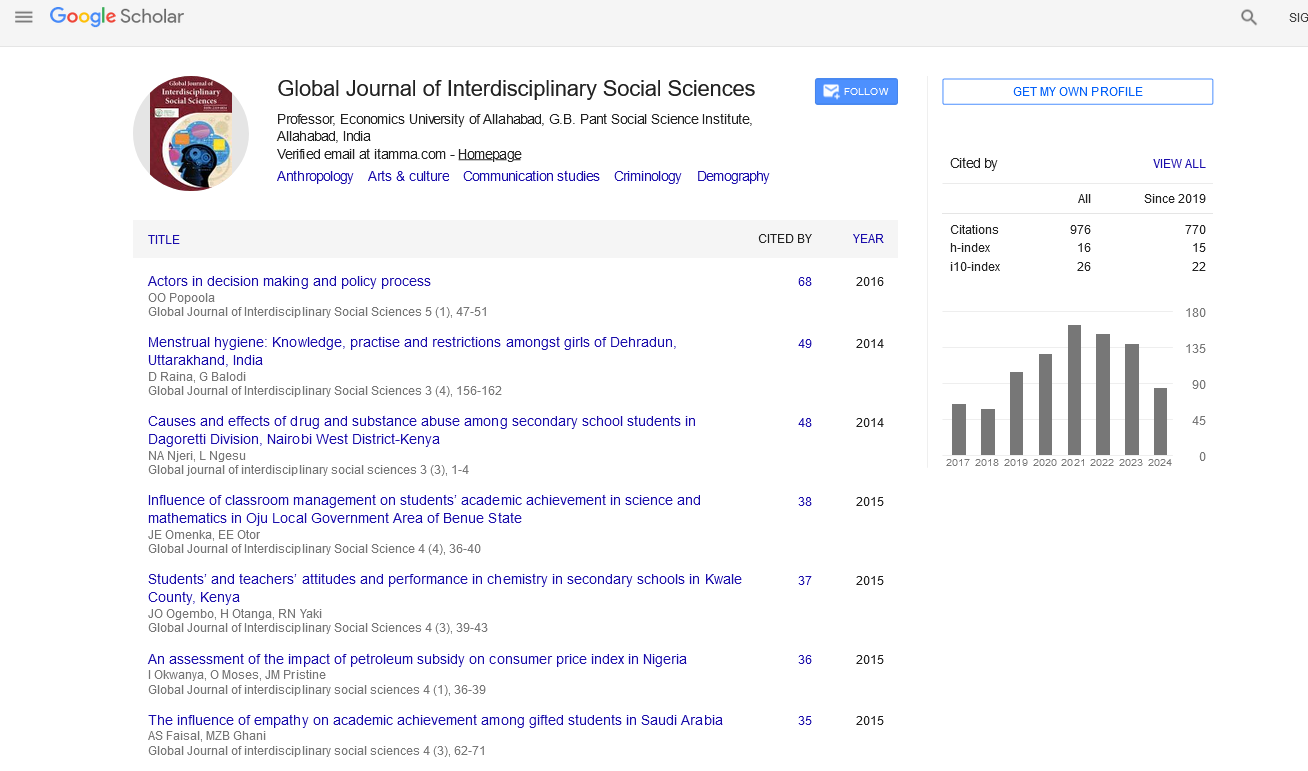

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Abstract

Financial & Economic Development

Travis N Head,

Along with the globalization process, the connection between the existence of a complicated economic system , financial development and economic process has become one among the foremost debated issues. The economic system , development and development indicators, which play a crucial role within the overall success levels of the economy, are among the topics to be considered thanks to this importance. In this study, financial development, economic process , and theoretical approaches are discussed. Moreover, the very fact that the topic is empirically presenting evidence requires examination of this example with studies within the literature. The presence of the findings obtained empirically, especially Turkey's economy has made it necessary to incorporate an outsized empirical literature. The generally accepted financial development indicators, which give comparability in terms of nations , are examined in terms of monetary markets and financial institutions in terms of depth, access, stability and efficiency

The rapidly changing nature of economies with industrialization continues to vary even sooner with technology. Increases in income levels and savings levels have led to the birth and development of the economic system . Today, the financial sector has become one among the important dynamics of economic process . In the financial sector, the power to quickly reflect the issues and opportunities that exist within the economy, the potential to influence the economy as an entire , suggests that the relationship between financial development and economic process must be investigated. In addition, the increasing integration between the countries with the globalization process has led to several developments which may be considered positive and negative economically. Outsourcing in economic policies within the scope of outward development strategies has became an open economy model, which has led to the investigation of the consequences of those policies on growth. With globalization becoming an idea shaping the planet economy, the amount of studies investigating the corelation between the extent of openness and growth of nations has also increased steadily. In these studies, the answer to the question of how the countries influence the growth of trade openness and financial openness is sought.

Technological developments and innovations, considered together of the important driving forces within the growth of an economy, underscore the concept of innovation which is gaining more importance especially after the 1980s. When innovation is named , it's desirable to explain a product or a process to be discovered consistent with things . It is the key to long-term growth and continuity of the economy in terms of economics, for the primary time to introduce a product or a process. Developing economies and systems have led to the widespread adoption of the concept of innovation within the financial field and therefore the look for the consequences of the concept of monetary innovation. Because financial innovations with attention on technology are influencing the availability and demand of cash within the economy and affecting growth. As the first financial innovations occur within the developed world's financial markets, Turkey has become the continuation of the implementation of monetary liberalization process that began within the 1980s.

The phenomenon of financial liberalization, especially after 1980, led to the start of research on empirical investigations between financial development and growth (King & Levine, 1993). The relationship between economic process and financial development has begun to be examined by establishing various models and adding variable or variables to the financial development indicators. Thus, the existence and direction of the corelation between financial development-growth has begun to require a crucial place within the literature. To affect the expansion of monetary innovation, to contribute to the saving of effects like growth turns into investment, it increased the importance of this relationship. Because these effects are directly associated with the financial intermediation activity. From this, it's possible to determine the connection between financial development and economic process

Investments need to increase in order for a country's economy to grow. An increase in investments is feasible with the rise in savings which will provide funds for investments. The greater the quantity of savings collected during a country, investments will increase therein direction and and therefore the rate of growth (ceteris paribus) are going to be that prime . The provision of savings within the country depends on the existence of a complicated economic system . The transfer of savings to the economy depends on the safe investment environment and therefore the acceptable rate of return. If this relationship is successfully established; financial markets, which are key factors in ensuring strong economic process , contribute to economic efficiency by directing resources from inefficient areas to productive areas.

Published Date: 2021-03-30;