Indexed In

- JournalTOCs

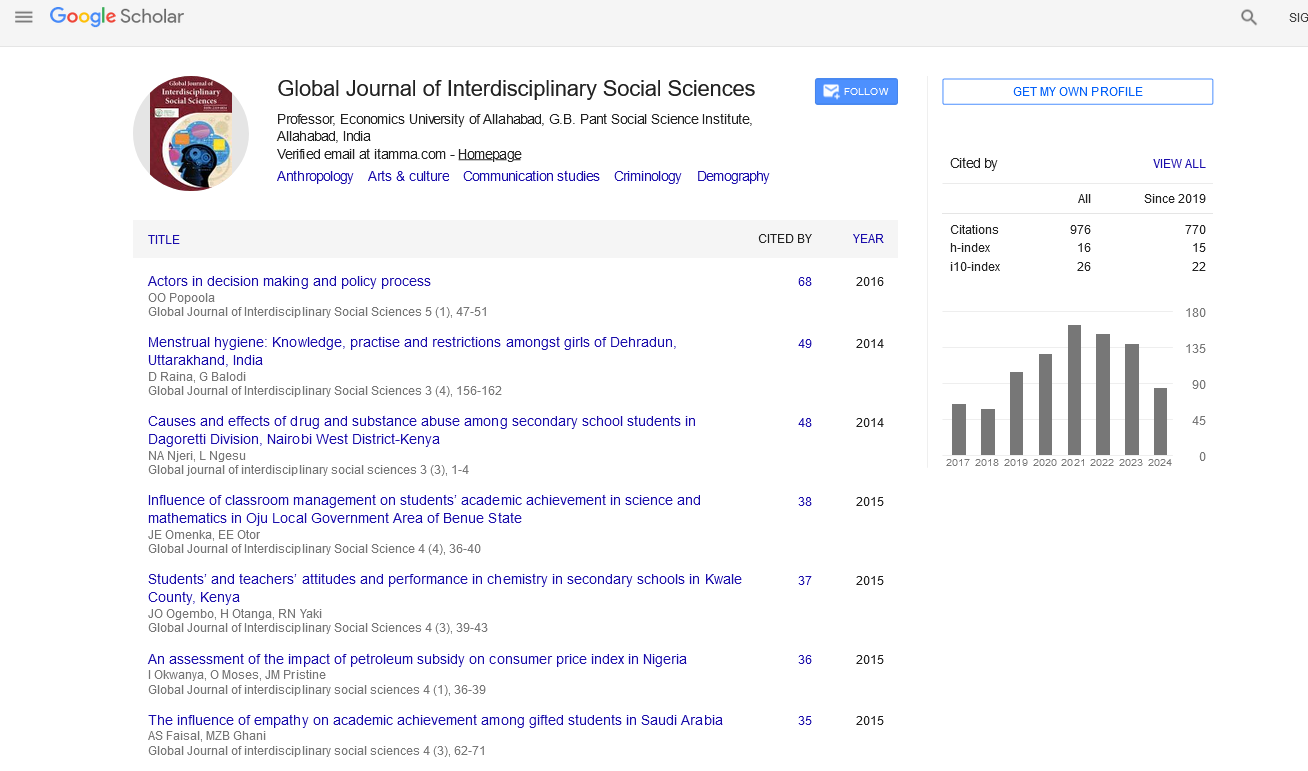

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Abstract

An Evaluation of the Roles of Financial Institutions in the Development of Nigeria Economy

James Ese Ighoroje & Henry Egedi

This study aims at evaluating the financial institutions and their roles in the development of the Nigeria economy. Two variables where selected by the researcher to explain the roles of financial institutions in the development of the economy. The analytical tool used was the simple linear regression involving the use of the ordinary least square [OLS]. Data for the period of [2001-2011] was used. From the result of the regression, we found out that there is significant relationship between the roles of financial institution [credit to the private sector] and the development of the Nigeria economy because about 65% variation in Gross Domestic Product [Y] was explained by the total bank loans to the private sector [X] while about 35% of the variation was unexplained due to some internal and external factors listed in the work. The researcher further recommended that the financial institutions in the country should increase their participation in areas of investment and development lending and also engage in the sponsorship of capital intensive projects in order to bridge the 35% unexplained gap and also a consistent monitoring of borrowers to ensure compliance and reduce the risk of nonpayment to the barest minimum.